Forget Nvidia: 2 Artificial Intelligence (AI) Stocks to Buy Now

Nvidia has been a top artificial intelligence (AI) stock in the past year as the semiconductor bellwether is playing a pioneering role in the proliferation of this technology with its graphics cards, whose massive computing power is allowing tech titans to train large language models (LLMs) such as ChatGPT.

Nvidia’s eye-popping revenue and earnings growth have led to a sharp surge in the company’s stock price, which has gone up 223% in the past year. That red-hot rally explains why Nvidia stock is now trading at a rich 30 times sales and 72 times trailing earnings. However, Nvidia seems attractively valued as far as its forward earnings and sales multiples are concerned, thanks to its ability to maintain its outstanding growth.

After all, Nvidia leads the lucrative market for AI chips by quite some distance, which explains why analysts are expecting its earnings to double every year for the next five years. As a result, Nvidia can justify the rich multiples it is commanding right now, but value-oriented investors may want to look at cheaper options to capitalize on the AI boom.

This is where Zoom Video Communications (NASDAQ: ZM) and Confluent (NASDAQ: CFLT) step in. Both companies could turn out to be big beneficiaries of AI adoption in the long run, and the good part is that investors can buy them at attractive multiples right now. Let’s look at the reasons why investors should consider buying these two Nvidia alternatives.

1. Zoom Video Communications

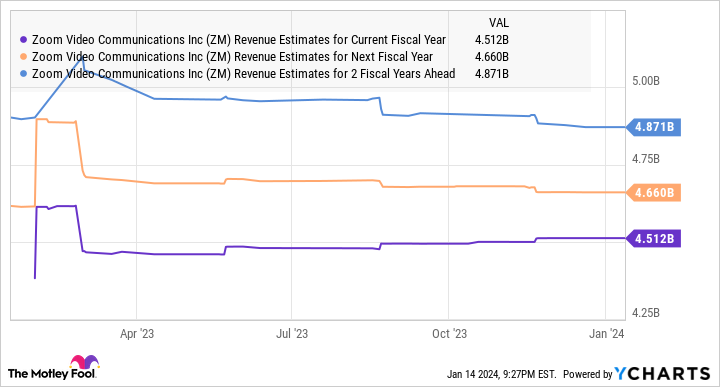

Shares of Zoom Video Communications have remained almost flat in the past year, underperforming the broader market. That’s not surprising, as the company’s growth has slowed down in a post-pandemic scenario. The company is expected to finish the ongoing fiscal 2024 (which will end this month) with an increase of just 2.7% in revenue to $4.5 billion. As the following chart indicates, consensus estimates aren’t expecting much of a jump in Zoom’s revenue over the next couple of years as well.

However, AI could help supercharge the company’s growth. That’s because the adoption of generative AI in the video conferencing market should unlock a new growth opportunity for Zoom. According to third-party estimates, generative AI adoption in video conferencing could grow at an annual pace of 18% through 2032. That would be faster than the growth of the overall video conferencing market, which is expected to grow at almost 13% a year over the same period and generate $28 billion in annual revenue.

Zoom is already taking steps to ensure it doesn’t miss this opportunity. Its Zoom AI Companion provides customers with multiple AI features, such as summarizing meetings, getting feedback on the presentations they make, drafting responses in chats, composing emails, and even asking questions in multiple languages.

Additionally, Zoom is bringing AI features to its contact center platform as well. The company has introduced three pricing tiers for its Zoom Contact Center customers, giving them access to AI capabilities such as allowing customer service agents to offer personalized support and increase agent productivity by recommending the next best action, among other things.

It is worth noting that Zoom Contact Center ended the previous quarter with 700 customers, which is impressive considering that the service was launched a couple of years ago. As a result, Zoom has now increased its share of the contact center market to 6.8%. This bodes well for the company’s long-term prospects as the size of the global contact center market is expected to grow from an estimated $42 billion this year to $164 billion in 2030.

If Zoom can corner even 10% of this space by the end of the decade, it could generate an additional $16 billion in revenue. At the same time, Zoom is ranked No. 1 in the market for videoconferencing software, with an impressive share of 57%. The addition of AI features should allow Zoom to maintain its strong share of this space and give its top line a nice boost in the long run as this market expands.

It won’t be surprising to see Zoom coming out of mediocrity and stepping on the gas thanks to AI, which probably explains why noted investor Cathie Wood’s Ark Invest believes that the stock could hit a whopping $1,500 by 2026. That would be a massive jump from current levels, so investors should consider buying Zoom stock before it goes on an AI-fueled surge.

Zoom currently sports a price-to-sales ratio of just 4.6 along with a forward earnings multiple of 16, which means investors are getting a good deal on this videoconferencing and contact center company, which could win big from AI in the long run.

2. Confluent

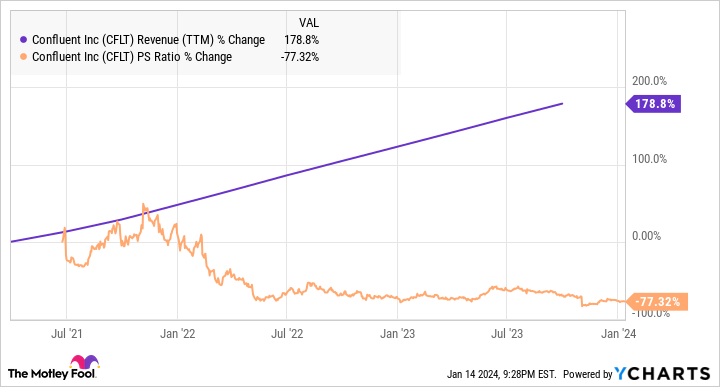

Confluent stock fell sharply in November last year after the company released its third-quarter results, but savvy investors should consider buying this cloud-native data streaming platform hand over fist, considering its valuation and impressive growth. As the following chart tells us, Confluent’s top line has increased at a nice pace over the years, but its price-to-sales ratio has moved in the opposite direction.

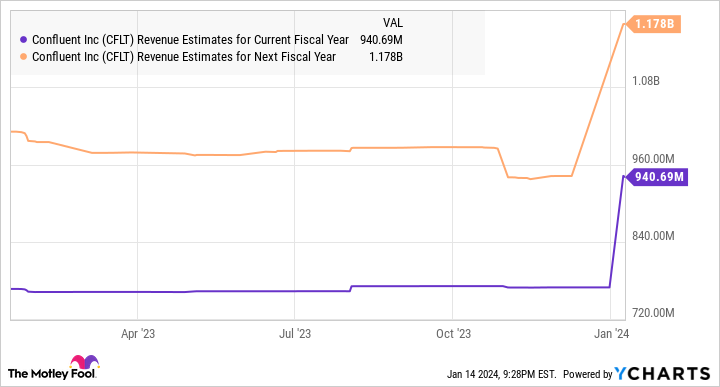

Confluent is now trading at 9 times sales, which makes it significantly cheaper than Nvidia. Also, the company expects to deliver $768.5 million in revenue for 2023, which would be a 31% increase over last year. Even better, analysts have raised their revenue growth expectations for Confluent, which points toward solid growth for the next couple of years as well.

AI, however, could allow Confluent to clock faster growth. That’s because Confluent’s data streaming platform, which allows its customers to connect their data and process it in real time as opposed to storing that data in silos and processing it later on, could play a central role in helping organizations build AI applications that are powered by real-time data.

Confluent says that the real-time data streams fed into AI systems and applications can help “deliver production-scale AI-powered applications faster.” As a result, AI applications won’t have to rely on old data, and they will be able to deliver more accurate results. According to a survey of 300 organizations using data streaming platforms conducted by platform provider Redpanda, 75% of the respondents were looking to incorporate real-time analytics to power their AI applications.

As such, Confluent could witness a sharp jump in the demand for its data streaming platform in the long run. It is worth noting that the data streaming market that Confluent serves is expected to clock an annual growth of 28% through 2030, generating $125 billion in revenue at the end of the forecast period compared to $18 billion in 2022.

As a result, Confluent should be able to sustain its healthy growth for a long time to come. That’s why investors should consider taking advantage of the recent pullback in its shares and invest in this potential AI winner while it remains relatively cheap.

Should you invest $1,000 in Zoom Video Communications right now?

Before you buy stock in Zoom Video Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Zoom Video Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Confluent, Nvidia, and Zoom Video Communications. The Motley Fool has a disclosure policy.

Forget Nvidia: 2 Artificial Intelligence (AI) Stocks to Buy Now was originally published by The Motley Fool