Morgan Stanley revenue tops estimates, but CEO warns of geopolitical, economic risks ahead

Morgan Stanley on Tuesday reported fourth-quarter revenue that surpassed expectations, boosted by the strength in investment banking.

Here’s how the bank did compared with Wall Street expectations:

- Earnings per share: 85 cents, may not compare with $1.01 expected, according to LSEG, formerly known as Refinitiv.

- Revenue: $12.90 billion vs. $12.75 billion, expected, according to LSEG.

Shares of Morgan Stanley initially climbed in premarket trading following the results, but the stock closed Tuesday’s session 4.2% lower.

Morgan Stanley said its revenue from investment banking rose 5% from a year ago on the back of a 25% increase in fixed income underwriting revenue amid higher investment-grade issuances.

Net income came to $1.52 billion, or 85 cents per share, down more than 30% from $2.24 billion, or $1.26 per share, a year ago.

The bank’s results were hit by two one-time regulatory charges, however. There was a $286 million charge related to a Federal Deposit Insurance Corp. special assessment and a $249 million legal charge to settle a criminal investigation and a related Securities and Exchange Commission probe of the unauthorized disclosure of block trades.

Revenue of $12.9 billion topped analysts’ estimates, and rose from $12.75 billion a year ago.

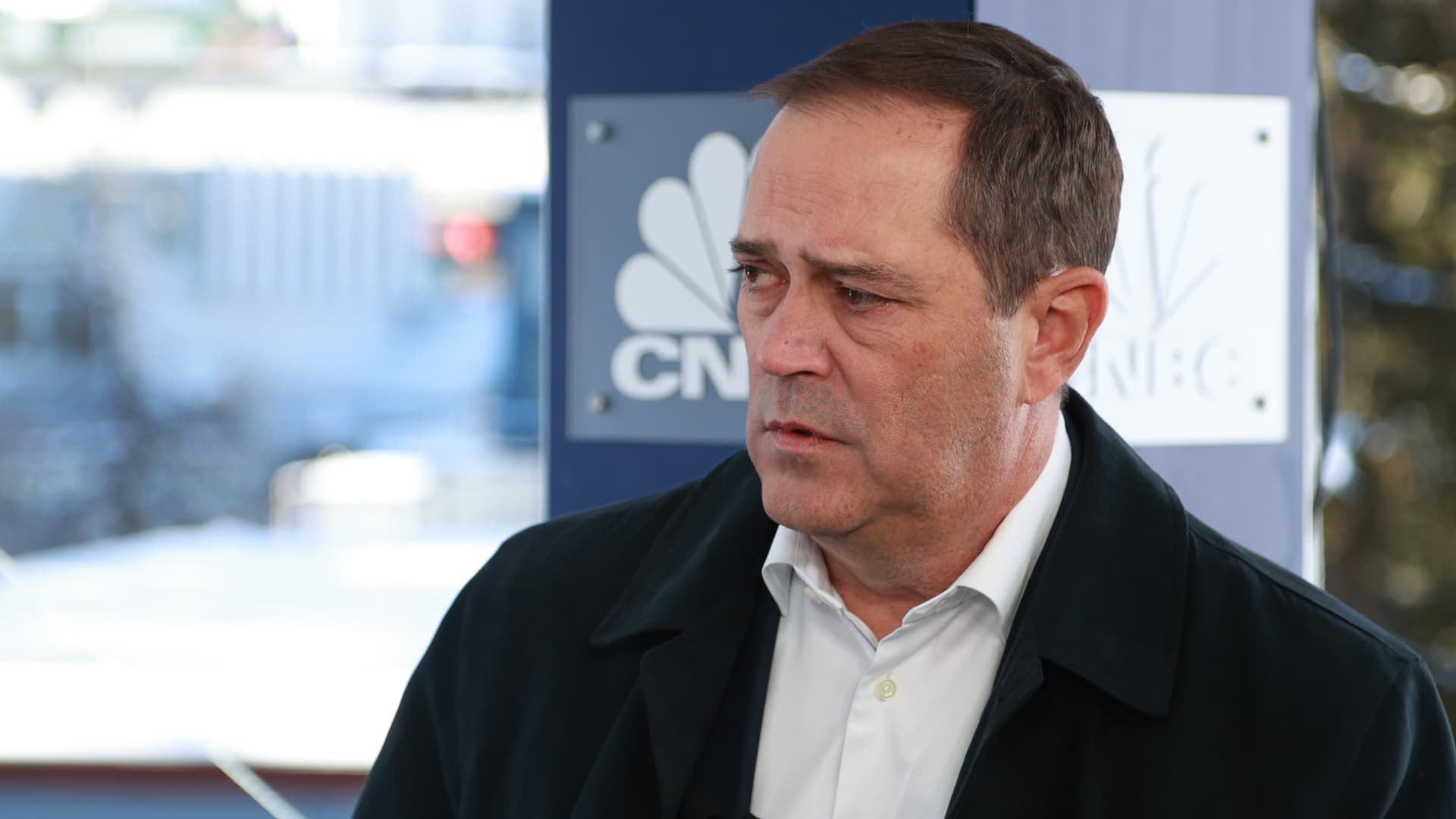

This is the first earnings report under new CEO Ted Pick, who succeeded James Gorman as chief executive at the start of 2024. Pick is a Morgan Stanley veteran who rose through the ranks to lead the bank’s Wall Street operations.

“In 2023, the Firm reported a solid ROTCE [return on average tangible common shareholders’ equity] against a mixed market backdrop and a number of headwinds,” Pick said in a statement. “We begin 2024 with a clear and consistent business strategy and a unified leadership team. We are focused on achieving our long-term financial goals and continuing to deliver for shareholders.”

Pick did, however, warn of two “major downside risks” that could weigh on his bank in 2024: The first is intensifying geopolitical conflicts; and the second is the state of the U.S. economy.

“The base case is benign, namely that of a soft landing,” Pick said. “But if the economy weakens dramatically in the quarters to come and the Fed has to move rapidly to avoid a hard landing that would likely result in lower asset prices and activity levels.”

He also said inflation could continue to challenge the consumer and the supply chain, which could result in a stickier Fed and higher interest rates for longer.

Wealth management delivered fourth-quarter net revenue of $6.65 billion, slightly higher than the $6.63 billion from the same quarter a year ago. Revenue from investment management was $1.46 billion for the quarter, little changed from last year.

Shares of the New York-based bank have fallen nearly 8% in 2024 after a 10% gain last year.

Don’t miss these stories from CNBC PRO:

- Tesla versus BYD: Analysts prefer one of them — giving it up to over 70% upside

- Goldman says small caps to beat large caps this year. 10 cheap smaller stocks to buy

- DoubleLine’s Gundlach sees ‘very painful’ economic downturn, S&P 500 may be forming ‘double top’

- ‘One of the best valuations for AI’: Buy the dip in this Big Tech stock, strategist says