Top headlines: S&P 500 hits record high on tech-led rally

The latest business news as it happens

Article content

Top headlines

Advertisement 2

Story continues below

Article content

Article content

Top story

Market close: Wall Street hits record high following 2-year round trip scarred by inflation

Wall Street returned to record heights and capped a punishing, two-year round trip dogged by high inflation and worries about a possible recession.

The S&P 500 rallied 1.2 per cent to surpass its prior all-time high set at the start of 2022. It had dropped as much as 25 per cent from that record on worries about much higher interest rates. But inflation has since cooled, the economy has remained out of a recession and the expectation is now for rates to ease.

Tech stocks again helped lead the market, and the Nasdaq composite rose 1.7 per cent. The Dow, which set its own record last month, rose 1.1 per cent.

In Toronto, the S&P/TSX composite index closed up 149.79 points at 20,906.52.

The Associated Press, The Canadian Press

4:12 p.m.

Natural gas prices continue downward streak

North American natural gas prices continued their downward slide this week, in spite of frigid winter conditions that gripped much of the continent.

The U.S. natural gas benchmark Henry Hub has fallen six per cent over the last week, trading Friday at around US$2.53 per million British thermal units, or mmBTU.

Advertisement 3

Story continues below

Article content

It’s a continuation of last year’s downward trend. U.S. natural gas prices averaged $2.57 per mmBTU in 2023, about 62 per cent below the 2022 average annual price.

Weather is typically a major factor in the price of natural gas, as demand is driven by the need to heat homes and businesses.

But while many regions are currently experiencing a blast of cold weather, analysts say fall and early winter were unusually warm which is keeping natural gas prices low.

Last year was a warm winter too across most of North America, and less demand contributed to rising amounts of natural gas inventories in storage.

The Canadian Press

3:25 p.m.

Chevron seeks to sell Duvernay shale assets after Hess purchase

Chevron Corp. has begun marketing its Duvernay shale holdings in Alberta as the oil giant divests assets following its agreement to buy Hess Corp.

Chevron plans to shed all of its 70 per cent stake in the Western Alberta oil and natural gas play, spokesman Braden Reddall said in an email. Other assets in Canada won’t be affected. The company inked a US$53 billion deal to acquire Hess in October.

Article content

Advertisement 4

Story continues below

Article content

“Chevron will be soliciting and reviewing expressions of interest, but there are no assurances of any sale,” Reddall said.

Chevron has been one of the largest drillers in the Duvernay, a rich producer of condensate, light oil and gas. The company is looking to sell as much as US$15 billion of assets by the end of 2028 in an effort to “high-grade” its portfolio and focus capital spending on the most productive areas, such as the Permian Basin and Guyana.

The California-based company is looking to step up performance this year after its stock tumbled 17 per cent in 2023, worse than its supermajor peers. It faced a multitude of operational difficulties, ranging from refinery disruptions to lower-than-expected Permian production to cost increases at its US$45 billion Tengiz project in Kazakhstan.

Bloomberg

12:28 p.m.

Banking regulator increasing focus on money laundering as risks rise: Routledge

The head of Canada’s banking regulator says he’s ramping up scrutiny of money laundering in the financial sector as risks increase.

Peter Routledge, who leads the Office of the Superintendent of Financial Institutions, says the intensity of money laundering risk is underappreciated and increasing in sophistication with artificial intelligence.

Advertisement 5

Story continues below

Article content

Speaking at the TD Securities Financial Services Conference in Toronto, Routledge said the regulator is also increasing its focus in the area after parliament amended OSFI’s mandate to explicitly include monitoring how well financial institutions protect against threats to their integrity and security.

The increased attention comes as Fintrac, Canada’s financial intelligence agency, has also ramped up enforcement, including penalties levied against Royal Bank of Canada and Canadian Imperial Bank of Commerce last month for non-compliance with anti-money laundering and terrorist financing measures.

Routledge says the increased digitization and integration of the global economy have contributed to the rise of the problem, which remains a challenge to detect.

He says the regulator is also working to move forward on reducing climate-related risks in the financial sector, but doesn’t see OSFI’s role as an instigator of climate policy.

The Canadian Press

12:08 p.m.

Midday markets: U.S. stocks power ahead as S&P 500 passes record close, TSX down

Advertisement 6

Story continues below

Article content

The S&P 500 passed its all-time closing high in intraday trading on Friday, riding the coattails of another rally in the index’s most influential group — technology.

The U.S. equity benchmark was up 0.48 per cent to 4,803.31, rising past its record close of 4,796.56 set on Jan. 3, 2022, as a drop in Treasury volatility continued to bode well for risk-taking.

Also helping sentiment was a report seen by many as “Fed-friendly” that showed a mix of elevated consumer confidence and lower inflation expectations.

“Overall, it was an encouraging round of data from the Fed’s perspective,” Ian Lyngen at BMO Capital Markets, said.

United States Federal Reserve Bank of Chicago president Austan Goolsbee said a continued decline in inflation would merit discussion of cutting rates, though he stressed the central bank will make decisions meeting by meeting. He spoke just hours before the Fed’s traditional pre-meeting communications blackout period.

The S&P 500 erased this week’s losses while the tech-heavy Nasdaq 100 continued to rise after hitting a record on Thursday. Ten-year Treasury yields were little changed.

Advertisement 7

Story continues below

Article content

In Canada, the S&P/TSX composite index is missing out on the U.S. stock surge, and was down 0.16 per cent, with only the financials sector eking out a gain so far on the day.

Bloomberg, Financial Post

11:10 a.m.

Bombardier wins court case against supplier Honeywell on engine costs

A Quebec Superior Court judge says engine supplier Honeywell International Inc. must negotiate with Bombardier Inc. on the cost of the jet engines it rolls out for the Montreal-based plane maker.

The decision from last month states that the U.S. manufacturer has an obligation to hold talks in good faith with Bombardier to try to reduce the price of the propulsion systems installed in its Challenger business jets.

The ruling also requires Honeywell to hand over a sheaf of sales records to an independent auditor to assess whether the company sold turbofan engines at a lower price to competitors.

Bombardier has argued that Honeywell hiked the price of engines despite a contractual obligation to lower it over time, while Honeywell has said it has not sold the same engine to competitors and denied Bombardier’s right to an audit.

Advertisement 8

Story continues below

Article content

The decision notes that starting in the 1990s the North Carolina-based aerospace giant began to design and manufacture an engine exclusively for Bombardier, but later began supplying similar systems to Bombardier rivals Gulfstream Aerospace Corp., Embraer S.A. and Textron Inc.

Bombardier is seeking $447 million in damages from Honeywell over claims it overpaid between 2012 and 2017. The court not handed down a ruling on damages.

The Canadian Press

10:14 a.m.

Markets open: S&P 500 nears record high

Wall Street was up in early Friday trading and nearing its all-time high set two years ago.

The S&P 500 rose 0.33 per cent, just below its record closed of 4,796.56. The Dow Jones Industrial Average was up 0.14 per cent and the Nasdaq composite was 0.37 per cent higher.

Companies overall in the S&P 500 are likely to report only slight growth in profits for the fourth quarter of 2023, if any, if analysts’ estimates are close to accurate. But optimism is higher for 2024. Inflation is on the way down, and the U.S. economy has managed to avoid a recession that many investors had earlier seen as inevitable.

Advertisement 9

Story continues below

Article content

Those factors, along with strong expectations for the Federal Reserve to cut interest rates sharply this year, are what have driven the S&P 500 to the brink of its record. It had earlier dropped as much as 25 per cent from its record after inflation topped 9% two summers ago to reach its most painful level since 1981.

In Canada, the S&P/TSX composite index was down 0.04 per cent.

The Associated Press

9:35 a.m.

Ford cuts production of F-150 Lightning electric truck

Ford Motor Co. cut production of its F-150 Lightning electric truck amid fading demand for electric vehicles.

About 1,400 employees will be impacted as the Rouge Electric Vehicle Center transitions to one shift beginning April 1, the Dearborn, Michigan-based automaker said Friday in a statement. The company said it expects continued growth in global EV sales in 2024, though it will be less than anticipated.

Related story: Ford cuts workforce making electric F-150 trucks on weak demand

Bloomberg

9 a.m.

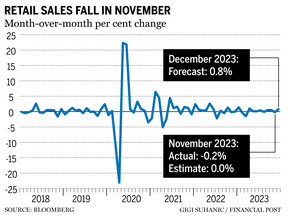

Retail sales down in November, but rose in December

Retail sales fell 0.2 per cent to $66.6 billion in November, led by decreases at food and beverage retailers, Statistics Canada says.

Advertisement 10

Story continues below

Article content

The agency’s early estimate for December suggests sales increased 0.8 per cent that month, but warned the figure would be revised.

For November, Statistics Canada said sales were down in four of the nine subsectors it tracks, led by a 1.4 per cent drop at food and beverage retailers.

The largest increase in retail sales in November was seen across motor vehicle and parts dealers, which were up for a third consecutive month.

Core retail sales — which exclude gas stations, fuel vendors and motor vehicle and parts dealers — were down 0.6 per cent in November.

Retail sales in volume terms decreased 0.2 per cent that month.

The Canadian Press

7:30 a.m.

Stock markets before the opening bell

U.S. futures pointed to further gains on Wall Street Friday after a tech-led rally that pushed the Nasdaq 100 to a record high.

Contracts on the Nasdaq 100 climbed about 0.7 per cent while S&P 500 futures were up 0.4 per cent. Chipmakers were among the biggest gainers in pre-market trading, with Advanced Micro Devices Inc. climbing two per cent and Intel Corp. up 1.2 per cent. Texas Instruments Inc. rose more than two per cent after maintaining its quarterly dividend.

Advertisement 11

Story continues below

Article content

The Stoxx Europe 600 index climbed 0.1 per cent, trimming its loss this week to 1.2 per cent. The technology sub-sector advanced further as Taiwan Semiconductor Manufacturing Co.’s outlook fuelled hopes for a global recovery in chip sales. Swiss electrical-equipment maker ABB dragged the industrials subsector lower after saying U.S. lawmakers are reviewing its operations in China.

Treasuries were little changed and the U.S. dollar slipped after frenetic repricing earlier in the week of the policy outlook. Investors will pay close attention to United States Federal Reserve speakers today for further cues on the timing and extent of rate cuts. Traders now see the prospect of easing in March at little more than a coin toss, down from almost 80 per cent at the end of last week.

The S&P/TSX composite index closed up 0.30 per cent on Thursday.

Bloomberg

6:43 a.m.

Best Buy, Bell partner to rebrand, revamp 165 The Source stores

Best Buy Canada and Bell Canada have announced a partnership to rebrand and revamp 165 The Source stores.

The companies say The Source, a wholly owned subsidiary of Bell, will be rebranded as Best Buy Express, with locations expected to start opening in the second half of 2024.

Advertisement 12

Story continues below

Article content

The small-format stores will offer consumer electronics as well as wireline and wireless services from Bell, Virgin Plus and Lucky Mobile.

Best Buy and Bell will invest in updating the stores, with an expanded assortment of products.

Bell spokeswoman Rachel Jaskula says there are currently just under 300 The Source locations, and the stores not being rebranded will close in 2024.

Best Buy Canada president Ron Wilson said in a press release that the partnership will expand the electronics store’s presence across the country.

The Canadian Press

What to watch today

Peter Routledge, superintendent of financial institutions, will speak at the TD Securities Annual Financial Services Conference in Toronto this morning.

Retail sales numbers for November are out this morning. Also on tap are U.S. existing home sales for December and the University of Michigan consumer sentiment index.

Recommended from Editorial

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments