Goldman Sachs Predicts at Least 45% Rally for These 2 âStrong Buyâ Stocks â Hereâs Why They Have Solid Upside

Back in 1992, political wonk James Carville told Bill Clinton, “It’s the economy, stupid,” and went on to steer his candidate toward a game-changing political win. A recent note from Goldman Sachs equity strategist, David Kostin, reminds us of this – and points out that this holds the key to understanding the bullish sentiment on stocks.

Simply put, investors are betting that the economy will show gains this year, and are playing stocks accordingly. Even though bond yields – which usually show a negative correlation to stocks – are up, so are equities.

Describing the situation, and its impact on the stock market, Kostin writes: “An improving economic growth outlook is one reason equities have recently been resilient despite rising yields. Equities generally digest growth-driven increases in yields far better than policy-driven increases. Although Fedspeak likely contributed to the increase in yields this month, the outperformance of cyclical vs. defensive stocks also indicates an improvement in the equity market pricing of the economic growth outlook to roughly 3%.”

“As investors worry less about the potential for Fed tightening, growth expectations should become a more important driver of yields, contributing to a less negative correlation between stocks and yields in 2024,” Kostin added.

Following this view, the analysts at Goldman are choosing potential winners for the months ahead – and see at least a 45% rally for two stocks in particular. In fact, it’s not only Goldman who favors these names. Using the TipRanks database, we found that both are also rated as Strong Buys by the analyst consensus. Let’s take a closer look.

Arvinas (ARVN)

We’ll start with Arvinas, a biopharmaceutical research company whose work is focused on protein degradation. This is a relatively new field in the overall biopharma realm, involving the study of the natural processes by which proteins are broken down and removed from living cells, at the molecular level. Proteins are essential in all biological processes, and disruptions in protein degradation have been linked to various diseases, as both causes and symptoms. Recent studies in this field have brought new drug candidates to light as potential therapeutic agents.

Arvinas boasts a research pipeline at the forefront of protein degradation research, with 12 active tracks examining several drug candidates in the treatment of oncological conditions like breast and prostate cancer as well as neurological disorders like Parkinson’s and Huntington’s diseases. The protein degrading drug candidates are developed through the company’s proprietary platform, PROTAC, as a line of proteolysis targeting chimeras. These candidates have been developed to work with the body’s own natural processes for degrading and removing proteins – in effect, to clean out the debris from the body, at the cellular level.

In December of last year Arvinas released Phase 1b data on its leading candidate, vepdegestrant. This candidate is a potential treatment for ER+/HER2 breast cancer, and is under development in partnership with Pfizer. The Phase 1b trial data covered vepdegestrant as a combination therapy with palbociclib, and showed an overall response rate of 42% in ‘heavily pre-treated patients.’ Vepdegestrant is currently the subject of two Phase 3 trials, VERITAC-3, a combo trial with palbociclib, and VERITAC-2, a monotherapy study. The drug also recently received fast track designation from the FDA.

This drug candidate forms the core of Goldman analyst Paul Choi’s outlook on the stock. He believes that the late-stage trials will show positive results, writing of the company and its late-stage pipeline, “We think VERITAC-2 monotherapy study is likely to be positive, which along with a planned palbociclib combination study should lead to vepdegestrant emerging as the next standard of care in 2L+ ER+/HER2- breast cancer, in-line with our KOL’s feedback. Further, vepdegestrant’s potential use in front-line patients provides a sizable intermediate-to-long term commercial opportunity.”

Longer-term, Choi is bullish on the quality of both vepdegestrant and Arvinas’ development platform, and their ability to expand treatment options into other disease categories. As he says, “Further, against the current biotech backdrop, we see the to-date clinical profile of vepdegestrant and ARVN’s PROTAC platform technology (e.g., prostate, hematology, neurology) as placing the company as a potential candidate for acquirers seeking late stage oncology assets, which could provide more upside over the intermediate-to-long term.”

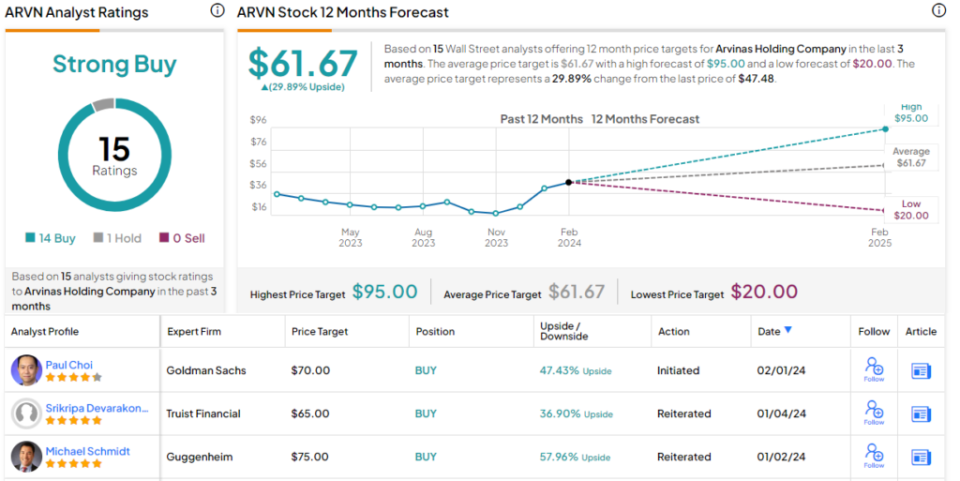

Quantifying his stance, Choi gives ARVN shares a Buy rating with a $70 price target that suggests a 47% share appreciation in the next 12 months. (To watch Choi’s track record, click here)

This upbeat outlook resembles the Street’s overall take. ARVN shares have a Strong Buy consensus rating, based on 15 recent reviews with a lopsided 14 to 1 split favoring Buy over Hold. The stock’s trading price of $45.97 and its average target price of $61.67 together imply a one-year upside potential of 30%. (See ARVN stock forecast)

Fiverr International (FVRR)

We’re living in a transitional period, from a manufacturing and industrial-based economy to an information and digital-based economy, and few areas show this change more than the rise of the gig work sector. It’s a form of freelance work, based on individual workers making deals directly with customers, using the internet as the medium – and the services are endless. Companies like Fiverr have emerged to facilitate these gigs, connecting vendors with buyers, as well as offering services to improve the nature of gig work. Vendors can keep online records of their work for tax purposes, buyers and vendors can rate each other, and both sides can search for the other based on type of work, offered price, or geographical location.

The great incentive in gig work, for the buyer, is low cost, a factor that has also become a point of controversy. Critics say that gig work encourages an underclass, working for peanuts for the online rich. Boosters say that gig work offers anyone a quick way to monetize a hobby or a skill – and to make that money on their own time, in their own way. In some ways, Fiverr’s own existence encapsulates this debate. The company gets its name from the $5 fee charged for every task on the platform – although now vendors on Fiverr can set their own prices.

Fiverr got its start in 2010, and has since grown from a small business to a Fortune 500-level company. Today, Fiverr boasts more than 400,000 active seller accounts, and nearly 4.2 million active buyers. There are more than 700 service categories listed on the site, gig terms are listed up front, and Fiverr offers 24/7 support for its users.

Fiver makes its money mainly through transaction and service fees, and in the last reported quarter, 3Q23, the company generated $92.5 million at the top line. This was up more than 12% year-over-year, and beat the forecast by $1.4 million. The company’s non-GAAP EPS of $0.55 beat the forecast by 9 cents. Fiverr will report 4Q23 earnings on February 22.

For Goldman’s 5-star analyst Eric Sheridan, the key points here are Fiverr’s business model and the relative discount of the shares. Sheridan writes, laying out the reasons why investors should buy in, “1) we see continued re-acceleration of revenue in 2024 driven by a stabilizing macro environment (net adds improving through the year), spend per buyer growth, international progress and continued Promoted Listing & Seller Plus adoption over time; 2) incremental improvements in profitability with a focus on marketing efficiency & higher-value buyers (higher Day 1 spend, higher LTV driven by frequency & retention, etc.); & 3) product innovation & focus – the company continues to position its platform and products for increased levels of personalization and matching capabilities, along with more complex projects, with many of those initiatives driven by AI. Based on this framework against current valuation/share price, we now see a positive risk/reward skew on the stock…”

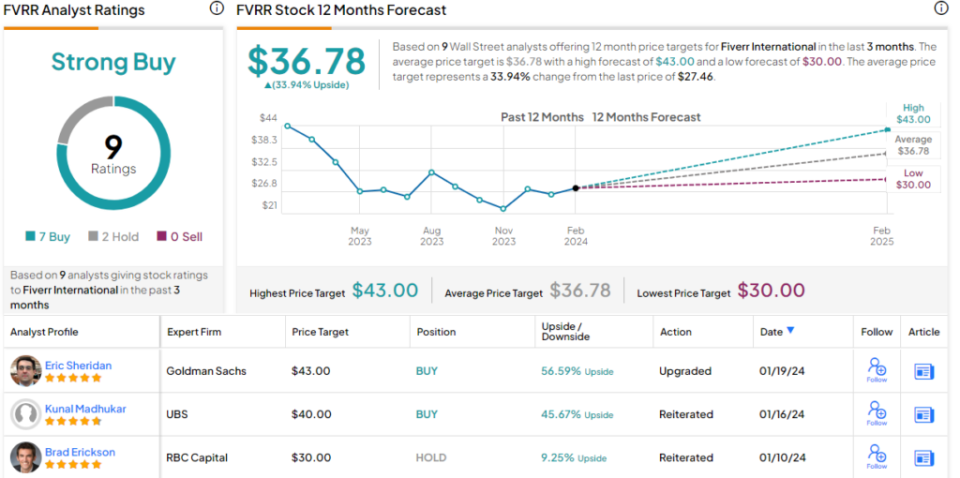

These comments support Sheridan’s Buy rating, while his $43 price target points toward a robust one-year gain of 56.5%. (To watch Sheridan’s track record, click here)

With 9 recent analyst reviews, including 7 to Buy against 2 to Hold, FVRR shares have earned a Strong Buy consensus rating from the Street. The stock’s current trading price is $27.46, and the average target price is $36.78; together these imply a gain of 34% on the one-year horizon. (See Fiverr stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.