Nvidia set to report fourth-quarter earnings after the bell

Nvidia is scheduled to announce fiscal fourth-quarter earnings after the bell Wednesday in a highly anticipated report that will give Wall Street a sense of how long the AI boom can last.

Here’s what Wall Street is expecting according to LSEG, formerly Refintiv, consensus estimates:

- Earnings per share: $4.64, adjusted

- Revenue: $20.62 billion

Nvidia has been the primary beneficiary of the recent technology industry obsession with large artificial intelligence models, which are developed on the company’s pricey graphics processors for servers.

Nvidia’s stock price has soared nearly fivefold since the end of 2022, giving the company a market value of $1.72 trillion, briefly surpassing tech giants Amazon and Alphabet.

Nvidia has to meet elevated expectations stoked by investor appetite for AI companies.

Analysts expect Nvidia to post a 240% increase in revenue from the year-ago period, for a total of $20.6 billion, driven by $17.06 billion in data center revenue — the business that sells AI GPUs like the H100. Net income is forecast to surge more than sevenfold to $10.5 billion in the January quarter.

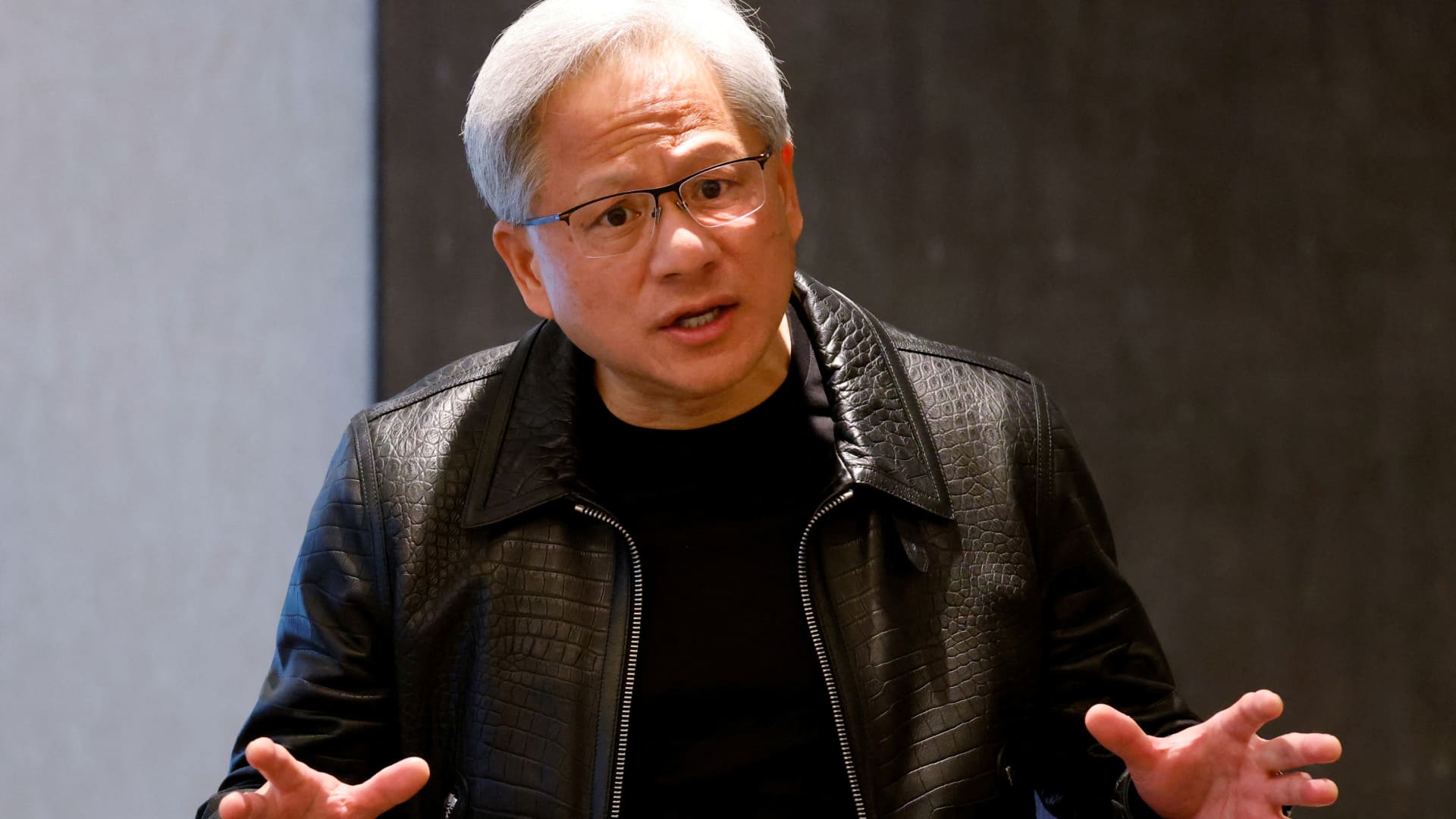

Investors want to hear from Nvidia CEO Jensen Huang about how long these stratospheric growth rates can last. One concern is that many of Nvidia’s GPUs are sold to big tech companies such as Microsoft, Amazon, Meta and Google.

Those companies reported earnings in recent weeks and signaled they will continue to invest in new GPUs in the short term, but some analysts think the long-term picture for demand could be more mixed.

“They referred to their purchasing as ‘flexible’ and ‘demand driven,’ implying they would scale it down if we got past the current hype cycle,” D.A. Davidson analyst Gil Luria wrote in a recent note to investors. “While we do not believe we are there yet, we are seeing possible early signs.”

Nvidia is also planning to start shipping a new highest-end server GPU called the B100 in 2024. The timing of that chip could affect the company’s growth rate.

In the current quarter, Wall Street analysts expect a 208% rate of growth to about $22.17 billion in sales.

Nvidia has other businesses, from chips for PC gaming to automotive chips. But the focus Wednesday will remain primarily on its AI GPUs, which make up more than 80% of Nvidia sales.

“The [data center] GPU number will be the only key metric that matters along with commentary on broader market adoption,” wrote Barclays analyst Thomas O’Malley in a note earlier this month.