Top headlines: Fairfax denies short seller Muddy Waters’ ‘allegations and insinuations’

The latest business news as it happens

Article content

Today’s headlines

Article content

Top story

Fairfax denies short seller Muddy Waters’ ‘allegations and insinuations’

Advertisement 2

Story continues below

Article content

Fairfax Financial Holdings Ltd. disagreed with a short seller’s report today that sent shares in the Canadian insurer down seven per cent.

Short seller Muddy Waters has placed bets against the shares of Fairfax, alleging manipulation in its asset values.

Its research note says the company’s underperformance since 2017 has “pressured Fairfax into becoming aggressive in pulling accounting levers starting in 2018.”

“We find that Fairfax has consistently manipulated asset values and income by engaging in often value destructive transactions to produce accounting gains,” it said.

Fairfax said in a statement on Feb. 8 that it disagrees with the “allegations and insinuations” in the report and assured shareholders that financial statements and reporting are done in accordance with “applicable accounting principles.”

The company added that it achieved record earnings and operating income in the first nine months of 2023.

Fairfax’s fourth-quarter financial results come out Feb. 15, and the company said management will answer any questions about the report at the conference call the day after.

Advertisement 3

Story continues below

Article content

— Financial Post staff

4:40 p.m.

Market close: TSX down almost 50 points as U.S. stock markets post gains

Canada’s main stock index posted a small loss as weakness in telecom and utilities stocks weighed on the market, while U.S. markets made gains.

The S&P/TSX composite index was down 49.54 points at 20,919.64.

In New York, the Dow Jones industrial average was up 48.97 points at 38,726.33. The S&P 500 index was up 2.85 points at 4,997.91, while the Nasdaq composite was up 37.07 points at 15,793.71.

The Canadian dollar traded for 74.26 cents U.S. compared with 74.24 cents U.S. on Wednesday.

The March crude contract was up US$2.36 at US$76.22 per barrel and the March natural gas contract was down five cents at US$1.92 per mmBTU.

The April gold contract was down US$3.80 at US$2,047.90 an ounce and the March copper contract was down three cents at US$3.70 a pound.

The Canadian Press

3:57 p.m.

Home builders group pushes for 30-year mortgages to boost construction

The group that represents residential builders in Canada wants Ottawa to offer a 30-year amortization period for insured mortgages on new homes.

Article content

Advertisement 4

Story continues below

Article content

The Canadian Home Builders’ Association says extending the period an additional five years would help with affordability and spur more construction.

Kevin Lee, the group’s chief executive, says it would bring more first-time homebuyers into the market, in turn encouraging developers to build more homes.

The association is also recommending setting up an investment tax credit to help the industry become more productive.

Housing expert Mike Moffatt says he likes that idea. But he says offering a longer mortgage risks boosting demand without addressing the core issues behind the shortage.

The Canadian Mortgage and Housing Corp. estimates the country needs to build 5.8 million homes by 2030 to restore housing affordability.

The Canadian Press

3:26 a.m.

Oil prices rallies on Israel dismissal of possible cease-fire

Oil rallied as Israeli Prime Minister Benjamin Netanyahu’s dismissal of a potential cease-fire in the Israel-Hamas war triggered algorithmic buying in markets.

West Texas Intermediate rose as much as 3.2 per cent to top US$76 a barrel in a rally partly sparked by Netanyahu’s comments that he sees “no other solution than total victory” and later extended by trend-following algorithms. Last week, crude slumped on news of cease-fire negotiations and their potential to ease the tensions in a region that accounts for about a third of the world’s oil output.

Advertisement 5

Story continues below

Article content

Rising energy supply risks from strikes in Iraq increase the danger of a broadening conflict in the Middle East and are providing tailwinds for crude oil markets, said Daniel Ghali, a commodity strategist at TD Securities. At the beginning of the session, Ghali expected commodity trading advisers to increase their total buying by 30 pe cent of their maximum position.

Adding to concerns of supply disruptions, major shipping companies are warning that the security situation in the Red Sea is continuing to deteriorate. Swaths of the merchant fleet have been avoiding the waterway since attacks by the Houthis began in mid-November. The area grew even more volatile after the United States and United Kingdom launched airstrikes in the middle of last month, prompting major owners in all sectors to avoid the region.

Restraining the price gains are apparent sluggishness in the Chinese economy and fading expectations that interest rates will be cut soon. Volatility in options markets has been sliding, reflecting the generally lacklustre trading this year, despite the barrage of geopolitical and macroeconomic headlines.

Advertisement 6

Story continues below

Article content

“Both oil-market sentiment and conviction remain low,” Royal Bank of Canada analysts including Michael Tran and Helima Croft wrote in a note. “The market still cannot break flat price out of the current range.”

— Bloomberg

2:32 p.m.

Competition Bureau probing use of restrictive property clauses in grocery sector

The Competition Bureau says it’s investigating the use of restrictive real estate clauses in the Canadian grocery sector.

Deputy commissioner Anthony Durocher told a House of Commons committee studying food prices that these measures, often called “property controls,” can be a major barrier to entry and expansion in the Canadian marketplace.

In the Bureau’s June 2023 report on competition in grocery it described property controls as clauses added to a lease or deed that limit how real estate can be used by competitors.

This can include limiting the kinds of stores that can open in a mall, or limiting the kind of store that’s allowed to open in that location after a tenant leaves the property.

For example, if a grocery store is moving to a nearby location, the property control clause could prevent a competitor from entering the old store.

Advertisement 7

Story continues below

Article content

The Bureau’s report recommended that governments limit use of the clauses in the sector, saying they make it harder for new supermarkets to open, and can curb competition.

– The Canadian Press

12:23 p.m.

Midday markets: TSX retreats more than 100 points

Canada’s main stock index was down more than 100 points in early-afternoon trading, weighed down by losses in the telecom, financial and utility sectors, while U.S. stock markets were mixed.

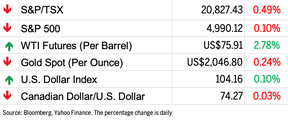

The S&P/TSX composite index was down 105 points, 0.49 per cent, at 20,827.43.

In New York, the Dow Jones industrial average was down 0.23 per cent at 38,588.74. The S&P 500 index was down 0.10 per cent at 4,990.12, while the Nasdaq composite was up 0.28 per cent at 15,7993.06.

The Canadian dollar traded for 74.27 cents US compared with 74.24 cents US on Wednesday.

The March crude contract was up 2.78 per cent at US$75.91 per barrel and the March natural gas contract was down five cents at US$1.92 per mmBTU.

The April gold contract was down 0.24 per cent at US$2,046.80 an ounce and the March copper contract was down five cents at US$3.69 a pound.

Advertisement 8

Story continues below

Article content

— The Canadian Press

11:21 a.m.

Devon Energy in talks to buy Calgary-based Enerplus, media report says

Devon Energy Corp., an Oklahoma City-based oil and gas company, is in talks to acquire Calgary-based driller Enerplus Corp., Reuters reported.

The companies have not come to an agreement, Reuters said, citing anonymous sources. It comes on the heels of a string of recent megadeals in the United States oil patch as companies push to line up future drilling sites. Investors are eager to see mergers too as explorers can save money by pairing up and assembling contiguous drilling positions.

Enerplus shares surged as much as 10 per cent. The company, which has a market value of about US$4.1 billion, operates primarily in the Bakken shale basin of North Dakota and in the Marcellus region in Pennsylvania.

Devon is one of the biggest independent shale explorers in the U.S., with operations in five U.S. basins, led by its presence in the Permian basin of Texas and New Mexico. Buying Enerplus would complement its operations in North Dakota.

In October, Bloomberg reported that Devon was on the hunt for major acquisition targets. At the time, the company had held preliminary talks with Marathon Oil Corp. and separately was eying CrownRock LP, according to people familiar with the matter.

Advertisement 9

Story continues below

Article content

— Bloomberg

11:20 a.m.

Cameco revenue soars 60 per cent

Cameco Corp. reported a fourth-quarter profit compared with a loss a year earlier as its revenue rose more than 60 per cent.

The uranium miner says it earned $80 million or 18 cents per diluted share in the quarter ended Dec. 31, compared with a loss of $15 million or four cents per diluted share in the last three months of 2022.

Revenue for the quarter totalled $844 million, up from $524 million a year earlier.

On an adjusted basis, Cameco says it earned a fourth-quarter profit of 21 cents per share compared with an adjusted profit of nine cents per share in the final quarter of 2022.

In its outlook for 2024, Cameco says it expects revenue of $2.85 billion to $3 billion and capital expenditures of $215 million to $250 million for the year.

Production for 2024 is expected to total 22.4 million pounds of uranium.

— The Canadian Press

10:20 a.m.

Markets open: Wall Street takes breather after hitting fresh highs, TSX falls

Stocks on Wall Street fluctuated after a rally that drove the market to fresh all-time highs. Treasury yields edged higher as traders geared up for a US$25 billion sale of 30-year bonds.

Advertisement 10

Story continues below

Article content

The equity market lost a bit of steam after the S&P 500 came very close to hitting the 5,000 mark for the first time. Longer-dated bonds underperformed, with the Treasury getting ready to test the market appetite after successful debt sales this week. Wall Street will also be positioning for Friday’s consumer-price index revisions because of what happened a year ago: the update was significant enough to cast doubt on overall inflation progress.

Thirty-year bonds “can be tricky, but our bet is that there should be good demand” in the auction, said Andrew Brenner at NatAlliance Securities. “As for headline risk, there is some talk that tomorrow’s CPI revisions could throw cold water on the recent good inflation numbers, but this is a wonky number. We think the next move comes off the CPI number next Tuesday.”

In New York, the S&P 500 was flat 4,995.87 while the Dow Jones industrial average was down 0.04 per cent at 38,662.38. The Nasdaq composite was up 0.16 per cent at 15,780.80.

In Toronto, the S&P/TSX composite index was down 0.10 per cent at 20,949.60 on weakness in utilities, financials and materials stocks.

Advertisement 11

Story continues below

Article content

— Bloomberg, Financial Post

9:54 a.m.

Lightspeed revenue jumps 27 per cent

Lightspeed Commerce Inc. reported a loss of US$40.2 million in its latest quarter as its revenue rose 27 per cent compared with a year earlier.

The Montreal-based e-commerce technology company, which keeps its books in U.S. dollars, says its loss amounted to 26 cents US per diluted share for the quarter ended Dec. 31.

The result compared with a loss of US$814.8 million or US$5.39 per diluted share a year earlier when the company took a non-cash goodwill impairment charge of US$748.7 million.

On an adjusted basis, Lightspeed says it earned US$11.8 million or eight cents per share in its latest quarter compared with an adjusted profit of US$400,000 or zero cents per share a year earlier.

Revenue for what was the third quarter of the company’s 2024 financial year totalled US$239.7 million, up from US$188.7 million a year earlier.

In its outlook for its full 2024 financial year, Lightspeed says it expects revenue of about US$895 million to US$905 million, while its adjusted earnings before interest, taxes, depreciation and amortization are expected to be break even or better.

Advertisement 12

Story continues below

Article content

— The Canadian Press

9:25 a.m.

PM hints at tougher penalties for car thieves as Ottawa seek ideas at national summit

Prime Minister Justin Trudeau says his Liberal government is considering more stringent penalties for criminals engaging in auto theft.

Trudeau made the comment as he kicked off a daylong national summit in Ottawa on how best to tackle auto theft.

He took a pointed jab at Conservative rival Pierre Poilievre, saying “catchy slogans” and two-minute videos won’t solve the problem.

And he hinted at the need for incentives to encourage automakers to install rigid anti-theft technology in their vehicles.

The summit includes officials from various levels of government, as well as police and industry leaders.

The federal government says an estimated 90,000 cars are stolen annually in Canada, resulting in about $1 billion in costs to Canadian insurance policy-holders and taxpayers.

It says auto theft increasingly involves organized crime groups, and the proceeds of these crimes are used to fund other illegal activities.

Ottawa says most stolen autos shipped abroad are destined for Africa and the Middle East.

Advertisement 13

Story continues below

Article content

On Wednesday, the government earmarked $28 million in new money to help tackle the export of stolen vehicles.

The announcement followed persistent pressure from the federal Conservatives, who have been pitching ideas this week to deal with the problem.

— The Canadian Press

Read more: ‘Cat-and-mouse game’: Automakers fight to stay ahead of criminals as car thefts surge

8:47 a.m.

Bombardier reports Q4 profit down from year ago, revenue up

Bombardier Inc. reported a fourth-quarter profit of US$215 million, down from a profit of US$241 million in the same quarter a year earlier.

The aircraft maker, which keeps its books in U.S. dollars, says the profit amounted to US$2.11 per diluted share for the quarter ended Dec. 31, down from US$2.40 per diluted share a year earlier.

Revenue totalled US$3.06 billion for the quarter, up from US$2.66 billion in the last three months of 2022.

On an adjusted basis, the company says it earned US$1.37 per share in its fourth quarter, down from an adjusted profit of US$2.10 per share a year earlier.

In its guidance for 2024, Bombardier says it expects to deliver between 150 and 155 aircraft compared with 138 aircraft deliveries in 2023.

Advertisement 14

Story continues below

Article content

Revenue for 2024 is forecast between US$8.4 billion and $8.6 billion, up from US$8 billion last year.

— The Canadian Press

8:16 a.m.

Cineplex reports $9M Q4 loss, revenue up from year ago

Cineplex Inc. reported a fourth-quarter loss $9 million compared with a profit of $10.2 million a year earlier as its revenue edged higher.

The movie theatre company says the loss amounted to 14 cents per diluted share for the quarter ended Dec. 31 compared with a profit of 16 cents per diluted share a year earlier.

Revenue for the quarter totalled $315.1 million, up from $309.9 million in the last three months of 2022.

The increase in revenue came as theatre attendance rose to 9.6 million patrons compared with 9.2 million a year earlier.

Box office revenue per patron was $12.90, down from $13.06 a year earlier, while concession revenue per patron was $9.28, up from $8.93 in the same quarter in 2022.

Cineplex also announced a refinancing plan it says will improve its financial flexibility and reduce the dilutive impact of its convertible debentures.

— The Canadian Press

Advertisement 15

Story continues below

Article content

7:30 a.m.

Stock markets before the opening bell

Stocks and bonds posted small moves on Thursday as investors grappled with a slew of company reports and prepared for a sale of 30-year United States government debt.

Europe’s Stoxx 600 gauge climbed 0.3 per cent on the busiest earnings day of the season. Unilever PLC rallied on better-than-expected sales growth while A.P. Moller-Maersk A/S tumbled more than 13 per cent after predicting the shipping industry will be hit by a slowdown later this year. Futures on the S&P 500 were flat after the underlying index hit a fresh high on Wednesday that took it closer to the 5,000 level.

After successful sales of three- and 10-year bonds, the U.S. Treasury’s latest auction of longer-maturity debt could prove a tougher test of investor appetite. Markets have so far largely shrugged off fears around the commercial real estate sector and absorbed a run of warnings from U.S. Federal Reserve policy makers that a cut isn’t likely until May at the earliest.

“This week’s government bond auctions have generally been well received, with the latest selloff in rates likely helping the case,” said Evelyne Gomez-Liechti, a multi-asset strategist at Mizuho in London. “Today’s 30-year Treasuries auction will be the last test of the week.”

Advertisement 16

Story continues below

Article content

What to watch today

The government of Canada will hold a national summit on combating auto theft.

The Toronto Regional Real Estate Board hosts its 2024 Market Outlook and Year in Review event.

Earnings today include Bombardier Inc., Brookfield Corp., Indigo Books & Music Inc., Colliers International Group Inc., ARC Resources Ltd., Saputo Inc. and Silvercorp Metals Inc.

Recommended from Editorial

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments