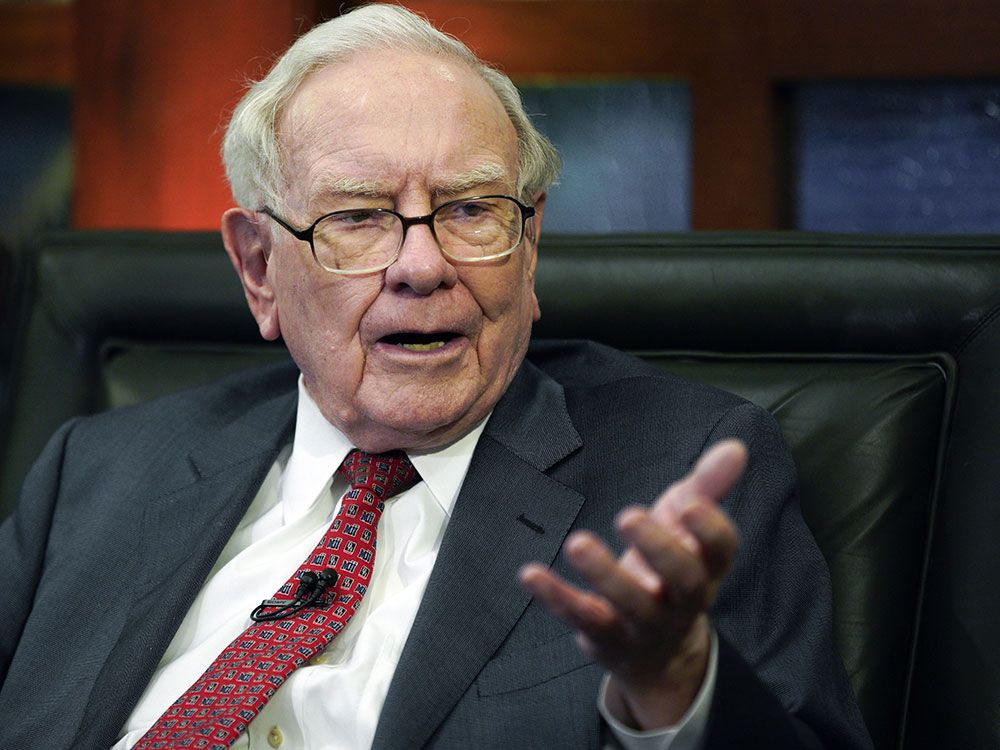

Warren Buffett’s best insights in this year’s letter to shareholders

A tribute to Charlie Munger and warning about the current state of the stock market

Article content

When legendary investor Warren Buffett releases his annual letter to his 3 million shareholders, the financial world pays attention.

This year in the letter that came out Saturday, Buffett devoted a special section to his longtime partner, Charlie Munger, who died Nov. 28, 2023, just 33 days before his 100th birthday.

Article content

He credits Munger with being the “architect” of Berkshire Hathaway Inc, while Buffett saw himself as the “general contractor” who carried out the “day-by-day construction of his vision.”

Advertisement 2

Story continues below

Article content

Buffett also tells shareholders not to expect “eye-popping performance” from Berkshire because of a lack of acquisition targets and has a few words of warning about the current state of the stock market.

Here are some of the insights in Buffett’s letter.

On Charlie Munger:

“Charlie, in 1965, promptly advised me: “Warren, forget about ever buying another company like Berkshire. But now that you control Berkshire, add to it wonderful businesses purchased at fair prices and give up buying fair businesses at wonderful prices. In other words, abandon everything you learned from your hero, Ben Graham. It works but only when practiced at small scale.” With much back-sliding I subsequently followed his instructions.”

Article content

On investing:

“I can’t remember a period since March 11, 1942 — the date of my first stock purchase — that I have not had a majority of my net worth in equities, U.S.-based equities. And so far, so good. The Dow Jones Industrial Average fell below 100 on that fateful day in 1942 when I ‘pulled the trigger.’ I was down about $5 by the time school was out. Soon, things turned around and now that index hovers around 38,000. America has been a terrific country for investors. All they have needed to do is sit quietly, listening to no one.”

Article content

Advertisement 3

Story continues below

Article content

On picking winners:

“Our goal at Berkshire is simple: We want to own either all or a portion of businesses that enjoy good economics that are fundamental and enduring. Within capitalism, some businesses will flourish for a very long time while others will prove to be sinkholes. It’s harder than you would think to predict which will be the winners and losers. And those who tell you they know the answer are usually either self-delusional or snake-oil salesmen.”

On markets:

“Though the stock market is massively larger than it was in our early years, today’s active participants are neither more emotionally stable nor better taught than when I was in school. For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants.”

Recommended from Editorial

On Wall Street:

“One fact of financial life should never be forgotten. Wall Street – to use the term in its figurative sense – would like its customers to make money, but what truly causes its denizens’ juices to flow is feverish activity. At such times, whatever foolishness can be marketed will be vigorously marketed – not by everyone but always by someone.”

Advertisement 4

Story continues below

Article content

Berkshire Hathaway’s cash mountain hit a new record at $167.6 billion in the fourth quarter, but it has struggled in recent years to find major acquisitions.

On Berkshire:

“There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can’t. And, if we can, they have to be attractively priced. Outside the U.S., there are essentially no candidates that are meaningful options for capital deployment at Berkshire. All in all, we have no possibility of eye-popping performance.”

With files from The Associated Press and Bloomberg

Article content

Comments