FTX founder Sam Bankman-Fried sentenced to 25 years for crypto fraud, to pay $11 billion in forfeiture

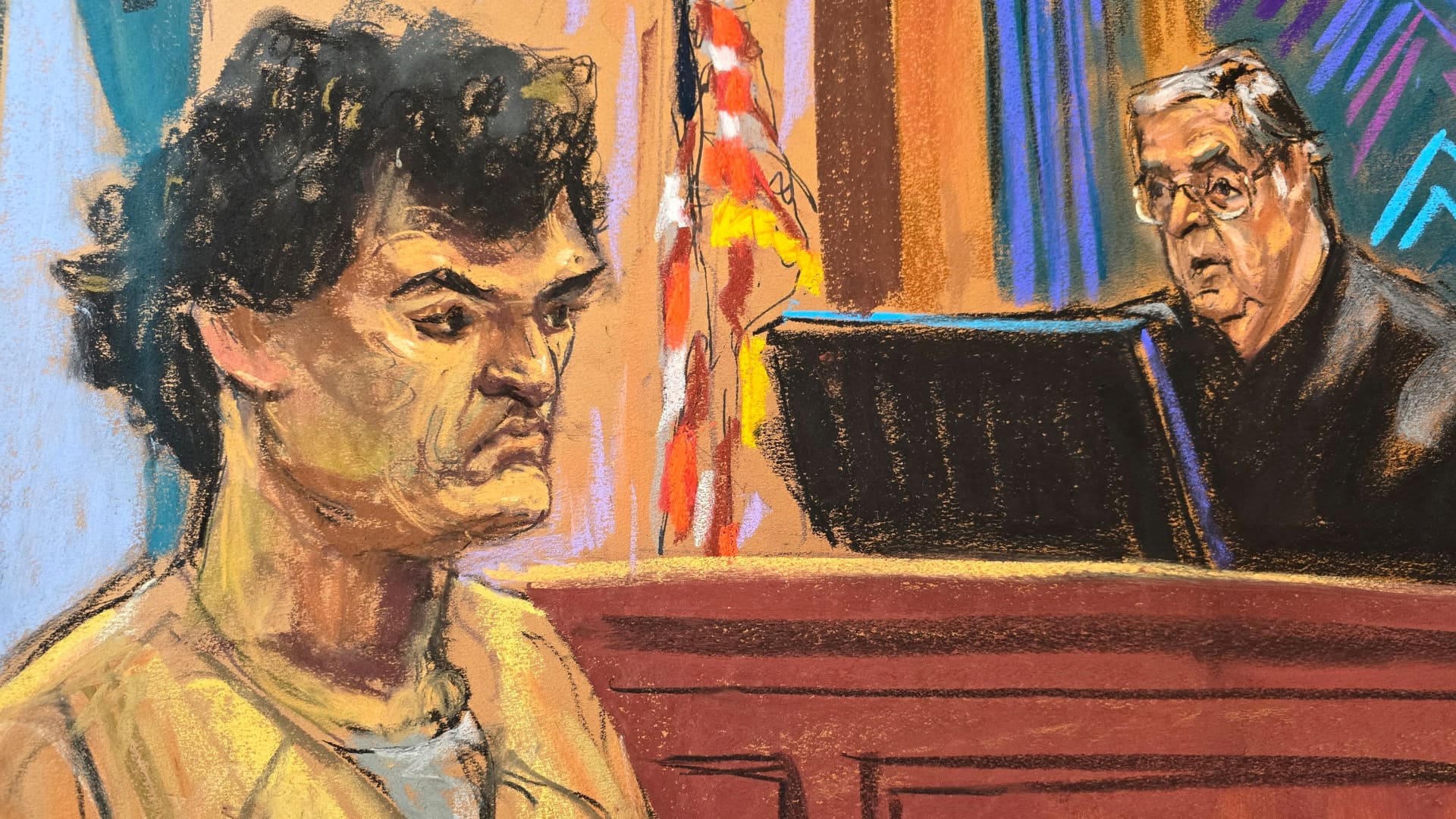

FTX founder Sam Bankman-Fried was sentenced to 25 years in prison on Thursday for the massive fraud and conspiracy that doomed his cryptocurrency exchange and a related hedge fund, Alameda Research.

The sentence in Manhattan federal court was significantly less than the 40 to 50 years in prison that federal prosecutors wanted for Bankman-Fried, but it was much more than the five to six-and-a-half years suggested by his attorneys.

“There is a risk that this man will be in position to do something very bad in the future,” Judge Lewis Kaplan said before sentencing the 32-year-old and ordering him to pay $11 billion in forfeiture to the U.S. government.

“And it’s not a trivial risk at all,” Kaplan added.

Kaplan noted he has never heard “a word of remorse for the commission of terrible crimes” from Bankman-Fried.

The judge said that in the 30 years on the federal bench, he had “never seen a performance” like Bankman-Fried’s trial testimony.

If Bankman-Fried was not “outright lying” during cross-examination by prosecutors, he was “evasive,” Kaplan said.

“There is absolutely no doubt that Mr. Bankman-Fried’s name right now is pretty much mud around the world,” the judge said.

Jurors at trial likewise did not buy Bankman-Fried’s version of events, convicting him in November of seven criminal counts and holding him responsible for losing about $10 billion in customer money due to the securities fraud conspiracy.

Prosecutors said Bankman-Fried led a conspiracy to loot customer money to make investments, fund political donations to both Democrats and Republicans and for his personal use, as well as to repay loans taken out by Alameda Research.

Before being sentenced, Bankman-Fried spoke contritely even as he suggested that the billions of dollars customers lost was the result of a “liquidity crisis” or “mismanagement,” not fraud.

“A lot of people feel really let down. And they were very let down,” he said. “And I’m sorry about that. I’m sorry about what happened at every stage.”

“My useful life is probably over,” he said while wearing a beige jailhouse jumpsuit. “It’s been over for a while now since before my arrest.”

“They built something really beautiful and I threw all of that away,” he said of his co-workers at FTX, a company once valued at $32 billion. “It haunts me every day.”

“It’s been excruciating to watch this all unfold,” he told Kaplan. “Customers don’t deserve this level of pain.”

“I was the CEO of FTX and I was responsible.”

But even as he took some responsibility, Bankman-Fried suggested that customers eventually would get back the money they placed with his exchange, and blamed a federal bankruptcy court for not making those customers whole yet.

Kaplan appeared to stop paying close attention at that point.

In response, Bankman-Fried crossed his arms and began rapidly tapping his right foot as he continued speaking.

Assistant U.S. Attorney Nicolas Roos, arguing for a prison sentence of up to five decades, scoffed at the picture painted by Bankman-Fried and his lawyers.

FTX’s collapse in late 2022 was not due to “a liquidity crisis or act of mismanagement,” Roos said. “It was the theft” of billions of dollars of customer money around the world, the prosecutor said. “It was a loss that affected people significantly.”

Bankman-Fried’s lawyer Marc Mukasey, in asking Kaplan for leniency, focused on his client’s psychological problems, noting that his mother said Bankman-Fried had “terrific sadness at his core,” which has been “a constant presence in his life.”

Mukasey noted that Bankman-Fried once wrote in his journal that he “doesn’t feel pleasure or happiness.”

“Sam was not a ruthless financial serial killer who set out every morning to hurt people,” the lawyer said.

Instead, “He’s an awkward math nerd” with a “tireless work ethic,” said the lawyer, who also compared the FTX founder to “a beautiful puzzle.”

Bankman-Fried should not be in a “four-by-four iron box,” Mukasey argued.

Before he sentenced Bankman-Fried, Kaplan said he rejected “the entirety of the defendant’s argument there was no loss” at FTX, calling that claim “misleading, logically flawed and speculative.”

Sunil Kavuri, a victim of Bankman-Fried, then talked about the damage he caused.

Bankman-Fried looked at Kavuri as he described speaking to thousands of other FTX fraud victims, several of whom are suffering from depression and taking prescription medication to deal with the trauma of their losses.

“I suffered every day for the past two years,” said Kavuri. “I continue to suffer.”

Manhattan U.S. Attorney Damian Williams, in a statement after the sentencing, said, “Samuel Bankman-Fried orchestrated one of the largest financial frauds in history.”

“His deliberate and ongoing lies demonstrated a brazen disregard for his customers’ expectations and disrespect for the rule of law, all so that he could secretly use his customers’ money to expand his own power and influence,” Williams said.

Attorney General Merrick Garland said, “Anyone who believes they can hide their financial crimes behind wealth and power, or behind a shiny new thing they claim no one else is smart enough to understand, should think twice.”

Bankman-Fried’s family, in a statement, said, “We are heartbroken and will continue to fight for our son.” Both Joseph Bankman and Barbara Fried, who are Stanford Law professors, were sitting in the first row of the courtroom gallery during the sentencing.

Bankman-Fried plans to appeal his conviction and sentence.

Three other people, who all testified against Bankman-Fried at trial, are awaiting their own sentencings after pleading guilty to criminal charges related to FTX and Alameda Research.

They are Caroline Ellison, the Alameda Research CEO who at one time dated Bankman-Fried; FTX engineering chief Nishad Singh; and Gary Wang, the co-founder and chief technology officer of FTX.