Posthaste: Canada’s GDP numbers not as good as you think, despite recession dodge

Latest data show higher rates taking their toll, economists say

Article content

Canada dodged the recession bullet in the fourth quarter, but that doesn’t mean the economy is ticking along — at least according these economists.

Article content

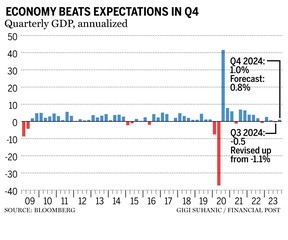

Statistics Canada on Thursday reported gross domestic product grew at a one per cent annualized rate in the fourth quarter, following a contraction of 0.5 per cent in the third quarter. The result was a surprise that beat Bloomberg analyst estimates for an increase of 0.8 per cent, but more importantly it allowed the economy to avoid a technical recession, defined as two consecutive quarters of negative GDP growth.

Advertisement 2

Story continues below

Article content

Still, digging into the data, economists found plenty of red flags as elevated interest rates continue to throttle the economy. With the final quarter of 2023 in the bag, growth for the year came in at 1.1 per cent, down sharply from 3.8 per cent the year before.

“The details are not as positive as the headline suggests,” said Charles St-Arnaud, chief economist at Alberta Central, noting in his analysis that there was no shortage of weak spots.

For example, St-Arnaud highlighted the 0.7 per cent quarterly contraction in final domestic demand — the sum of final consumption, investment and building expenditures by the private and government sectors — brought on by a substantial quarterly drop in business investment that outpaced growth in exports and consumer demand.

It was the first drop in final domestic demand in a year.

Canada’s economy is “just grinding forward,” riding the coattails of strong spending in the United States, said Douglas Porter, chief economist at Bank of Montreal.

“There’s no debate that growth is nevertheless anemic, especially when cast in per-capita terms, down more than two per cent year over year,” Porter said in a note.

Article content

Advertisement 3

Story continues below

Article content

He is among many sounding the alarm on sliding per-capita GDP.

Canada’s population grew at a record pace in 2023 with more than one million people admitted during the first nine months of the year. That beats any 12-month period since 1867, Statistics Canada said at the end of December when it released population numbers for the third quarter.

However, as the population swelled, GDP per capita has continued to fall and “is now about 3.2 per cent lower than its recent peak,” St-Arnaud said.

Royal Bank of Canada also flagged this metric.

With the population expected to grow more in the fourth quarter, “the Q4 increase will mark a sixth consecutive drop on a per-capita basis,” said Nathan Janzen, assistant chief economist at RBC.

Weak GDP per capita is a worry because it is a sign of poor productivity. Productivity has been tumbling in Canada, and “is stark evidence that Canadians on average are worse off than prior to the pandemic,” said Porter, in an earlier report on the issue.

That wasn’t all the jarred economists.

“The details from the latest quarter point to a mishmash of patterns, but the drag of monetary policy on domestic demand is clear,” said Bryan Yu, chief economist at Central 1.

Advertisement 4

Story continues below

Article content

He described consumer demand as “stale and mild” at growth of one per cent, mostly fuelled by vehicle purchases as supply chain pressures eased, while demand for services slowed sharply to 0.4 per cent annualized in the fourth quarter from 2.4 per cent the quarter before — “jarring given strong population growth.”

There were also “sharp retrenchments” in investments.

Residential investment fell 1.7 per cent. Non-residential building investment was down 11.6 per cent, and machinery and equipment declined 5.7 per cent, “signalling the pressures from higher interest rates and the broader cyclical economic slowdown on business activity,” Yu said.

Even with these many signs of distress in the economy, most economists don’t think the weak data will force the Bank of Canada’s hand on interest rates at either its March 6 or April 10 meetings.

“The contraction in domestic demand, weaker compensation growth, and negative per capita output growth coupled with the slide in inflation are likely to trigger a cut by as early as June,” Yu said.

St-Arnaud is pushing a first rate cut even farther out and doesn’t expect the Bank of Canada to start cutting until its July 24 meeting or until inflation is “sustainably” below three per cent.

Advertisement 5

Story continues below

Article content

Sign up here to get Posthaste delivered straight to your inbox.

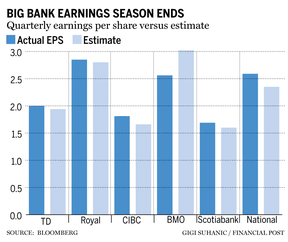

Canada’s Big Six banks reported earnings this week with all but one beating expectations on an earnings-per-share basis.

Analysts worried what earnings for the first quarter would bring as elevated interest rates forced Canada’s major lenders to increase provisions for loan losses. While that trend continued for most of the banks — Royal Bank Bank of Canada hiked loan-loss provisions more than 50 per cent — RBC, like Toronto-Dominon Bank, reported results that beat analysts’ estimates because of stronger-than-expected performance from capital markets and wealth management.

Meanwhile, earnings at Bank of Montreal and Bank of Nova Scotia were marred by increasingly cash-strapped consumers and businesses amid a challenging economic landscape.

The first of the big Canadian lenders to report, BMO missed estimates on lower capital-markets, insurance and corporate-services revenue and Scotiabank topped expectations. Both lenders also set aside more money for potentially bad loans as higher interest rates strain credit quality and missed payments mount.

Advertisement 6

Story continues below

Article content

Canadian Imperial Bank of Commerce, which beat EPS estimates, benefited from growth in its domestic retail business even as it set aside more money than analysts expected for credit losses.

National Bank of Canada closed at a record high on Feb. 28 after it reported earnings that wowed analysts, widening its lead over the country’s other large lenders in shareholder returns. — Bloomberg, The Canadian Press

- Today’s data: S&P Global Canada manufacturing purchasing managers’ index for February. U.S. manufacturing PMI, construction spending for January

- Earnings: Tupperware Brands Corp., Athabasca Oil Corp., AtkinsRealis, formerly SNC-Lavalin Group Inc., Canadian Western Bank

Recommended from Editorial

Tax expert Jamie Golombek takes a deeper dive into the Canada Revenue Agency’s rules around using a tax-free first home savings account to buy a home. Read his column here.

Advertisement 7

Story continues below

Article content

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line at aholloway@postmedia.com with your contact info and the general gist of your problem and we’ll try to find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers led by Julie Cazzin or one of our columnists can give it a shot.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments