Posthaste: The inside story on Bitcoin’s crazy gains â and why this record run might have legs

Five reasons the cryptocurrency is breaking records

Article content

You don’t have to be a bitcoin investor to be fascinated by the cryptocurrency’s eye-popping run this year. You can’t look away from this spectacle.

Article content

Yesterday bitcoin hit its fourth record in six days, touching a high of US$73,664. Its gains have topped 70 per cent this year, and it’s dragging other cryptocurrencies up with it.

So what’s driving the appeal of this asset many still consider suspect? Deutsche Bank researchers Marion Laboure and Cassidy Ainsworth-Grace reveal the reasons the cryptocurrency is trading at a record high and why, in their view, it will stay high.

Advertisement 2

Story continues below

Article content

Everybody loves Exchange Traded Funds

The United States Securities Exchange Commission approved the first U.S.-listed ETFs to track bitcoin on Jan. 10 and since then it’s been game on.

The SEC approved 11 applications from such heavyweights as Blackrock, Fidelity, Invesco and VanEck.

By early March, Blackrock’s fund alone attracted $9.2 billion and Fidelity’s $5.3 billion.

This week, net daily inflows into U.S. spot bitcoin ETFs topped $1 billion for the first time.

“The reasons behind the rally are pretty clear. A rampant demand for the physically-backed ETFs amid a low market depth backdrop,” Manuel Villegas, digital assets analyst at Swiss private bank Julius Baer, told Bloomberg.

As funds buy up large piles of bitcoin, supply diminishes and the weekly issuance of about 6,300 tokens is “utterly dwarfed” by demand that has grown to about 40,000 a week, he said.

More ETFs are coming

Cryptocurrencies are moving into the mainstream.

Futures ETFs, first approved in 2021, expanded access for regulated brokers and funds; now the approval of spot ETFs could further drive mainstream adoption by allowing direct crypto exposure, says Deutsche.

Article content

Advertisement 3

Story continues below

Article content

And there are more in the pipeline. The SEC is scheduled to decide on a spot ETF application for another cryptocurrency, Ethereum, by May 23, with a total of seven Ethereum ETFs pending.

ProShares has plans to launch five more cryptocurrency ETFs, one that would provide twice the daily exposure to a bitcoin tracking index, the analysts said.

“The crypto world is gradually moving toward greater institutionalization as traditional financial players enter the market,” they said.

Large investors such as hedge funds and companies are increasingly putting Bitcoin on their balance sheets.

“Overall, the evolving ETF landscape and participations of institutional players are helping crypto mature into a more established asset class,” said Deutsche.

The Bitcoin halving nears

April 2024 will be a big deal in the world of cryptocurrencies.

Bitcoin miners use specialized computer hardware to validate transactions and record them permanently on the blockchain, and for this they are rewarded with newly minted bitcoins.

But every four years, the number of new bitcoins awarded to miners is cut in half in maintain scarcity. The next halving is next month.

Advertisement 4

Story continues below

Article content

Last time it happened in May 2020 the profit hit forced many miners to shut down outdated rigs — but anticipation of the event also boosted prices.

Bitcoin prices jumped 13 per cent in the month ahead of the July 2016 halving and 27 per cent ahead of the May 2020 event.

Risk On!

The unexpectedly strong performance of the U.S. economy and the S&P 500, thanks to the ‘Magnificent Seven,’ has increased investors’ appetite for risk assets like bitcoin, said Deutsche.

That ‘Risk on’ attitude is only expected to increase as the Federal Reserve and other central banks begin to cut interest rates this year.

When the Fed cut rates during the pandemic, cryptocurrencies rallied, and when it hiked rates beginning in 2022, they retreated.

Regulation is catching up

Cryptocurrencies have long been considered the Wild West of investing, but regulation is catching up.

In the European Union, the Markets in Crypto-Assets (MiCA) regulation, which comes into effect this year, should bring clarity and oversight to EU crypto markets, said Deutsche.

The United States has no overarching rules, but regulatory action is stepping up. The Commodity Futures Trading Commission took 47 enforcement actions involving digital assets in the last fiscal year, almost half of their total actions.

Advertisement 5

Story continues below

Article content

And in a move that signalled the digital world is being scrutinized as closely as traditional financial firms, the SEC sued Binance Holdings Ltd and Coinbase Global Inc, two of the world’s biggest crypto exchanges.

“We view regulation as a net positive development for the industry,” said the Deutsche analysts.

“A clearer regulatory framework is expected to drive increased corporate adoption and higher liquidity (resulting in less concentration), and, ultimately, help address volatility. These factors, in turn, should contribute to an increase in Bitcoin prices.”

Sign up here to get Posthaste delivered straight to your inbox.

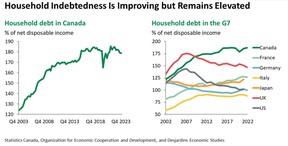

Canadians’ debt mountain is shrinking ever so slightly. Statistics Canada revealed Wednesday that households owed $1.79 in credit market debt on average for every dollar of disposable income in the fourth quarter. That ratio has been falling for the past three quarters and is now at the lowest level, (outside of the pandemic) since 2015.

“That said, Canadian households were the most indebted in the G7 by a wide margin in 2022, and the 2023 data suggest this likely hasn’t changed,” said Randall Bartlett, Desjardins senior director of Canadian economics.

Advertisement 6

Story continues below

Article content

Household credit market debt now tallies over $2.9 trillion, nearly three quarters of which is mortgage loans, he said.

- Today’s Data: Canada Manufacturing Sales & Orders for January, United States retail sales and producer price index for February

- Earnings: Empire Co. Ltd, Wheaton Precious Metals Corp, Dollar General Corp, Adobe Inc

Recommended from Editorial

The Magnificent Seven is centred on U.S. companies, so it’s understandable that foreign interest in Canadian stocks is dwindling. But portfolio manager Martin Pelletier says the homegrown market is compelling for those looking for equity income backstopped by the safety and security of oligopolies and protective moats. Find out more at FP Investing

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line at aholloway@postmedia.com with your contact info and the general gist of your problem and we’ll try to find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers led by Julie Cazzin or one of our columnists can give it a shot.

Advertisement 7

Story continues below

Article content

McLister on Mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments