This Artificial Intelligence (AI) Stock Could Double, and It Is Way Cheaper Than Nvidia

Technology stocks had a good start in 2024, with the Nasdaq-100 Technology Sector index gaining more than 10% already, and artificial intelligence (AI) has been a driving force behind this rally.

Strong quarterly results from top AI names such as Nvidia lifted not only tech stocks but also the market as a whole, with both the Nasdaq and the S&P 500 indexes hitting new highs. The positive stock market sentiment seems to have rubbed off on internet browser provider Opera (NASDAQ: OPRA) as well.

Shares of the company shot up more than 15% on March 1 as investors reacted positively to its fourth-quarter 2023 earnings report. Let’s see why the market gave the thumbs-up to Opera’s results, and check why it could be an ideal alternative for investors looking to buy an AI stock that’s not as expensive as Nvidia.

Opera beats expectations and predicts another good year

Opera’s fourth-quarter revenue increased 17% year over year to $113 million, landing at the higher end of its guidance range and exceeding the consensus estimate of $112.2 million by a whisker. The company’s adjusted earnings per share (EPS) shot up to $1.38 from $0.22 in the year-ago period.

Opera credited its growth to the increased traction of its ad business, which grew 20% year over year. Advertising now accounts for 60% of the company’s total revenue, and it is improving thanks to a focus on monetizing its browsers. Also, it had a 15% year-over-year increase in its search revenue.

The company finished the fourth quarter with 313 million monthly active users (MAUs), a slight jump from 311 million in the third quarter. More importantly, Opera was able to significantly improve the monetization of its customer base. Average revenue per user (ARPU) increased 22% year over year to $1.44.

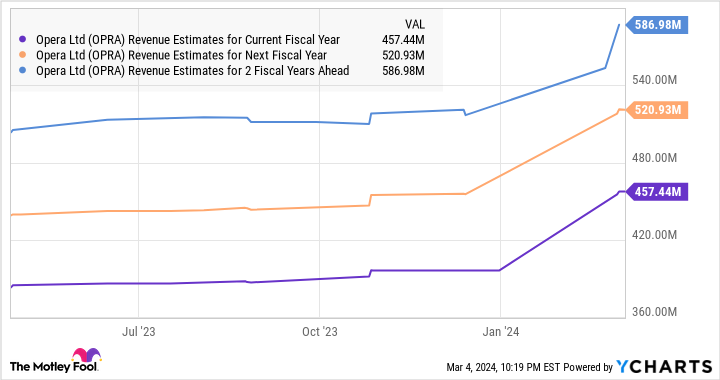

This year, Opera is predicting a 15% increase in revenue to a range of $450 million to $465 million. While that would be a tad slower than the 20% full-year revenue growth it recorded in 2023, investors should not forget that the company kept raising its guidance each quarter last year.

It was originally anticipating $380 million in revenue in 2023 with adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $76 million. However, it finished 2023 with $397 million in revenue and adjusted EBITDA of $94 million. Opera could repeat that feat in 2024 and outperform expectations thanks to its focus on integrating generative AI tools into its browsers.

Management said on the latest earnings conference call that generative AI is one of its core growth drivers. Its Aria browser AI service has been available since May 2023, and it surpassed 1 million users within just two months after launch.

The service offers many features such as AI prompts, which allow users to launch AI-powered services such as translation, explore more about the selected topic, or get a brief explanation about the text selected in the browser.

Opera’s browser also includes a conversational AI assistant that provides real-time contextual information in response to users’ queries. Considering Opera’s huge user base, more of its users could adopt generative AI services in the future and help boost its ARPU. All this explains why analysts have raised their revenue expectations from Opera significantly in 2024.

More reasons to buy the stock

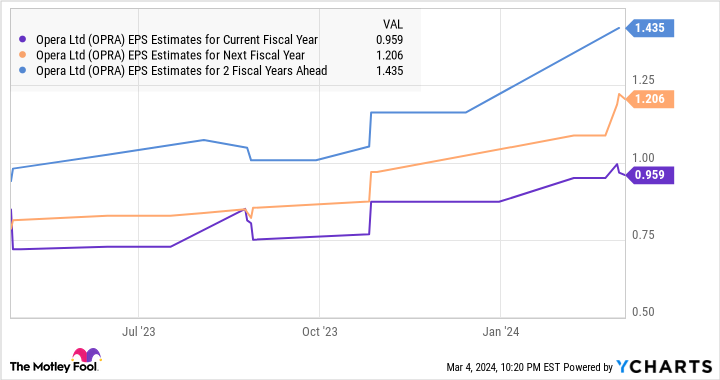

Opera’s consistently strong revenue growth is expected to lead to robust improvement in the company’s bottom line as well.

Investors would do well to buy Opera stock right away to capitalize on its earnings growth. That’s because the stock is trading at just 3.4 times sales and 19.6 times trailing earnings right now. Those multiples are way cheaper when compared to Nvidia’s sales multiple of 33.7 and trailing earnings multiple of 69.

Of course, Nvidia is growing much faster, but investors looking for a mix of growth and value could be attracted to Opera. If it can indeed hit $1.44 per share in earnings in 2026, as per the chart above, and maintain its current earnings multiple of almost 20, its share price could jump to $28 — double the current price.

However, the market could reward Opera with a higher earnings multiple if it can clock stronger growth thanks to AI, which could lead to even better gains. That’s why investors looking for an AI stock now would do well to buy Opera since it could sustain its post-earnings bounce in the long run.

Should you invest $1,000 in Opera right now?

Before you buy stock in Opera, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Opera wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

This Artificial Intelligence (AI) Stock Could Double, and It Is Way Cheaper Than Nvidia was originally published by The Motley Fool