Chinaâs $170bn gold rush triggers Taiwan invasion fears

China has built up a $170bn (£135bn) stockpile of gold after a record buying spree, in a move that has raised fears Beijing is preparing its economy for a possible conflict over Taiwan.

The People’s Bank of China (PBOC) bought 27 tonnes of gold in the first three months of the year, taking its reserves to a record high of 2,262 tonnes, according to data from the World Gold Council.

China has now been buying gold steadily since October 2022, marking its longest build up of the precious metal since at least 2000. The 17-month streak has increased its gold reserves by 16pc.

Gold is currently trading near a record high of $2,343 per troy ounce, valuing Beijing’s stockpile at $170.4bn.

Experts said China’s stockpiling was likely an effort to guard its economy against Western sanctions in the event of a conflict over Taiwan.

Jonathan Eyal, associate director at the Royal United Services Institute (RUSI), said: “The relentless purchases and the sheer quantity are clear signs that this is a political project which is prioritised by the leadership in Beijing because of what they see is a looming confrontation with the United States.

“Of course it’s connected also to plans for a military invasion of Taiwan.”

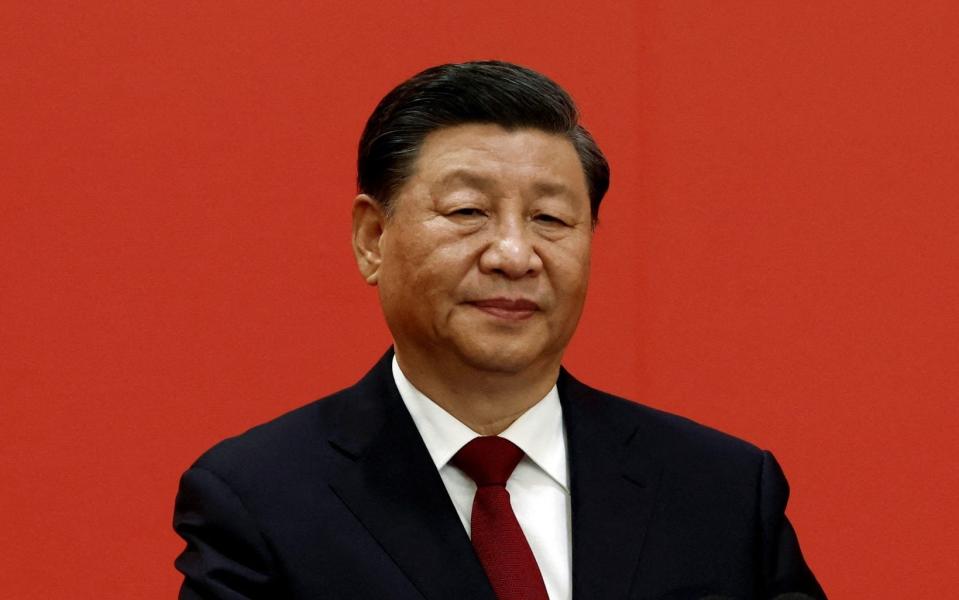

President Xi Jinping has repeatedly said he wants to “reunify” China with Taiwan, using his New Year’s address to say that it was inevitable the island nation would fall under Beijing’s sway.

Taiwan is a long-time US ally and President Joe Biden has signalled he would be willing to send American troops to defend it in the event of an invasion.

Sir Iain Duncan Smith MP, co-chair of the Inter-Parliamentary Alliance on China, said of the gold stockpiling: “If they get much closer to bullying Taiwan and countries start to move their investments out of China, it will give them a bit of padding to be able to ride through some of the difficulties.”

China’s central bank began purchasing gold shortly after Western nations froze Russian currency reserves held at foreign central banks in response to its full-scale invasion of Ukraine. Western sanctions wiped out $350bn of Moscow’s foreign currency.

Mr Eyal said: “There is absolutely no question that the timing and the sustained nature of the purchases are all part of a lesson that [China] has drawn from the Ukraine war.”

He said China was likely building up gold reserves to protect it against dollar sanctions if it came into major confrontation with the West.

Mr Eyal added: “It was a major shock that it is possible to take sovereign holdings and freeze them. I think that was a fundamental change as far as Xi Jinping was concerned.”

China has increased gold as a share of its total financial reserves from 3.2pc to 4.6pc since October 2022, according to the World Gold Council. The country now has the sixth-largest gold stockpile in the world, just behind Russia.

John Reade, chief market strategist at the World Gold Council, said: “The sanctions placed upon the Central Bank of Russia following the Russian invasion of Ukraine back in 2022 made politicians and reserve managers realise that they are more at risk than perhaps they thought they were.

“If you offend the Western powers, then you can lose access to your foreign exchange reserves.”

Beijing’s stockpile is dwarfed by the holdings of the US, which has the largest reserves in the world. US holdings are worth $602bn, while the UK owns $23bn of the precious metal.

Mr Eyal said China’s urgency was clear given it is buying up vast amounts of gold at a time when prices are at historic highs. Its price has risen by almost a fifth over the last year, reaching an all-time high in recent weeks. The surge has coincided with fears of a spiralling conflict in the Middle East.

As well as stockpiling gold, President Xi has campaigned for self-sustaining agriculture in China. The PBOC has also been selling down its holdings of US government debt.

Mr Eyal said: “The most important thing is this determination to be self-sufficient in both food and finances to withstand a long-term confrontation with the United States. I mean not months but years of confrontation with the United States, of the kind the West has with Russia at the moment.”

American military officials have warned that China aims to have the military capabilities to invade Taiwan by 2027.

Globally, central banks bought more gold in the first quarter of 2024 than during any other start of the year on record, according to the World Gold Council.

High inflation has been a key driver, but central banks in emerging economies are also increasing their gold purchases as an alternate store of wealth to US dollars, Mr Reade said.