Prediction: 5 Stocks That’ll Be Worth More Than Artificial Intelligence (AI) Stock Nvidia 3 Years From Now

Over the last 30 years, no next-big-thing trend or innovation has come close to rivaling the advent of the internet. However, artificial intelligence (AI) has the potential to do for businesses in this generation what the internet did for corporate America three decades ago.

By the turn of the decade, analysts at PwC foresee AI, which relies on software and systems in place of human oversight, increasing global gross domestic product by $15.7 trillion. No company has more directly benefited from the AI revolution than semiconductor stock Nvidia (NASDAQ: NVDA).

Nvidia’s stock may be in a bubble

Over the span of 15 months, Nvidia’s valuation has soared by $1.9 trillion to $2.26 trillion, which ranks behind only Microsoft and Apple among publicly traded companies in the U.S.

Nvidia’s outperformance is a reflection of the overwhelming demand for its high-powered A100 and H100 graphics processing units (GPUs). Some analysts believe Nvidia’s top-tier chips could account for more than 90% of the GPUs deployed in AI-accelerated data centers this year. The early stage scarcity associated with these chips has afforded Nvidia exceptional pricing power.

But there are also plenty of reasons to believe Nvidia is in a bubble.

For example, every next-big-thing trend and innovation over the last three decades has worked its way through an early stage bubble. Investors have a habit of overestimating the adoption of new technology, and I don’t anticipate AI being the exception.

Nvidia is also likely to see its pricing power wane in the quarters to come as new competitors enter the space and the company’s own production reduces the scarcity of AI-GPUs. The bulk of Nvidia’s 217% data-center sales growth in fiscal 2024 (ended Jan. 28, 2024) can be traced to its pricing power.

The chief concern might just be that its top four customers, which are “Magnificent Seven” constituents and comprise roughly 40% of its sales, are all developing in-house AI chips for their data centers. One way or another, Nvidia’s orders from its top customers are liable to taper off in the quarters to come.

If history rhymes, once more, and the AI bubble bursts, Nvidia’s market cap could crater (in context to where it is now) and allow other companies to leapfrog it.

Here are five companies — not including Microsoft and Apple, which are already ahead of Nvidia — which have the tools and intangibles to be worth more than Nvidia three years from now.

1. Alphabet: $1.88 trillion current market cap (Class A shares, GOOGL)

The first industry titan that shouldn’t have any trouble surpassing Nvidia’s market cap over the coming three years is Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG), the parent company of internet search engine Google, streaming platform YouTube, and autonomous-driving company Waymo, among other ventures.

The reason Alphabet would hold up substantially better than Nvidia if the AI bubble bursts is because it’s a veritable monopoly in internet search. In March, Google accounted for more than 91% of worldwide internet search share. Looking back through nine years of monthly data from GlobalStats, Google hasn’t ceded more than 10% of global internet search share to all other companies, combined. It’s the clear-and-obvious choice for advertisers looking to get their message in front of users, and it’s going to benefit immensely from long periods of domestic and international growth.

Google Cloud can also thrive if Nvidia stumbles. Enterprise cloud spending is still in its early innings, and Google Cloud has gobbled up a 10% share of worldwide cloud infrastructure service share, as of September 2023. Since cloud margins are traditionally juicier than advertising margins, Alphabet’s cash flow growth may accelerate in the latter-half of the decade.

2. Amazon: $1.87 trillion current market cap

Like Alphabet, e-commerce juggernaut Amazon (NASDAQ: AMZN) can jump back ahead of Nvidia at some point over the next three years if the AI bubble deflates.

Most people are familiar with Amazon because of its world-leading online marketplace. In 2023, an estimated 38% of online retail spending in the U.S. was traced to its e-commerce site. But the real benefit of having more than 2 billion people visit Amazon’s website each month is the advertising revenue it can generate, and the subscription revenue brought in via Prime. Amazon topped 200 million Prime users in April 2021, and has almost certainly added to this figure since becoming the exclusive streaming partner of Thursday Night Football.

However, Amazon’s premier cash flow driver is its cloud infrastructure service platform. Despite accounting for a sixth of the company’s net sales, Amazon Web Services (AWS) consistently generates 50% to 100% of Amazon’s operating income. AWS is the world’s top cloud infrastructure service platform by spend, per Canalys.

3. Meta Platforms: $1.24 trillion current market cap

Even though social media company Meta Platforms (NASDAQ: META) is betting on a future fueled by AI and augmented/virtual reality, the company’s core operations should sustain double-digit earnings growth and help lift its valuation well past Nvidia come 2027.

Meta’s “secret sauce” is no secret at all. Despite its metaverse ambitions and big spending at Reality Labs, the company’s bread-and-butter continues to be its social media empire. It’s the parent of the most-visited social site on the planet (Facebook), and collectively attracted just shy of 4 billion monthly active users during the December-ended quarter with its family of apps. Just as advertisers willingly pay a premium to Alphabet’s Google because of its dominance in internet search, Meta’s ad-pricing power tends to be superior in most economic climates.

The other reason Meta can shine and completely close the roughly $1 trillion valuation gap between it and Nvidia over the coming three years is its balance sheet. Meta is a cash-flow machine. It generated more than $71 billion in net cash from operations last year and closed out 2023 with $65.4 billion in cash, cash equivalents, and marketable securities. Not only does this cash provide a buffer to the downside, but it affords Meta the luxury of taking chances that few other companies can match.

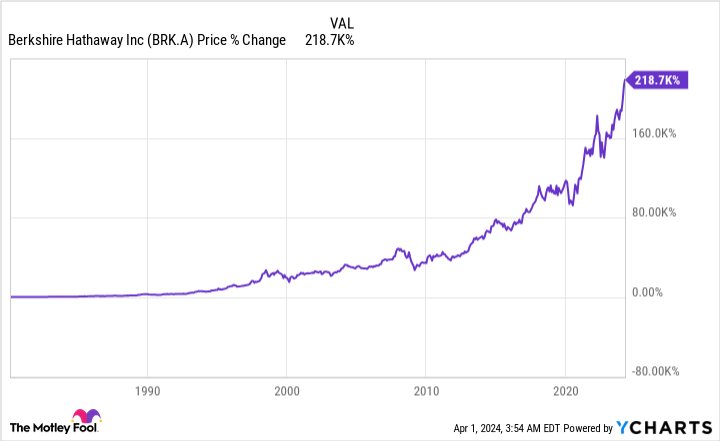

4. Berkshire Hathaway: $908 billion current market cap (Class A shares, BRK.A)

A fourth company that can surpass AI stock Nvidia’s market cap over the course of the next three years is conglomerate Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). Since Warren Buffett took the reins at Berkshire Hathaway in the mid-1960s, he’s overseen an annualized average return on his company’s Class A shares that’s approaching 20%!

One of the primary reasons Berkshire Hathaway has been such a moneymaker for investors is the “Oracle of Omaha’s” love of dividend stocks. Berkshire is on track to collect in the neighborhood of $6 billion in payouts this year, with just five core holdings accounting for almost $4.4 billion in aggregate dividend income. Since dividend-paying companies are often profitable on a recurring basis and time-tested, they’re just the type of businesses we’d expect to grow in lockstep with the U.S. economy over long periods.

Warren Buffett and his investment team also gravitate to brand-name businesses with trusted management teams. For instance, the $155 billion invested in Apple adds up to almost 42% of Berkshire Hathaway’s invested assets. Apple is one of the world’s most-valuable brands, and CEO Tim Cook has done a masterful job of leading ongoing physical product innovation while also pivoting the company to a subscription services-driven future.

5. Visa: $573 billion current market cap

The fifth stock that’ll be worth more than artificial intelligence stock Nvidia three years from now is payment-processing behemoth Visa (NYSE: V). As things stand now, Visa will have to close a nearly $1.7 trillion valuation gap. But if the AI bubble pops and Visa keeps doing what it’s been doing for decades, it can happen.

What makes Visa tick is the company’s long runway of opportunity. It’s the undisputed market share leader in credit card network purchase volume in the U.S. (the largest market for consumption globally), and has a multidecade opportunity to organically or acquisitively push its payment infrastructure into underbanked regions, such as the Middle East, Africa, and Southeastern Asia. Visa should be able to sustain a double-digit earnings growth rate throughout the remainder of the decade, if not well beyond.

Visa’s other source of success is its relatively conservative management team. Although it would probably be wildly successful as a lender, its leaders have chosen to keep the company solely focused on payment facilitation. The advantage of this approach is that Visa doesn’t have to set aside capital to cover loan losses during economic downturns since it’s not a lender. The result is a profit margin that’s consistently hovered at or above 50%!

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 1, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet, Amazon, Meta Platforms, and Visa. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Visa. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: 5 Stocks That’ll Be Worth More Than Artificial Intelligence (AI) Stock Nvidia 3 Years From Now was originally published by The Motley Fool