A Once-in-a-Decade Opportunity: 3 Magnificent Dividend Stocks Down Between 19% and 28% to Buy Now and Hold Forever

Down between 19% and 28% from their all-time highs, dividend growth stocks Unilever (NYSE: UL), The Hershey Company (NYSE: HSY), and Lamb Weston (NYSE: LW) currently trade near once-in-a-decade valuations.

These magnificent stocks have five-year betas well below 1, making these discounted prices even more alluring for investors. Betas measure a company’s share price volatility compared to the broader market. Low betas of less than 1 often belong to reliable, steady-Eddie operators fit to anchor any investor’s portfolio.

This combination of low share price volatility and steady dividend growth at a decade-low valuation makes these three stocks promising once-in-a-decade opportunities. Here’s how they could reward investors handsomely over the coming years.

1. Unilever

Consumer goods juggernaut Unilever owns more than 400 brands sold in more than 190 countries. Thanks to powerful labels such as Dove soap, Axe body spray, Tresemme shampoo and conditioner, Vaseline, and Ben & Jerry’s, roughly 3.4 billion people use its products daily.

Despite this global reach and widespread customer adoption, there are two critical reasons for investors to remain excited about the company’s long-term prospects — especially with the behemoth trading nearly 20% below its all-time high share price.

First, Unilever generates 59% of its sales from emerging markets. Since it’s expanding its presence in high-growth-potential countries like India, Brazil, China, and Indonesia, the company’s growth story should have plenty of chapters left. It increased 2023 sales by 15% in Latin America and 7% in Asia Pacific and Africa. Unilever is well-positioned to see strong growth as the middle class continues expanding globally.

Second, the company recently announced the upcoming separation of the smallest and least profitable unit, its ice cream operations. The ice cream unit weighs on the company’s cash-generating potential, as the cold storage supply chain infrastructure needed is capital-intensive and dissimilar from the rest of Unilever’s operations.

Best yet for investors, even after the company’s share price rose 8% following its first-quarter results in April, its price-to-earnings (P/E) ratio of 19 and dividend yield of 3.6% remain more attractive than the S&P 500 index’s 25 and 1.4% averages.

2. The Hershey Company

With its share price down 29% over the last year, confectioner Hershey continues to battle against an array of issues, such as:

-

Cocoa prices more than tripling since 2023.

-

Capital expenditures (capex) soaring to all-time highs as the company implements a new enterprise resource planning (ERP) system.

-

The threat of GLP-1 obesity drugs and their effect on snacking.

-

YouTuber Jimmy Donaldson’s (Mr. Beast) entrance into the industry with quickly growing Feastables chocolates.

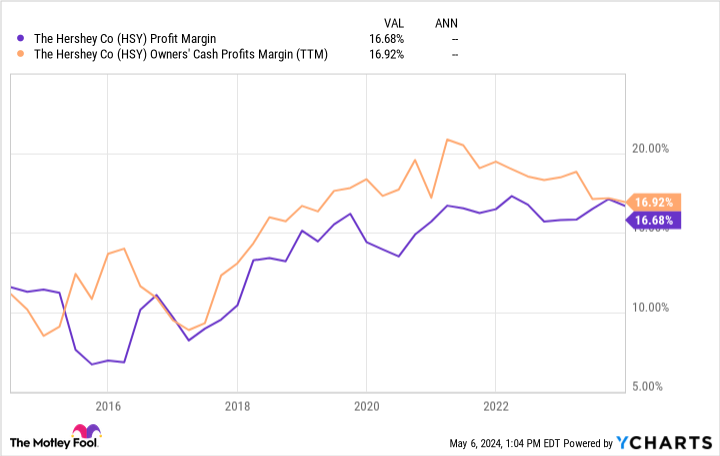

Despite these potentially crippling circumstances, Hershey has maintained a robust 17% net profit and free cash flow (FCF) margin.

Furthermore, the company’s KitKat, Hershey’s, and Reese’s brands ranked first among Gen Z snackers, according to a study from Segmanta, highlighting sustained popularity across generations.

With this unwavering popularity and profitability — while operating in a recession-resilient industry — Hershey makes for an intriguing turnaround candidate as cocoa prices and the company’s capex revert to “normal” levels.

Best yet, trading at just 21 times earnings and with a 2.5% dividend yield, Hershey trades at a discount to the broader market and its own 10-year averages. Thanks to this discount, Hershey’s brand power, and its longer-term rebound potential, the company looks like an excellent holding, which is why I’m excited to add it to my daughter’s portfolio.

3. Lamb Weston

While the frozen potato industry may not elicit thoughts of turmoil, Lamb Weston’s share price drop of 21% year to date shows otherwise. Like our other steady-Eddie investment idea, Hershey, Lamb Weston has embarked on a mission to deploy a new ERP system.

However, this has not been a smooth process for the frozen potato juggernaut. During the company’s third-quarter earnings call, management estimated that the ERP transition caused sales volume to decline by 8% due to negative impacts on order fulfillment rates.

Making matters worse, increased capex used to boost manufacturing capacity in the Netherlands, Argentina, and China has temporarily caused Lamb Weston’s free cash flow (FCF) to turn negative. While this short-term pain is tough to stomach, management estimates it will be able to grow international sales from 15% of sales in 2022 to 34% in 2024 — all while giving it valuable exposure to higher-growth markets.

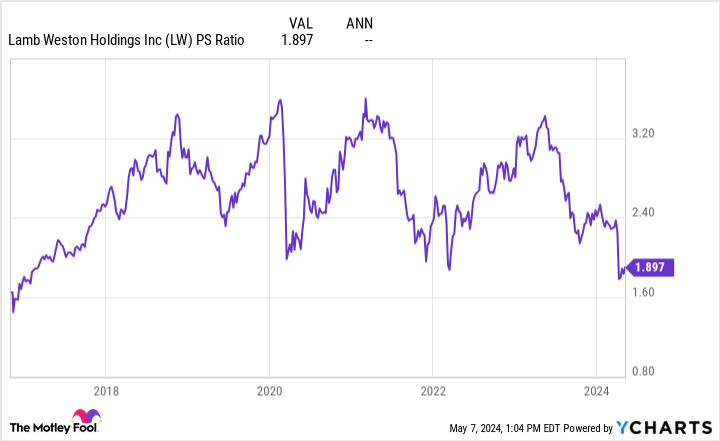

With a decade-low price-to-sales (P/S) ratio of 1.9, Lamb Weston could be a steal at today’s discount once capex normalizes and its growth investments start to pay dividends.

If the company can return to the average FCF margin of 11% it saw between 2016 and 2022, it would trade at just 17 times FCF.

If you plug this into a reverse discounted cash flow model, Lamb Weston would only need to deliver 5% growth to match the market’s average performance of 10% annually. With global potato demand expected to grow by 3% annually over the long term and Lamb Weston poised for international growth, I think it could easily exceed this 5% growth rate and beat the market.

This outperformance potential, paired with the company’s growing dividend that yields 1.5% and only uses 15% of net income, makes for an excellent once-in-a-decade opportunity.

Should you invest $1,000 in Unilever right now?

Before you buy stock in Unilever, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Unilever wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Josh Kohn-Lindquist has positions in Hershey. The Motley Fool recommends Hershey and Unilever Plc. The Motley Fool has a disclosure policy.

A Once-in-a-Decade Opportunity: 3 Magnificent Dividend Stocks Down Between 19% and 28% to Buy Now and Hold Forever was originally published by The Motley Fool