Is It Time to Dump Nvidia Stock for Advanced Micro Devices After Microsoft Announcement?

Microsoft recently announced that it would offer its cloud computing customers the option of using MI300X artificial intelligence (AI) chips made by Advanced Micro Devices (NASDAQ: AMD). Microsoft will offer clusters of MI300X chips through its Azure cloud computing service as an alternative to Nvidia‘s (NASDAQ: NVDA) H100 graphic processing units (GPUs).

Given this announcement, is it time to dump Nvidia stock in favor of AMD?

The simple answer is no. Expanding on that answer, it might be a good time to buy both stocks — and another beneficiary as well.

Why Microsoft started offering AMD chips

Microsoft isn’t offering cloud customers the option of AMD GPUs as a knock on Nvidia’s GPUs, which have become the industry standard for helping power AI applications in the data center. The issue is that Nvidia’s chips are so popular that it is becoming difficult for companies to get hold of them. This isn’t a bad problem to have.

Both Nvidia and AMD are having difficulty keeping up with demand for their GPUs. Taiwan Semiconductor Manufacturing (NYSE: TSM), the world’s largest semiconductor manufacturer, said that its advanced packaging capacity is fully booked for both the rest of this year and next. It’s presumed this is due to demand for GPUs from both Nvidia and AMD, which are both top-10 customers of the company.

TSCM is working to aggressively expand its production capacity to meet AI and other high-performance computing (HPC) chip demand. The company now plans to build a third fabrication facility (fab) in Arizona after its first facility in the state just began wafer production. It also just completed its first specialty technology fab in Japan and announced a second in the country to be completed by the end of 2027. It is also building a fab in Germany for automotive and industrial applications, scheduled to start construction late this year.

TSMC is also looking to fully develop its 2-nanometer chip technology. Within the semiconductor industry, as technology moves to smaller nodes (semiconductor sizes), more chips can fit on a wafer, which increases production capacity and lowers costs.

However, until this technology and fab expansion take hold, the market for GPUs looks like it will remain tight.

Time to buy Nvidia, AMD, and TSMC

Instead of dumping Nvidia, now could be a great time for investors to buy both Nvidia and AMD stock, as well as TSMC. The demand for high-performance computing chips and GPUs is massive, and the industry is currently struggling to meet demand.

Nvidia remains the clear leader, and its growth has been nothing short of spectacular. The company long ago became the GPU industry standard before the advent of AI through its CUDA software platform, which allows its GPUs to be programmed directly. At this point, the company can likely sell as many chips as its foundry partners can produce. These days most semiconductor companies don’t own their own manufacturing facilities, and instead use contract manufacturers like TSCM.

AMD, meanwhile, is a nice beneficiary of a very tight GPU market. With its Q1 results, the company just raised its expected full-year data center GPU revenue from $3.5 billion to $4.0 billion. And with Nvidia GPUs difficult to get, AMD has the opportunity to make inroads into this market and become a viable number-two player. Companies generally don’t like to rely too heavily on one supplier, so the current market dynamics could give AMD a longer-lasting boost if its chips are well received.

TSCM, meanwhile, is a prime beneficiary of GPU and chip demand, as companies race to get these chips to power AI applications. By adding additional fabs and moving to 2-nanometer technology, TSCM is set to benefit from the AI chip boom. It also will benefit as other companies jump on board. For example, it has been reported that Arm Holdings and Softbank have been looking to design an AI chip, while companies like Amazon have gotten into the AI chip business as well. Apple executives, meanwhile, have been reported to have met with TSMC to reserve 2-nanometer production to help it catch up in AI. This all benefits TSMC.

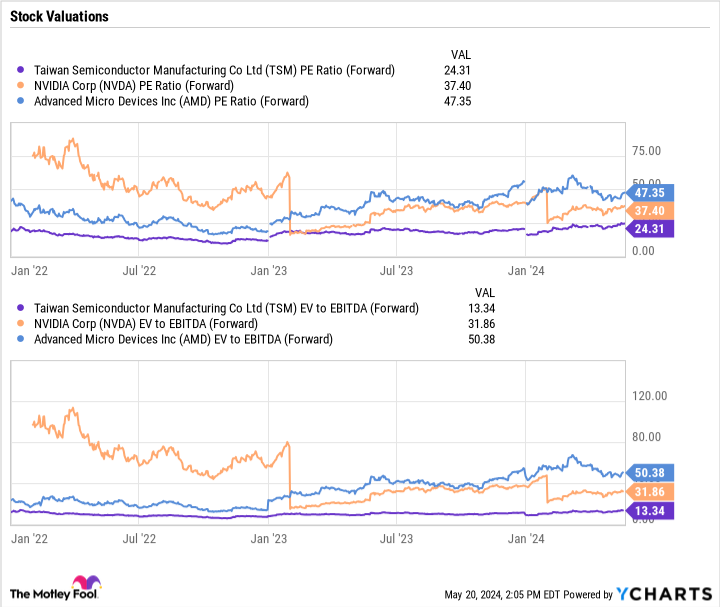

When looking at valuations, TSMC is the cheapest stock, trading at about 24 times forward P/E. It is even cheaper on an enterprise value-to-EBITDA basis, trading near 13 times. This metric takes into consideration its net debt position and takes out non-cash expenses.

Nvidia, meanwhile, trades at a forward P/E of 37, and 32 on an EV/EBITDA basis. Given its growth, this is an inexpensive valuation.

AMD is the most expensive stock of the group, trading at a forward P/E of over 47 and an EV/EBITDA multiple of over 50. However, the company has not yet seen the potential AI chip inflection point that the other two companies have, so it still holds potential.

In order of preference at this time, Nvidia would be my first choice, closely followed by TSMC, and then AMD. However, all three stocks hold strong long-term potential.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $635,982!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Apple, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Is It Time to Dump Nvidia Stock for Advanced Micro Devices After Microsoft Announcement? was originally published by The Motley Fool