Canadians getting more anxious about their finances as they await more rate cuts

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Article content

More Bank of Canada interest rate cuts can’t come soon enough for an increasing number of people who say they are worse off financially on several fronts, says a new survey.

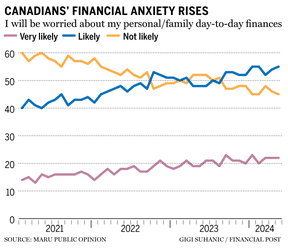

Fifty-five per cent of Canadians indicated they are worried about their personal and day-to-day family finances, which ties the highest reading recorded by Maru Public Opinion since it started its Household Outlook Index four years ago.

Article content

The number of people worried about their personal finances has been on a steady march upward since early 2021, when 40 per cent of people harboured such concerns.

John Wright, executive vice-president at Maru Public Opinion, links the inexorable rise in the measure to the acceleration of inflation, which rose from 3.1 per cent in June 2021 to a peak of 8.1 per cent a year later.

“It’s something people haven’t been able to shake off,” he said.

Maru had even more bad news. For example, 28 per cent of Canadians said they were worse off financially in May, up from 25 per cent the month before and 23 per cent at the start of the year. And a record number of people said they are struggling to make ends meet — 43 per cent compared to 37 per cent in March — the poll of 1,500 adult Canadians from May 31 to June 3 said.

“During COVID, many people didn’t have the expenses they had. Cars were sitting in driveways. They were working from home. It was bad with the virus, but pretty good with finances,” Wright said. “The last six to eight months, they began to realize the cost of living was much more than they expected. They’re into credit debt in a significant way.”

Article content

The latest Maru poll was taken days before the Bank of Canada made its first interest rate cut in four years. On June 5, the central bank cut 25 basis points off its benchmark borrowing rate to 4.75 per cent from a two-decade-plus high of five per cent.

Wright thinks more cuts will be needed before people shift their financial outlook.

“I know people will be pleased, but at 25 basis points, that’s not going to make a big impact on people’s lives,” he said.

All this personal “pocketbook pessimism” has pulled the Household Outlook Index down after it had started to rise from its all-time low at the end of last year.

The index slipped to 85 in May from 86 in April. The base number for the index is 100. A result above 100 indicates optimism, and below 100, pessimism. Maru compiles its household index each month by asking a panel of people a series of questions about the economy’s prospects over the next 60 days.

Recommended from Editorial

On the economy front, 34 per cent think it is on the right track, up three percentage points from the previous poll. That brought the reading back to where it was two months ago, Wright said, noting that a significant number of people — 66 per cent — still believe the economy is on the wrong track.

“On the national front, nothing has changed, but on the personal front, people continue to struggle,” he said.

• Email: gmvsuhanic@postmedia.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Share this article in your social network