Nvidia Has Completed Its 10-for-1 Stock Split: Here’s Why I’m Still Not Touching This Artificial Intelligence (AI) Titan With a 10-Foot Pole

One of the most anticipated events of the year is officially over. Less than 24 hours ago, following the close of trading on Friday, June 7, the infrastructure backbone of the artificial intelligence (AI) revolution, Nvidia (NASDAQ: NVDA), completed its 10-for-1 forward split.

A “stock split” is an event which allows publicly traded companies to cosmetically alter their share price and outstanding share count by the same magnitude. It’s cosmetic in the sense that stock splits have no effect on a company’s market cap or operating performance. Stock splits can make shares more nominally affordable for retail investors, as with a forward-stock split. They can also increase a company’s share price to ensure continued listing on a major stock exchange, as seen with a reverse-stock split.

Investors have been gravitating to stock-split stocks over the last three years because they have a history of outperforming. More than a dozen high-flying stocks have announced and/or enacted forward-stock splits since the midpoint of 2021, including Nvidia, which just completed its second split since July 2021.

Nvidia has gained $2.68 trillion in market value in a little over 17 months

On paper, Nvidia has given investors every reason to hop aboard and enjoy the ride. On June 5, Nvidia’s market cap topped $3 trillion for the first time, with the company surpassing Apple for the No. 2 spot among America’s largest publicly traded companies. Since 2023 began, Nvidia has added roughly $2.68 trillion in market value, which has entirely been driven by AI.

Nvidia’s AI-inspired graphics processing units (GPUs) are the cornerstone of high-compute data centers. Based on varied estimates, Nvidia’s chips account for around 90% of AI-GPU market share, with the ultra-popular H100 GPU powering generative AI solutions and helping to train large language models.

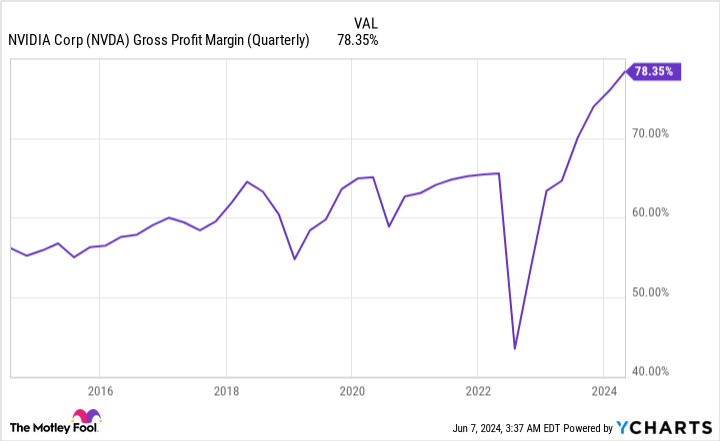

Nvidia’s innovative advantage is driving gains, too. The company’s next-generation Blackwell chip, which costs between $30,000 to $40,000, is believed by some Wall Street analysts to be sold out well into 2025. With demand overwhelming supply, Nvidia has had no trouble raising the price of its AI-GPUs and reaping the rewards of a massive uptick in gross margin — 78.35% in the fiscal first quarter of 2025, ended April 28.

Despite Nvidia’s stock gaining 738% in a little over 17 months, it still appears reasonably cheap on a fundamental basis. Although shares are currently trading at roughly 34 times forward-year earnings, Wall Street’s consensus calls for an annualized earnings growth rate of 46.5% over the next five years.

On the surface, Nvidia looks perfect following its 10-for-1 stock split. But as an investor, I can’t judge a book solely by its cover.

History suggests Nvidia may be a ticking time bomb

Taking a step back, widening the lens, and allowing history to be my guide leads to a completely different investment view of Nvidia over the months and/or years to come. While there’s no denying that it’s been firing on all cylinders and handily surpassing even the loftiest expectations thrown its way by Wall Street analysts, there are a handful of reasons why I wouldn’t touch Nvidia stock with a 10-foot pole in the wake of its 10-for-1 split.

The primary reason I want nothing to do with Nvidia has to do with the history of next-big-thing innovations.

Since the advent of the internet roughly three decades ago, Wall Street has had no shortage of next-in-line trends that were expected to change the growth arc for corporate America. Some of these innovations include genome decoding, the rise of nanotechnology, business-to-business commerce, 3D printing, blockchain technology, the metaverse, and now, artificial intelligence.

While some of these trends were successful over the long run, they all share one thing in common (save for AI): an early stage bubble-bursting event. Investors have consistently overestimated the adoption of new technologies and innovations for more than 30 years. Every game-changing innovation comes with immense promise and lofty analyst expectations. Unfortunately, every new innovation needs time to mature — and artificial intelligence is unlikely to be the exception. If and when the AI bubble bursts, there isn’t a company that’s going to take it on the chin more than Nvidia.

Mind you, I have no clue when the AI bubble could burst. History has shown that stock valuations can remain extended for years before correcting. But eventually (key word!), we’ve witnessed every new innovation navigate its way through a bubble-popping event.

We’re also beginning to see subtle “warnings” from Nvidia that the peak is here or nearby.

If you were to scour Nvidia’s fiscal first-quarter operating results and conference call, you’d find nothing but positive commentary from its management team. However, the company’s fiscal second-quarter gross margin guidance of 75.5%, plus or minus 50 basis points, is the red flag I speak of.

After increasing its gross margin by 13.8 percentage points in a year, a forecast decline of 235 to 335 basis points (78.35% to a range of 75% to 76%) might sound like a nothingburger. But it’s noteworthy when you consider that external competitors are hitting the ground running with AI-GPUs of their own. Furthermore, Nvidia’s top four customers, which account for roughly 40% of its sales, are internally developing AI-GPUs for their data centers.

This forecast decline in sequential quarterly gross margin would appear to signal that Nvidia’s pricing power has peaked. If GPU scarcity wanes, Nvidia’s pricing power will taper, too.

The third reason I want nothing to do with Nvidia following its now-complete 10-for-1 stock split is, once again, history — but this time I’m talking about its valuation.

As I noted earlier, Nvidia is still relatively inexpensive, based on the price-to-earnings-growth ratio (PEG ratio). But on the basis of trailing 12-month (TTM) sales, Nvidia has reached a level of historic priciness that rivals only Amazon and Cisco Systems prior to the dot-com bubble bursting.

In late March 2000, Cisco Systems peaked at just shy of 39 times TTM sales. Meanwhile, Amazon topped 43 times TTM sales in January 1999 before falling off a cliff. Nvidia is currently sitting at a multiple of 38 times TTM sales.

History may not repeat perfectly on Wall Street, but it does have a tendency to rhyme. For those reasons, I’m not touching this artificial intelligence titan with a 10-foot pole.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $741,362!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Apple, Cisco Systems, and Nvidia. The Motley Fool has a disclosure policy.

Nvidia Has Completed Its 10-for-1 Stock Split: Here’s Why I’m Still Not Touching This Artificial Intelligence (AI) Titan With a 10-Foot Pole was originally published by The Motley Fool