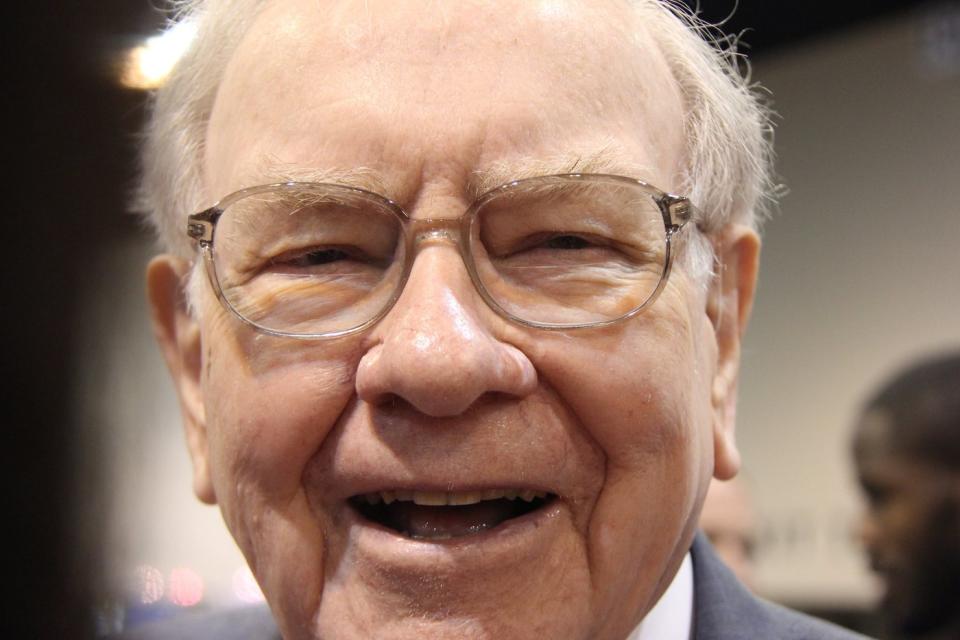

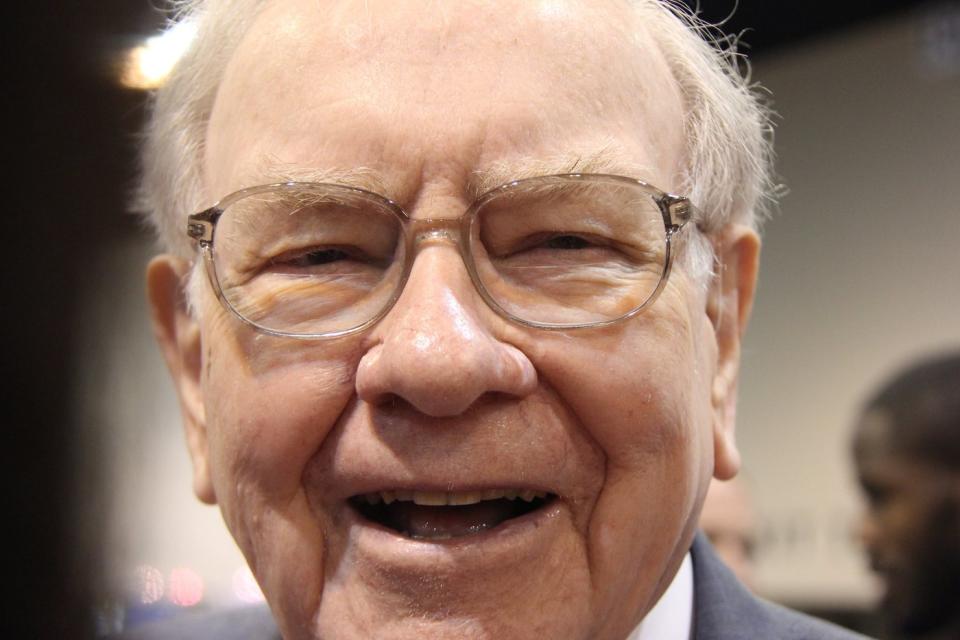

Billionaire Warren Buffett Has Purchased $77 Billion of His Favorite Stock, Which Is More Than Double What He’s Spent Buying Shares of Apple!

For nearly 60 years, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has been running circles around Wall Street’s major stock indexes. Since ascending to the CEO chair in the mid-1960s, he’s overseen an aggregate return of greater than 5,350,000% for Berkshire’s Class A shares (BRK.A), as of the closing bell on July 18. This works out to an annualized return or nearly 20% over six decades.

Returns of this magnitude over such a lengthy time frame are virtually unheard of, which is why the “Oracle of Omaha” garners so much attention on Wall Street. Some 40,000 people flock to Omaha, NE, each year for a chance to hear Buffett speak about the U.S. economy, his investment philosophy, and the stocks he favors.

If there’s one investing trait that’s been vital to Buffett’s success as CEO of Berkshire Hathaway, it’s portfolio concentration. Billionaire Warren Buffett and the late, great Charlie Munger have long favored putting an outsized percentage of Berkshire’s capital to work in their best ideas. As of last week, 75% of Berkshire’s $416 billion investment portfolio was invested in just five unstoppable stocks.

Yet what might come as a surprise is that Buffett’s biggest investment — $77 billion in under six years — and favorite stock to buy doesn’t show up in Berkshire’s investment portfolio.

Apple is Berkshire’s top holding, but not its largest cost basis

Despite Buffett and his team of advisors (Todd Combs and Ted Weschler) selling almost 126.2 million shares of tech stock Apple (NASDAQ: AAPL) during the combined fourth quarter and first quarter, Berkshire’s top holding still accounts for more than 43% of its invested assets.

During Berkshire Hathaway’s most recent annual meeting, Buffett attributed this selling activity as being tax-related and not representative of him or his team losing faith in Apple. In fact, Buffett has previously referred to his company’s top holding as “a better business than any we own.” Perhaps it’s not surprising that the remaining 789.4 million shares of Apple owned by Berkshire have a mammoth estimated cost basis of more than $31 billion.

Although the Oracle of Omaha isn’t the biggest fan of investing in tech stocks or buzzy innovations, he does understand consumer behavior, the power of branding, and a high-quality management team when he sees one.

Apple finds itself at the top of the pecking order in domestic smartphone market share. Since introducing 5G-capable iPhones in 2020, it’s accounted for a 50% or greater share of the market. It’s also made strides in personal computing, with Mac gaining market share in the U.S. over the last three years.

However, CEO Tim Cook isn’t satisfied with Apple simply being a physical product innovator. Cook is spearheading a multiyear shift that’s seen Apple focus its efforts on subscription services. A services-driven operating model should improve the company’s operating margin over time and help keep customers within its ecosystem of products and services.

Lastly, Apple’s share repurchase program is unrivaled among publicly traded companies. Since kicking off its buyback program in 2013, the world’s largest publicly traded company has bought back $674 billion worth of its common stock. Share repurchases are increasing Berkshire’s stake in Apple without Buffett or his crew having to do a thing.

Buffett has spent a small fortune buying shares of his favorite stock

The estimated $31.3 billion that’s been spent buying shares of Apple is more than the Oracle of Omaha and his team have put to work in Chevron, Occidental Petroleum, Bank of America, and any other core holding in Berkshire Hathaway’s portfolio.

Yet this $31.3 billion investment in Apple is less than half the amount Warren Buffett has spent buying shares of his favorite stock.

The reason you don’t hear about Buffett’s favorite stock all that often is because you won’t find it in the company’s quarterly Form 13F filing with the Securities and Exchange Commission. A 13F is where investors look to see what stocks Wall Street’s brightest (and richest) money managers were buying and selling the latest quarter.

For details on Warren Buffett’s favorite stock to buy, investors have to dig into Berkshire Hathaway’s quarterly operating results. On the final page of each report, just prior to the executive certifications, you’ll find detailed trading activity on share repurchases. That’s right… billionaire Warren Buffett’s top stock to buy over the last six years has unquestionably been shares of his own company.

Since Berkshire Hathaway doesn’t pay a dividend, repurchasing stock is one of the easiest ways to reward the company’s long-term investors. However, buying back stock hasn’t always been easy.

Prior to mid-July 2018, Buffett and Charlie Munger had their hands tied when it came to buybacks. Repurchases were only allowed if Berkshire’s stock fell to or below 120% of book value, which hadn’t occurred for a long, long time. This meant not a penny was put toward buybacks.

On July 17, 2018, Berkshire Hathaway’s board altered the criteria governing share repurchases to make it easier for its dynamic duo of Buffett and Munger to come off the bench and work their magic. The board decreed that buybacks could continue without an end date or ceiling as long as:

-

Berkshire Hathaway has at least $30 billion in cash, cash equivalents, and U.S. Treasuries on its balance sheet; and

-

Warren Buffett (and Charlie Munger) believe shares are intrinsically cheap.

Because “cheap” is subjective, and Berkshire’s cash pile has been growing with consistency for years, Buffett has overseen more than $77 billion worth of buybacks over 23 consecutive quarters. This dwarfs the amount of capital put to work in Apple.

One clear advantage of this aggressive repurchase policy is that it’s incrementally increasing the ownership stakes of Berkshire Hathaway’s shareholders. The Oracle of Omaha and the late Munger have always preached a long-term ethos, and a steady stream of buybacks certainly supports this approach.

A steady diet of share repurchases should also reduce Berkshire’s outstanding share count. For companies with rising net income, buybacks can increase earnings per share (EPS), which can improve their attractiveness to fundamentally focused investors.

With Berkshire Hathaway potentially tipping the scales at north of $200 billion in combined cash, cash equivalents, and U.S. Treasuries as of the end of June 2024, look for Buffett to continue mashing the buy button on his favorite stock.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,626!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, and Chevron. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Billionaire Warren Buffett Has Purchased $77 Billion of His Favorite Stock, Which Is More Than Double What He’s Spent Buying Shares of Apple! was originally published by The Motley Fool