Posthaste: Nearly half of post-secondary students canât afford basics like food and housing, TD survey finds

Many are turning to the bank of mom and dad for help, but parents could be hurting their own financial health in the process

Article content

TD’s findings revealed that 65 per cent of students consider themselves “financially unstable” and 45 per cent say they can’t adequately cover basic needs, such as food and housing.

Advertisement 2

Story continues below

Article content

Close to half (45 per cent) said their summer job earnings from their summer jobs won’t cover the cost of living during the school year either.

But in the meanwhile, to fill in the gaps, many of them are turning to the bank of mom and dad for extra cash. About 62 per cent of students in the Ipsos/Simplii Financial survey admit they won’t be able to make it through the school year without some financial help from their family.

The TD report also found 94 per cent of parents are financially supporting their children during their post-secondary studies, with 58 per cent saying they provide a significant amount of support.

But the vast majority (71 per cent of parents) note this support impacts their own ability to meet basic financial needs or afford additional activities. Many parents believe their children need to practise better spending habits and improve their financial literacy.

Article content

Advertisement 3

Story continues below

Article content

“Our survey shows that many Canadian post-secondary students wish they knew more about budgeting and managing their finances, and it’s encouraging to see them interested in seeking advice,” said Emily Ross, vice-president, Everyday Advice Journey at TD.

“That said, it’s prudent for students to exercise some caution when taking financial advice from certain sources on social media platforms, which are often unvetted and untailored to each individual and their unique circumstances.”

The survey showed one in five students mainly get their financial advice from social media platforms like TikTok, Instagram and YouTube.

Sign up here to get Posthaste delivered straight to your inbox.

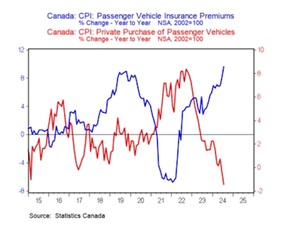

Car ownership costs cooled in July, with one exception.

Used vehicle prices fell 5.7 per cent, and new vehicle prices rose just one per cent year over year, writes Sal Guatieri, senior economist with BMO Capital Markets. Gas prices were up just 1.9 per cent and electricity costs down 0.8 per cent.

Auto insurance premiums, on the other hand, jumped 9.6 per cent in the past year, adding two tenths to the annual CPI rate, said Guatieri.

Advertisement 4

Story continues below

Article content

- Today’s Data: Canada current account balance, United States GDP and pending home sales

- Earnings: Canadian Imperial Bank of Commerce, Choice Properties Real Estate

Recommended from Editorial

Getting a divorce is costly from both a financial and emotional point of view. Wealth managers Ted Rechtshaffen and Michelle Hung say divorces can result in an estate value being 42 per cent lower than if the couple stayed together. But there are ways to recover from the hit, financially speaking anyway. Find out more.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line with your contact info and the gist of your problem and we’ll try to find some experts to help you out, while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers, led by Julie Cazzin, can give it a shot.

Advertisement 5

Story continues below

Article content

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Today’s Posthaste was written by Serah Louis, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected].

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments