Whoâs going to win the presidential election? The stock market has a prediction.

There’s a 64% probability that Kamala Harris will win this November’s presidential election, given the stock market’s strong year-to-date performance.

This is moderately higher than the 58% probability I reported in a column this past May. That’s because the stock market is higher now than it was then, and there is a significant correlation between the stock market’s election-year performance and the incumbent party’s chances of retaining the White House.

Most Read from MarketWatch

Read more economic and political news

Many readers have been urging me to update that column, now that President Biden has withdrawn from the race and Kamala Harris is the presumptive Democratic Party nominee. But the change in candidates does not impact the statistical conclusion, which is based on the identity of the incumbent party rather than the nominee. The only input to my simple statistical model is the Dow Jones Industrial Average’s DJIA year-to-date return, which is higher today than three months ago.

It’s important to put this model’s conclusion in its proper context. On the one hand, it by no means is a guarantee. In 2016, for example, the stock market on Election Day was sitting on modest year-to-date gains and the incumbent party still lost. In any case, it’s entirely possible the stock market will fall between now and Election Day and thereby reduce the probabilities currently calculated by my model. Harris’s probability of winning would drop below 50%, for example, if the DJIA’s year-to-date return on Election Day were to be negative.

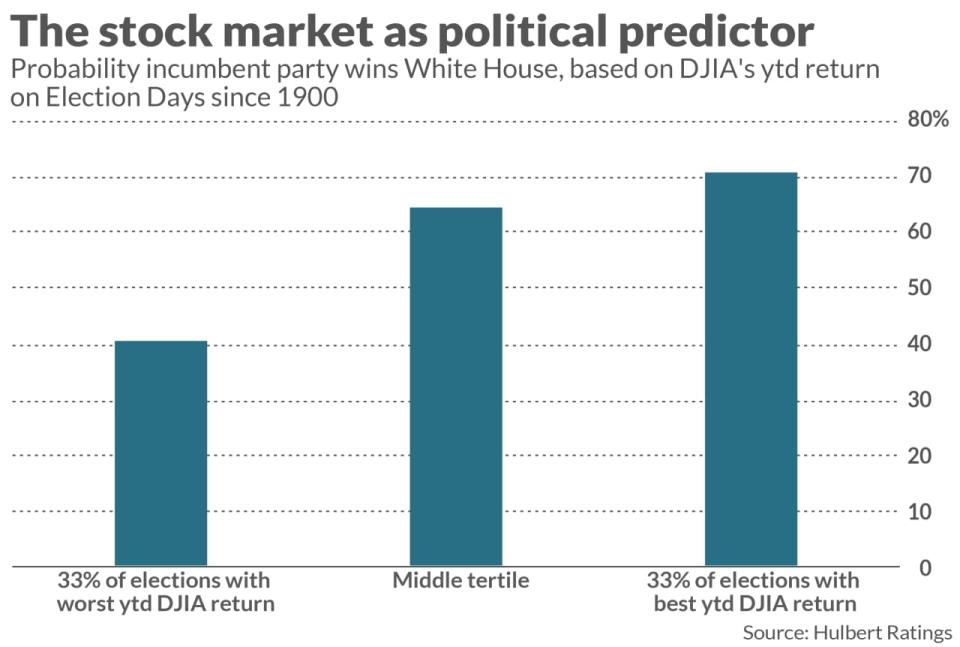

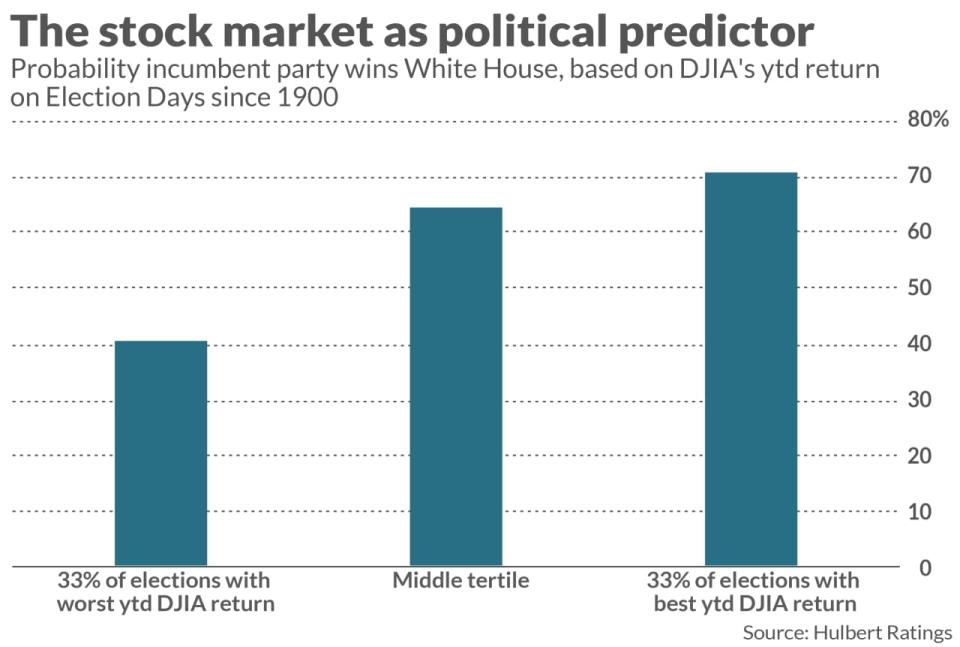

On the other hand, the stock market has a stronger statistical record than the several other indicators that I analyzed, such as the economy (as measured by GDP), the Conference Board’s consumer-confidence index and the University of Michigan’s consumer-sentiment survey. Look at the accompanying chart, which was built by dividing all election years since 1900 into thirds, based on the DJIA’s year-to-date return on Election Day. Notice that the incumbent party’s chances of winning rise with each tertile.

What about the electronic futures and betting markets? Given that they have been around for just a handful of presidential election cycles, there is too little data to know whether they have a better track record than the stock market. Nevertheless, I note that those markets currently are placing similar odds on a Harris victory as my stock market model. The Harris contract at PredictIt.org, for example, is giving her a 58% probability of winning.