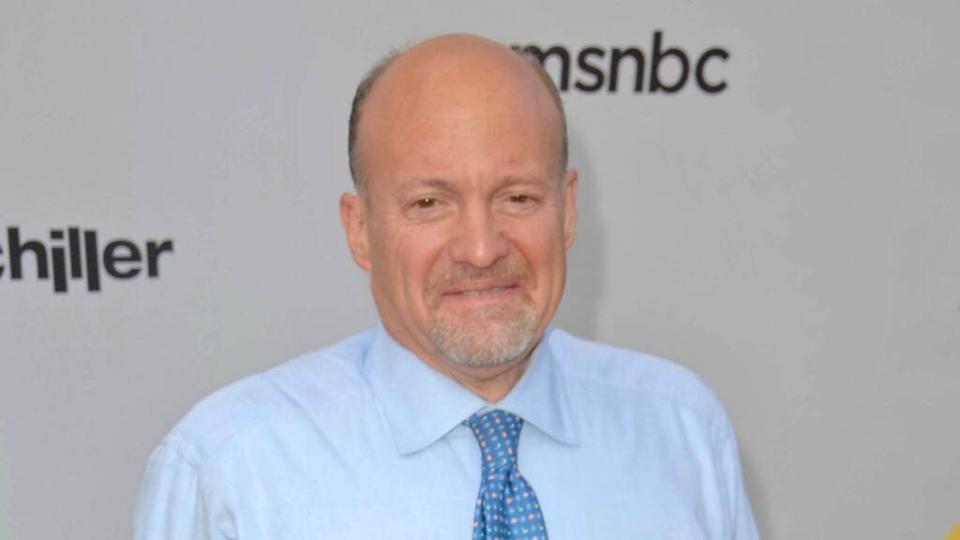

Jim Cramer Says He Likes This Nancy Pelosi Portfolio Stock ‘Very Much:’ And This AI Play Is Reasonably Valued Than High-Flier Nvidia

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Chipmaker Broadcom Corp.’s (NASDAQ:AVGO) shares, which began to rally at the start of 2023, have been going through a consolidation phase since topping out in late June. The stock has found itself a fan in CNBC Mad Money host Jim Cramer.

Trending Now:

-

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Commercial real estate has historically outperformed the stock market. This platform allows accredited investors to invest in commercial real estate, invest today for a 1% boost.

What Happened: Stephanie Link, chief investment strategist and portfolio manager at Hightower Advisors, has bought Broadcom shares, said Cramer in a post on X on Monday. More than the disclosure about Link’s Broadcom buy, what caught the attention of social media users was Cramer’s comment about his disposition toward the stock. Broadcom, he said, is “a stock I like very much….”

Some social media users poked fun at Cramer by reminding him about the negative psychology he has on stocks. “It’s up $30 (21%) or so in 5 days after a dip and it’s near all-time highs, then Jim endorses it…,” one of his followers said.

Broadcom Living Up To Hype? Broadcom, which was largely flying under the radar once, has now risen to prominence with its artificial intelligence foray. The company is now the 11th most-valued global corporation, boasting a market capitalization of a little over $766 billion. Incidentally, it has the highest market cap among techs outside of the Magnificent Seven, minus Tesla, and TSMC.

This semiconductor and infrastructure software products manufacturer recently reported third-quarter results that thumped Street estimates, thanks to strong AI revenue and solid performance of its VMware business. The San Jose, California-based company also raised its AI revenue guidance for the fourth quarter and the full year. Despite the results ticking most boxes, the slightly light fourth-quarter guidance sent the stock tanking a little over 10% immediately after the results.

Since then the stock has come back up, thanks to its nearly 20% rise from its post-earnings low.

Keep Reading:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

“Rocket City” is about to blast off — you can invest in this real estate market for just $100.

Yet, the stock trades at a reasonable forward price/earnings multiple of 26.81 compared to Nvidia Corp.’s (NASDAQ:NVDA).

Incidentally, Rep. Nancy Pelosi (D-Calif), who is known for her investments, bought 20 Broadcom call options on June 24, with a strike price of $800 and an expiration date of June 20, 2025. The purchase was made after the company reported its second-quarter results on June 12 and announced a 10-for-1 stock split. The stock began trading on a split-adjusted basis on July 15. The congresswoman’s call options now have a strike price of $80, giving effect to the split.

The average analysts’ price target for Broadcom is $198.66, according to TipRanks, with the 12-month price target pointing to over 21% upside from current levels.

Looking For Higher-Yield Opportunities?

The current high-interest-rate environment has created an incredible opportunity for income-seeking investors to earn massive yields, but not through dividend stocks… Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities and Benzinga has identified some of the most attractive options for you to consider.

For instance, the Ascent Income Fund from EquityMultiple targets stable income from senior commercial real estate debt positions and has a historical distribution yield of 12.1% backed by real assets. With payment priority and flexible liquidity options, the Ascent Income Fund is a cornerstone investment vehicle for income-focused investors. First-time investors with EquityMultiple can now invest in the Ascent Income Fund with a reduced minimum of just $5,000. Benzinga Readers: Earn a 1% return boost on your first EquityMultiple investment when you sign up here (accredited investors only).

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article Jim Cramer Says He Likes This Nancy Pelosi Portfolio Stock ‘Very Much:’ And This AI Play Is Reasonably Valued Than High-Flier Nvidia originally appeared on Benzinga.com