The Fed May Cut Interest Rates This Week. History Says Stocks Will Do This Next.

The long-awaited moment has arrived. The Federal Reserve is meeting this week, and economists are predicting policymakers will launch the first interest rate cut in four years. The Fed began lifting rates back in 2022 to calm raging inflation and since has lifted the benchmark rate 11 times, leaving it at 5.5% today. That’s the highest level in more than 20 years.

These moves have done their job, with inflation dropping over this period. Right now, it’s at 2.5% and nearing the Fed’s goal of 2%. Why that level? Because it “is most consistent with the Federal Reserve’s mandate for maximum employment and price stability,” according to the Federal Open Markets Committee.

So economists and traders have been speculating that on Wednesday the Fed will lower the benchmark rate by at least 25 basis points, and some even predict a 50 basis point cut. As an investor in the stock market, you may be wondering what the market will do following the Fed’s move. Let’s look to history for some clues.

Why is a rate cut such a big deal for stocks?

First, let’s consider why a rate cut is such a big deal for the stock market in general and for investors in particular. Higher rates can hurt corporate earnings and investor appetite for stocks due to a couple of factors. As the fed funds rate goes up, so do other borrowing costs for individuals and companies.

For example, high-growth companies relying on loans to build their businesses will see these expenses climb. As a result, potential investors may worry about their ability to fund growth and may stay away from these sorts of stocks. As for individuals, higher borrowing costs eat into their budgets, and that means they probably won’t have as much discretionary income to spend.

Investors, seeing this unfold, often lose confidence in stocks most vulnerable in this sort of environment. They might hesitate to buy shares of those young growth companies — often technology players — and they may stay away from companies, such as those in entertainment or travel, that rely on discretionary spending.

Investors might even rein in their investments in the stock market as a whole and opt for investments that tend to flourish in a higher-rate environment, such as bonds.

Of course, as interest rates fall, the situation shifts, with borrowing becoming easier and cheaper for companies and individuals, while consumers find themselves with more money to spend on non-essentials. All of this paints a brighter picture for corporate earnings, and that, in turn, makes investors more confident about putting their dollars into the stock market.

The S&P 500’s performance after past rate cuts

Now, as we await the Fed‘s next move, let’s consider how the stock market reacted in the past to rate cuts. In the past two cycles of cuts, from the initial rate decrease, the S&P 500 index (SNPINDEX: ^GSPC) rose in the double digits in the 12 months following that move. Those rate cuts were on March 3, 2020 and Aug. 1, 2019, and the S&P 500 rose 27% and 10%, respectively, over the year to follow.

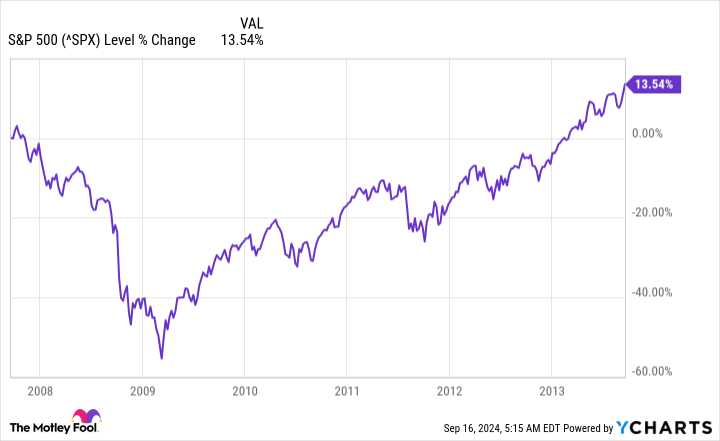

Prior to that, rate cuts happened during the Great Recession and a crash in the housing market over the 2007 and 2008 period. The first rate cut then happened in September of 2007, and this time it took a lot longer for the S&P 500 to climb back to previous levels.

It’s important to note, though, that the Great Recession was a particularly difficult time worldwide, so it doesn’t represent a good point of comparison for the S&P 500 today.

What does all of this mean for the stock market moving forward? It’s impossible to predict what the index will do next, but recent history shows us a favorable trend. That said, if the Fed lowers rates as expected or makes an even more aggressive cut this week, this won’t ease the borrowing situation for companies and individuals overnight. It will take a series of cuts to produce concrete results.

But the good news is that a potential rate cut this week will get things moving in the right direction — and that could help the S&P 500 follow the recent historical trend and rise in the coming year.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The Fed May Cut Interest Rates This Week. History Says Stocks Will Do This Next. was originally published by The Motley Fool