Battery metal deployment in newly sold EVs consequently also hit an all time high. A combined 171 kilotonnes of graphite, LCE (lithium carbonate equivalent), nickel, cobalt and manganese were contained in the EVs sold during September, 26% more than the same month last year. Keep in mind that these are terminal installed tonnes and that metal demand at the mine mouth is considerably greater.

The robust expansion also comes despite a noticeable swing from full electric vehicles towards plug-in hybrids (PHEV sales are growing nearly four times the rate of BEVs this year) which have inherently smaller batteries and therefore less contained metal.

Price slump

When pairing metals demand with prices in the EV battery supply chain there is less to cheer, however.

Lithium is still firmly in a bear grip with average hydroxide prices in October more than 30% below the average in December last year while carbonate prices are showing a 26% decline.

Cobalt sulfate is down by double digit percentage points in 2024 bobbing along at historically low prices while nickel sulfate has only recently turned positive, after losing touch with the $20,000 a tonne level (100% Ni basis) more than a year ago.

With flake graphite also still trading in the red, manganese sulfate is the only battery raw material in positive territory with prices in China up a robust 25% year to date.

The record number of battery metals deployed was not enough to offset the slump in prices with September recording an overall value of $1.26 billion. That’s up 38% from the lows struck in January but 34% below September 2023’s total and nowhere near the all-time peak hit in December 2022 of $4.23 billion when battery metal prices were at or near record highs.

xEV

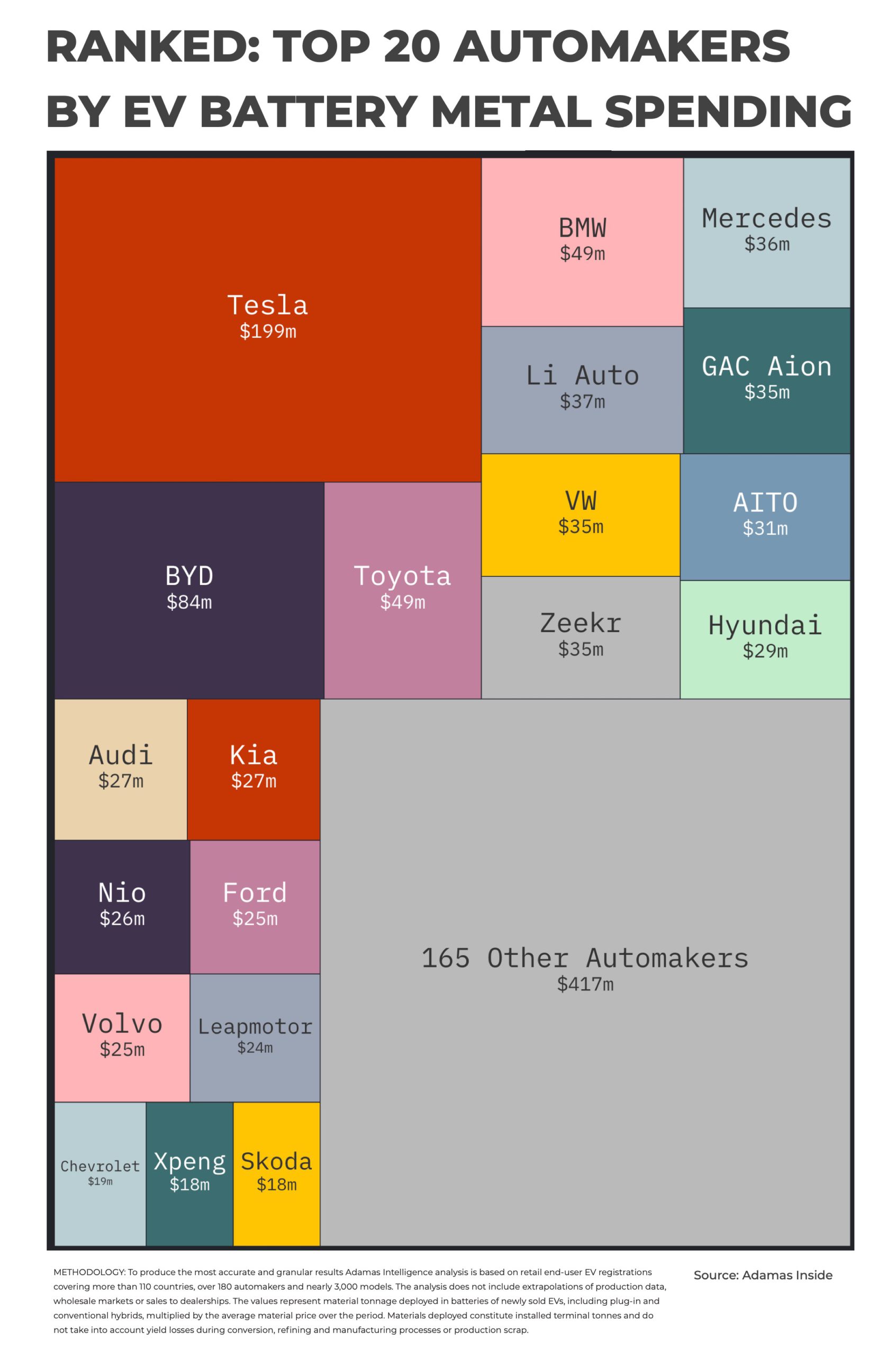

The graph from Adamas Intelligence shows what each carmaker spent in September on lithium, nickel, cobalt, manganese and graphite contained in the batteries of their EVs models sold during the month.

The total value of battery materials used is based on global end-user registrations, matched with battery specifications, battery chemistries, and metal loadings of the 3,000 EV models on the market tracked by Adamas Intelligence.

That Tesla spent more than twice the amount on battery raw materials than BYD, despite selling 209,000 fewer vehicles in September than the Chinese giant is indicative of the fact that BYD has an all-LFP battery model line-up (therefore zero spending on nickel, cobalt or manganese), relies on PHEVs for 57% of sales and favour budget vehicles with smaller batteries.

Similarly, third placed Toyota’s less than $50 million spent is explained by its sales mix: 9 out of 10 EVs shipped by the world’s top vehicle manufacturer were conventional hybrids (HEVs) where batteries top out at less than 4 kWh compared to the average for BEVs for all automakers of more than 60 kWh. That said it also shows HEVs, usually fitted with nickel-metal hydride cell packs, remain a significant demand source for the battery metal.

A marque’s sales mix is not a straightforward indicator of its metal use however. Li Auto at position five which splashed $37 million on battery raw materials during the month enjoys a high ranking despite being a PHEV specialist, or more precisely an EREV (Extended Range EV) specialist.

The Chinese brand’s EREVs, where the internal combustion engine only serves as a generator to charge the battery, are big and brawny and its most popular model, the L6, boasts a range of nearly 1,400 km (870 mi). While the L6 is fitted with an LFP battery, Li Auto uses NCM batteries for its flagship models, specifically high-nickel cathodes consisting of roughly 80% nickel.

For a fuller analysis of the battery metals market check out the Northern Miner print and digital editions.

* Frik Els is Editor at Large for MINING.COM and Head of Adamas Inside, Toronto-based provider of battery metal and EV supply chain analysis.