Bank of Canada to trim rates four more times: What economists say about GDP

One forecaster, however, thinks the chances of a pause in January have risen

Article content

Canada’s economy likely contracted in November, signalling that growth could come in lower than the Bank of Canada’s latest forecast for the final quarter of 2024, economists say.

Article content

Article content

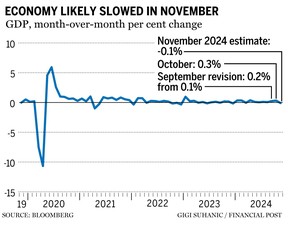

Statistics Canada released an advanced estimate suggesting that gross domestic product fell by 0.1 per cent month over month in November.

It’s the first contraction of the year and a slowdown from October when GDP grew by 0.3 per cent, beating both analysts’ estimate of 0.2 per cent and the agency’s flash estimate of 0.1 per cent.

Advertisement 2

Story continues below

Article content

Statistics Canada also revised its growth figure for September to 0.2 per cent from 0.1 per cent.

The Bank of Canada, in its October Monetary Policy report, said it expected annualized GDP growth of two per cent in the fourth quarter.

Here’s what the economists think the latest GDP data means for the Bank of Canada and interest rates in 2025.

Lower rates working: National Bank of Canada

“For the Bank of Canada, it is clear that lower interest rates are having an effect, based on this sequence of steady increases in the interest-sensitive real estate sector,” Daren King, an economist at National Bank of Canada, said in a note.

But growth has yet to expand across all sectors of the economy, “and we’re still tracking towards slightly below potential advance in Q4 (thanks to an expected contraction in November),” he said.

The Bank of Canada has said it wants the economy to pick up the pace to soak up “unused capacity,” which means the economy needs to post stronger GDP numbers than it’s currently putting up.

“The economy is not at this point yet,” King said, indicating that further interest rate cuts, just not any more jumbo 50-basis-point reductions.

Article content

Advertisement 3

Story continues below

Article content

National Bank is “leaning” toward a 25-basis-point cut at the Bank of Canada’s meeting on Jan. 29.

December jobs numbers and a consumer price index report will provide policymakers with more guidance on their next decision, King said.

Four more cuts: Oxford Economics

Canada’s economy is on pace to grow faster than it did in the third quarter, Michael Davenport, an economist at Oxford Economics Canada, said, even though Statistics Canada is predicting the growth contracted in November.

Despite a forecast for a quarterly pickup in the fourth quarter, the economy still isn’t firing on all cylinders, he said.

Davenport thinks the stimulus provided by the GST/HST tax holiday will boost consumer spending in the new year. Coupled with easing mortgage lending rules from Ottawa and “improving household finances,” that should lead to improved GDP growth throughout the year.

“However, with ample slack in the economy, we expect the Bank of Canada will likely press ahead with four more 25-basis-point cuts to bring the policy rate to 2.25 per cent by mid-2025,” he said in a note.

Advertisement 4

Story continues below

Article content

January pause: Capital Economics

The projected contraction in GDP in November is “hardly a surprise” to Stephen Brown, deputy chief North America economist at Capital Economics Ltd., due to “the slump in rail freight traffic following the earlier port strikes” and the Canada Post work stoppage, which began Nov. 15 and ended Dec. 17.

“Despite that (November) fall, it now looks likely that fourth-quarter GDP growth will be close to the (Bank of Canada’s) forecast from its October Monetary Policy Report of two per cent,” he said in a note.

Recommended from Editorial

The stronger-than-forecast growth in October and upward revisions to GDP in September and August flesh out the picture of a more positive outlook.

That’s why Brown thinks the odds are rising that the Bank of Canada pauses interest rate cuts in January.

• Email: gmvsuhanic@postmedia.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments