Mineral exploration activity in October was highest in a year, S&P data shows

S&P reports that the metrics it uses to calculate the PAI were again mostly positive in October 2024. Significant drill results, financings and initial resources all increased, while positive milestones announced by mining companies stayed flat.

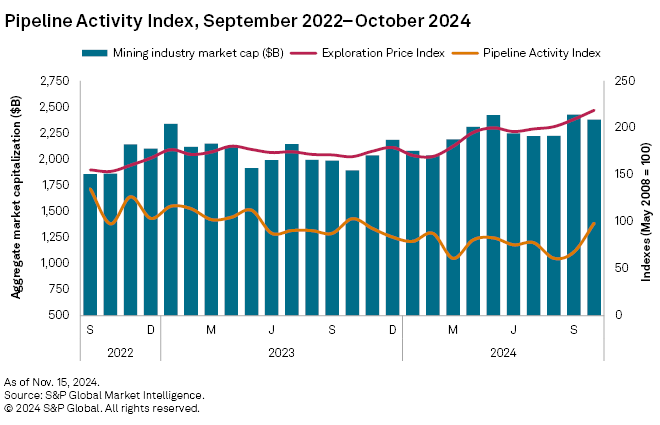

Meanwhile, the Exploration Price Index (EPI), which the firm uses to measure the relative change in precious and base metals prices, rose to another record high.

However, despite gold hitting all-time highs and a strong monthly showing in base/other metals, mining equities lost steam, and the aggregate industry market cap ended October down 2%.

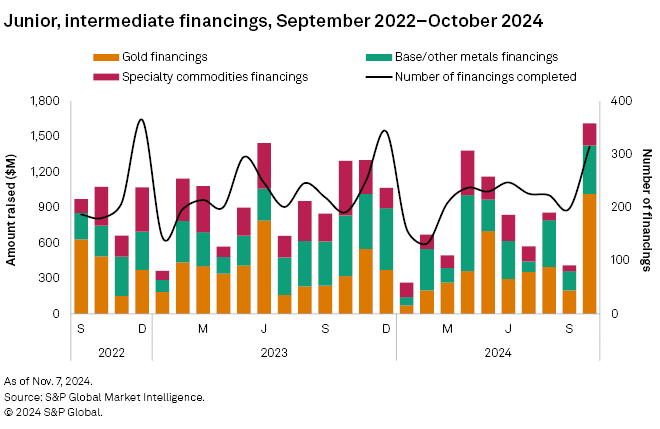

Surge in financings

According to S&P, funds raised by junior and intermediate mining companies nearly quadrupled to $1.61 billion in October — the highest level since March 2022 — with a surge in transactions and high-value financings reversing the September declines.

Companies in the gold sector had the largest increase in financings among the three commodity groups, jumping 412% to $1.02 billion in October — the highest total since March 2022. The number of financings rose to 177 from 101 in September, and the number of significant financings more than doubled to 59 from 22. Two transactions were valued at more than $50 million, up from zero in September.

Funds raised for the base/other metals group increased in October, up 150% to $411 million — the highest in six months. The growth was fueled by higher copper fundraisings, which surged 260% to $311 million. The total number of transactions rose to 70 from 66, and there were two transactions valued at more than $50 million compared to one in September.

Overall, the total number of transactions increased to 315 from 198 in September, while the number of significant financings — transactions valued at more than $2 million — jumped to 97 from 39. There were five transactions valued at over $50 million, up from one in September.

Drilling growth

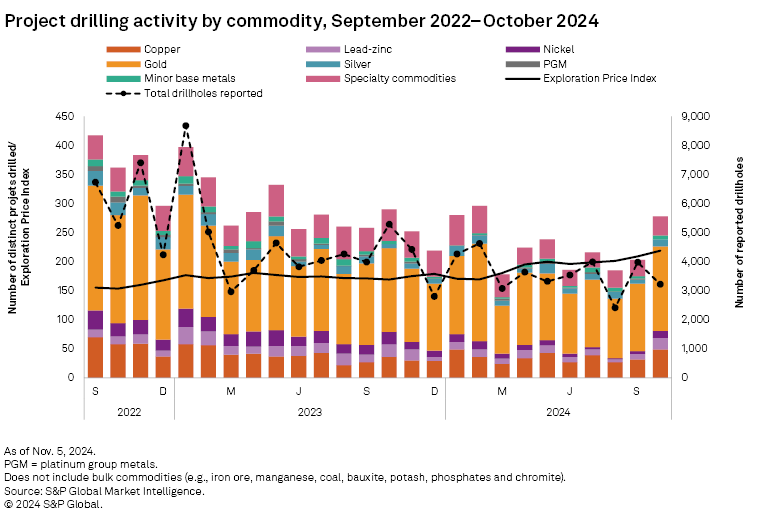

Almost all drilling metrics increased in October, driven by an increase in the total number of projects drilled across all commodities, the report adds.

The total number of companies reporting also increased, up 32% to 254 — the most since January. Drilling increased across all stages, with early-stage projects rising 46% to 98, late-stage projects increasing 34% to 135, and mine site projects growing 48% to 49 total projects drilled.

However, total holes drilled was down 19%, primarily due to a 23% decrease in gold drilling and a 64% drop in specialty metal drilling, S&P says.

October’s top result came from CanAlaska Uranium’s West McArthur project in Saskatchewan, where the Toronto-listed miner reported an intercept of 25.8 metres grading 6.47% uranium.

Resources & Milestones

Other key components of S&P’s activity index remained largely unchanged month to month, namely initial resources and positive milestones.

There were a total of three initial resource announcements in October, up from two in September. Two of the resource announcements were copper-focused projects (Ero Copper’s Furnas and Lara Exploration’s Planalto), while the remaining one was for gold (Axcap Ventures’ Rattlesnake Hills).

The number of positive milestones was the same for both months (3). The first milestone in October was Capstone Copper’s feasibility study for the Mantoverde brownfield expansion, followed by Castile Resources’ bankable feasibility study at the Rover copper project and the successful commissioning of Pan African Resources’ tailings retreatment operation in South Africa.

Other trends

According to S&P data, the industry’s EPI for the month of October came in at 219, surpassing the record high of 209 registered just the month prior. This is also the fourth consecutive monthly increase.

Gold remained elevated, up 4.7% month over month including multiple all-time highs in October. Other precious metals posted sizable monthly gains, with silver up 8% and platinum up 3.5%. Base metals also gained (zinc +8.9%, nickel +3.6%, copper +2.7%, molybdenum +1.6%) while cobalt was flat month over month.

Unlike last month, the strong metals prices were not enough to prevent a minor pullback in mining equities valuation. S&P estimates that the aggregate market capitalization of the 2,682 listed mining companies decreased about 2% to $2.38 trillion from $2.43 trillion in September.