Posthaste: Economists search for Bank of Canada end rate as whirlwind year of cuts comes to close

Interest rates, at the top end of policymakers’ neutral range, still have a ways to fall, say economists

Article content

Article content

Article content

It’s been an action-packed year for the Bank of Canada, with policymakers cutting interest rates five consecutive times by a total of 175 basis points.

With the book closed on 2024 and 2025 likely the year this rate-cutting cycle comes to a close, economists took a crack at where they see the neutral rate — which neither stimulates nor dampens growth — and the terminal rate — best suited for the long term — landing.

Advertisement 2

Story continues below

Article content

The Bank of Canada’s rate cut on Dec. 11 — a 50-basis-point whopper — brought its benchmark lending rate to the top end of its neutral rate of 2.25 per cent to 3.25 per cent.

Getting a fix on the neutral rate is important because it provides clarity on where interest rates will come to rest after policymakers began cutting in June and never looked back.

So far, nailing down the neutral rate has proved elusive for the Bank of Canada. Governor Tiff Macklem admitted a few months ago that policymakers might have to “discover” neutral.

“We don’t know exactly the pace,” Macklem said at an event in Toronto in October. “We don’t exactly know where the landing is.”

But with the Canadian economy set for disappointing growth next year and other economic challenges looming, including tariffs levied on exports by the United States and a population cut, most economists think interest rates have a lot further to fall before they hit neutral.

“Weaker potential growth in 2025 and 2026, likely below one per cent in both years, suggests that the neutral interest rate for this period will likely be below the BoC’s estimates,” Charles St-Arnaud, chief economist at credit union Alberta Central, said in a year-end analysis. “The downside pressures on the neutral rate are dominant.”

Article content

Advertisement 3

Story continues below

Article content

He said that means interest rates will remain “restrictive” — a drag on economic growth — until the Bank of Canada cuts rates to at least 2.25 per cent.

But St-Arnaud doesn’t think the central bank will stop there.

He believes policymakers will close out this cycle of rate cuts at two per cent, reaching the terminal rate in October 2025.

St-Arnaud expects policymakers to cut rates in January and March, take a break in June, cut again in July, pause in September and make a final trim in October, for a total reduction of 125 further basis points.

“The continuation of the easing cycle is supported by our expectations that inflation will remain consistent with the target in 2025,” he said. Inflation currently stands at 1.9 per cent, Statistics Canada said on Tuesday.

Dylan Smith, vice-president and senior economist at Rosenberg Research & Associates Inc., also thinks the Bank of Canada will need to take rates below neutral to lift Canada’s economy.

“Monetary policy is still relatively tight overall, and what is needed to absorb the emerging slack is not a ‘neutral’ stance. It’s active stimulus,” he said in a note.

Advertisement 4

Story continues below

Article content

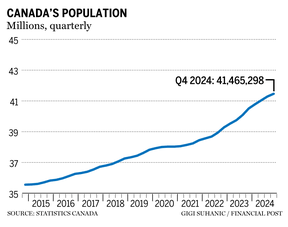

The “slack” that Smith is referring to is the growing inability of Canada’s job market to absorb a 3.6 per cent increase this year in the working-age labour force compared to last year, brought about by immigration.

“The labour market isn’t just one element of the rate-setting equation for the Bank of Canada; it’s now the central factor driving the case for lower rates,” he said.

Ottawa announced cuts to immigration numbers over the next three years, possibly giving employers room to absorb some of the labour force “slack.” However, cuts to immigration also threaten to hit growth as the “fresh spending power” of newcomers, which economists said saved the economy from a recession, dries up.

“This is why we think rates will still fall significantly from the current level of 3.25 per cent,” Smith said.

Like Smith, St-Arnaud thinks there are plenty of risks that add up to the terminal rate coming in lower than neutral, “especially if the incoming U.S. administration were to impose tariffs on imports from Canada.”

The terminal rate could come to rest a bit higher; however, if Canada’s federal government decides to only partially implement cuts to immigration, while “full implementation” would push it lower, he said.

Advertisement 5

Story continues below

Article content

Sign up here to get Posthaste delivered straight to your inbox.

More than two million newcomers are expected to leave Canada in the next two years as their permits expire, which is part of the federal government’s plan to reduce the overall number of temporary residents and cut the population growth of the past few years.

But economists and immigration lawyers don’t think it’s realistic to expect such a large volume of international students and temporary foreign workers to leave in such a short time. They expect many to convert their residential permits to prolong their stay. — Naimul Karim, Financial Post

- Canada’s Department of Finance posts financial results for October 2024

- Today’s data: Statistics Canada releases retail sales for October.

- Earnings: Brookfield Corp., Brookfield Asset Management Ltd.

Advertisement 6

Story continues below

Article content

Recommended from Editorial

Inflation may be cooling, but high prices are still forcing consumers to think outside the (gift) box this holiday season. The Financial Post explains how the cost of living crisis is shaping holidays this year, from who is spending the most to the coping mechanisms some Canadians are adopting. Watch the video here

Hard Earned Truth

In an ongoing series about what the next generation needs to know to build wealth, we offer another hard earned truth: Good debt can boost investment wealth, but beware its bad twin.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Financial Post on YouTube

Visit Financial Post’s YouTube channel for interviews with Canada’s leading experts in economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected].

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments