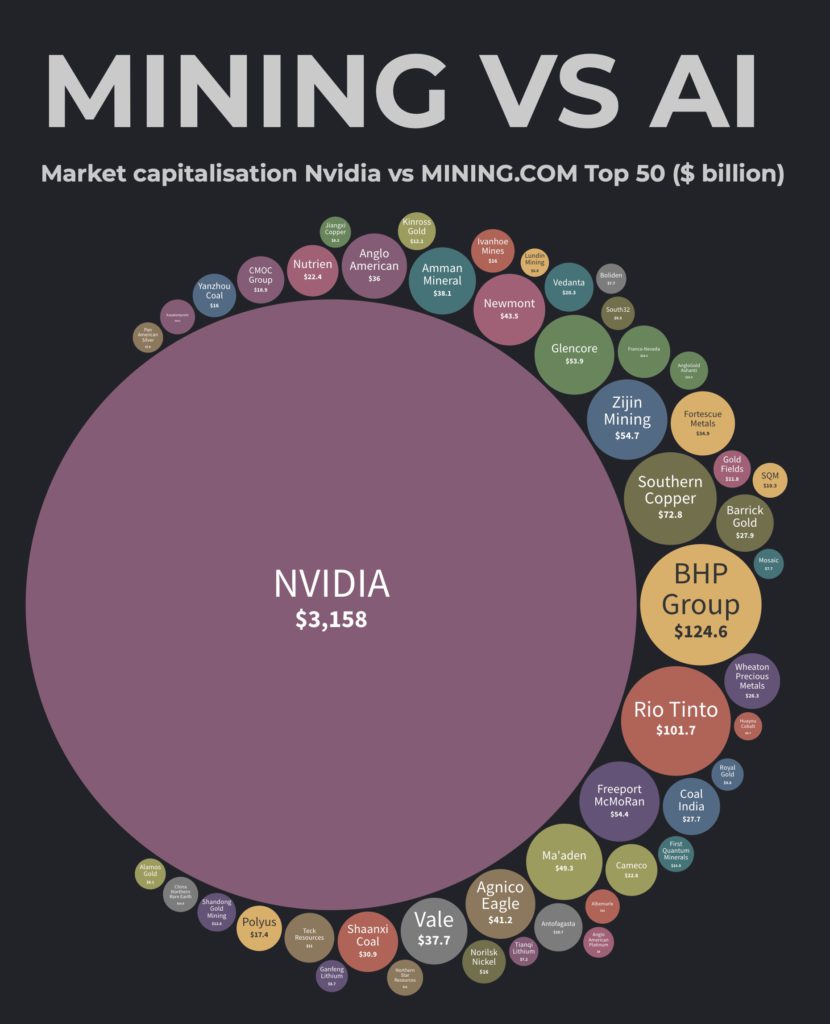

GRAPH: Mining vs AI vs Deepseek

Even after the fallback, investors who bought Nvidia a year ago can still toast to 111% gains. Those who saw the AI boom coming three years ago are enjoying 465% returns. The stock’s value is now comfortably back up to over $3 trillion.

In contrast, at the end of 2024, the MINING.COM TOP 50 ranking of the world’s most valuable miners had a combined market capitalization of $1.28 trillion, down $126 billion for the year after a dismal final quarter.

The Top 50 is now trading $480 billion below the peak hit in the second quarter of 2022, and so far in 2025 the biggest mining stocks, with the exception of a handful of gold counters, have moved sideways or retreated further.

It’s not the first time these pages have lamented the gulf between how investors appraise the industrial economy and any stock with even a whiff of the latest tech trend.

A treemap of just one AI stock surrounded by mining companies looks like a solar system (as one reader commented on a previous iteration). Never mind comparing miners to the mag-7.

There are plenty of mining industry narratives that fit into AI or whatever the next trend is – humanoid robots most likely. Uranium for one, dragged down by the Deepseek debacle because supposedly fewer small modular reactors will now be needed to power data centres.

But once again mining participates more on the downside of technological breakthroughs. When metals and minerals are swept up in the excitement it usually last for a half-cycle. For painful evidence of that just look at electric vehicles and where battery metals are now trading.