Kyrgyzstan political turmoil and mining jurisdiction risks

This is Kyrgyzstan’s third political revolt since 2005, so the political risk in such jurisdiction would likely remain when or if the current situation is resolved.

Attack on Kyrgyz mining

Antagonism against mining operations is often a reflection of weakness in a country’s institutions, says Camilla Ogunbiyi, principal analyst, Financial Sector Risk and Forecasting at Verisk Maplecroft.

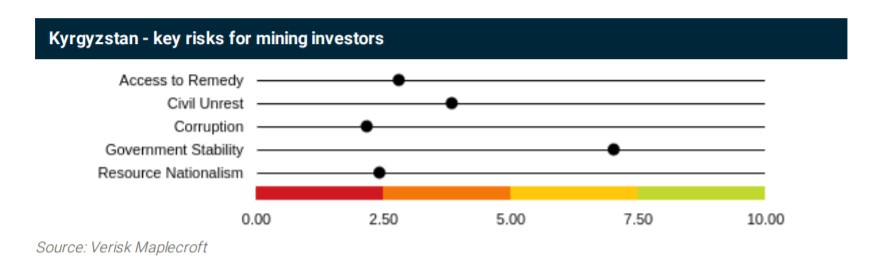

As seen in the aftermath of the Kyrgyz election, the government’s status was quickly undermined with the annulment of election results and state of emergency declared. The fragility in governance also endangers the safety of foreign investors’ assets, as it aggravates public concerns surrounding pollution, corruption and resource nationalism, Ogunbiyi asserts.

In Kyrgyzstan, the political upheaval also became an opportunity for the ill-disposed to direct their anger towards local mining operators, attacking several sites over the past few days. This included an attack on the office of Centerra Gold (TSX: CG), owner of the Kumtor mine, the nation’s largest gold operation.

The Kumtor gold mine, meanwhile, exemplifies the risk of resource nationalism. The country’s largest gold mine, largest employer and taxpayer, accounting for up to 7% of GDP, has been the subject to both renegotiations and protracted legal battles, Ogunbiyi says.

As Kyrgyzstan’s largest employer and taxpayer, accounting for up to 10% of its GDP in 2019, the Kumtor mine has been the subject of protracted legal battles and exemplifies the risk of resource nationalism concerns faced by mine operators.

In the same week, Kaz Minerals also suspended operations at the Bozymchak copper and gold mine due to the Kyrgyz political turmoil.

According to Verisk Maplecroft, the Central Asian nation currently ranks as the 54th riskiest of 198 countries scored in its Corruption Index.

Without a clear break with political practices and leaders of the past, corruption is likely to remain a driver of anti-government sentiment and weak governance, the firm says.

Violence in Africa

When it comes to notoriously high-risk jurisdictions for miners, the Democratic Republic of Congo often comes to mind.

In June, a violent attack on Société Minière de Bisunzu’s (SMB) coltan mine claimed three amid an increase of attacks on mining operations in the country’s mineral-rich eastern region.

This was just one of many violent occurrences this year in what is one of the world’s top sources for cobalt, tin and tantalum.

The political meltdown provides Kyrgyzstan an opportunity to start anew and establish stronger, less corrupt political and governance institutions, which would enable foreign investment and economic development, Ogunbiyi asserts.