Treasury yields dip as coronavirus cases surge and election uncertainty continues

U.S. Treasury yields moved lower on Friday after coronavirus cases globally reached a single-day record, along with uncertainty ahead of next week’s U.S. presidential election.

The yield on the benchmark 10-year Treasury note fell to 0.822% at 5:14 a.m. ET, while the yield on the 30-year Treasury bond dipped to 1.597%. Yields move inversely to prices.

It comes after the number of confirmed coronavirus cases recorded daily hit a record 500,000 on Thursday.

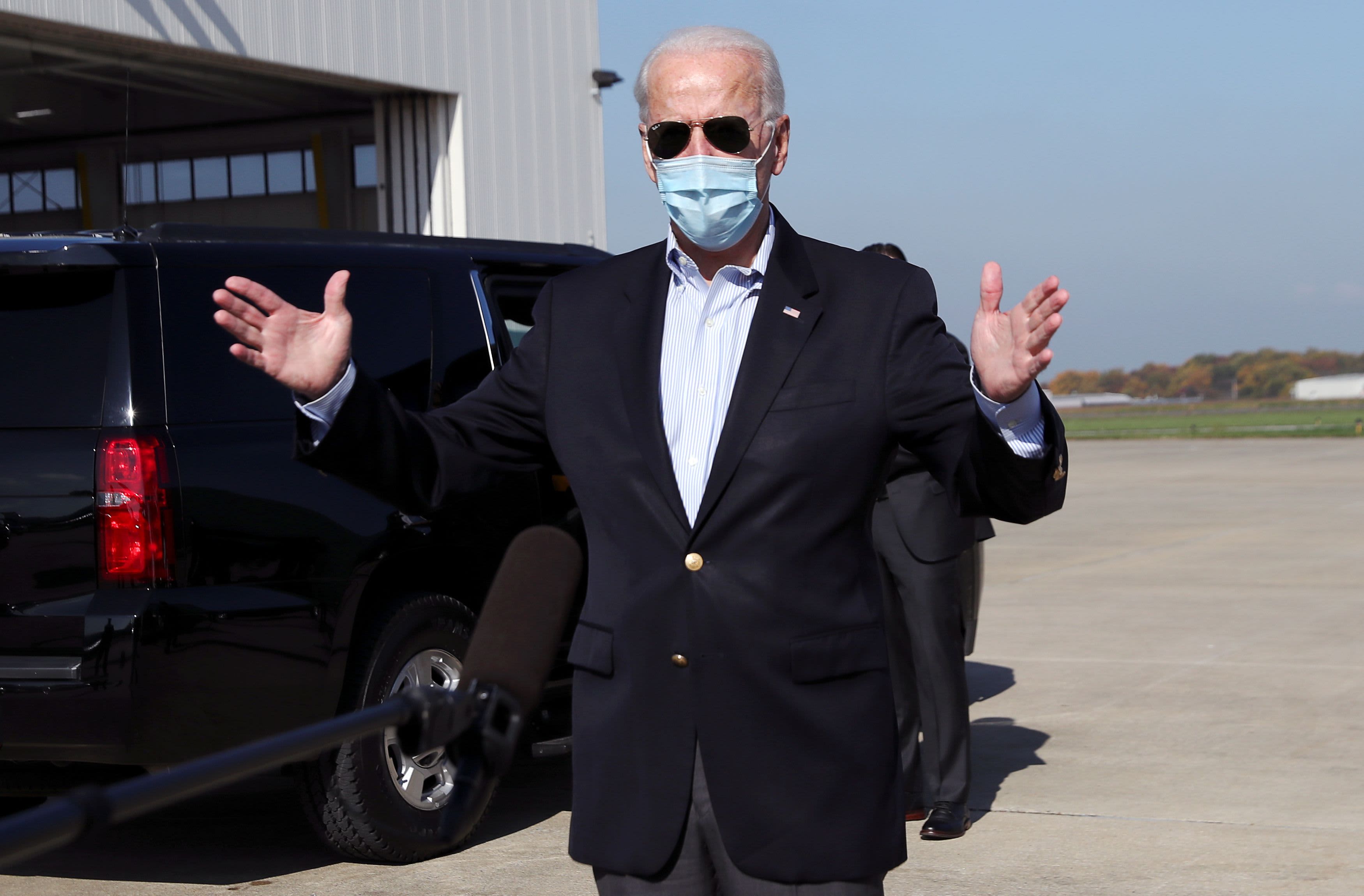

Traders were also mindful of the U.S. election next week. President Donald Trump and Democrat nominee Joe Biden both held rallies in the key state of Florida on Thursday. Both candidates fared pretty equally in the polls, though Biden came out slightly ahead, leading by 1.2 points.

Friday’s fall in yields came despite better-than-expected third-quarter economic data from the U.S. on Thursday. The country’s GDP (gross domestic product) rose by 33.1% in the third quarter, higher than the forecasted 32% growth.

Investors will also be watching out for September’s figures on U.S. personal income and spending, expected to be out at 9:30 a.m. ET.