10-year Treasury yield drops to 2-week low as election results show no clear winner

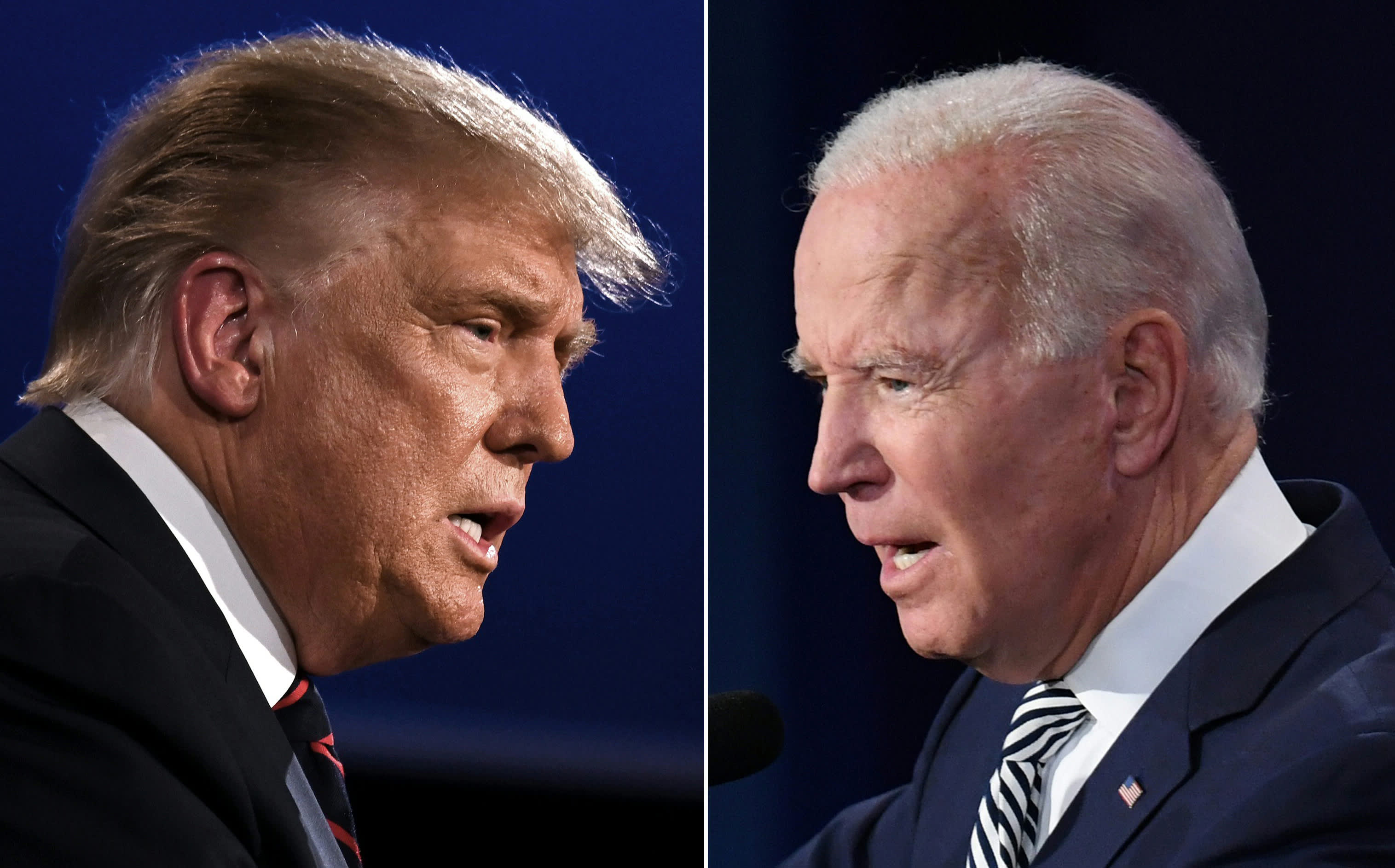

U.S. Treasury yields fell Wednesday as the incoming results of the presidential election failed to show a clear winner between incumbent President Donald Trump and former Vice President Joe Biden.

The yield on the benchmark 10-year Treasury note slipped 9 basis points to 0.766%, its lowest level since Oct. 18. The yield on the 30-year Treasury bond fell 10 basis points to 1.560%. Yields move inversely to prices.

The 10-year government bond yield fell from a five-month high of 0.945%, with Trump leading in the crucial state of Florida, tightening the election race. The yield on the 30-year Treasury also retreated from a high of 1.757% earlier in the trading session.

Trump is also projected to win Ohio, while Democrat candidate Biden is leading in Arizona. However, results in the key swing states of Michigan, Wisconsin and Pennsylvania could take days to determine.

“The long end of the Treasury market was short heading into last night. And the price action very indicative as the lack of a Blue wave became apparent,” Gregory Faranello, head of U.S. rates trading at AmeriVet Securities, said in a note on Wednesday.

The president falsely claimed victory in an address early on Wednesday, despite the fact that millions of votes were still being counted.

“We’ll be going to the U.S. Supreme Court, we want all voting to stop,” Trump added. “We don’t want them to find any ballots at 4 o’clock in the morning and add them to the list.”

Besides the focus on the election, the October ADP national employment report is also due out Wednesday at 10:15 a.m. ET, while the September balance of trade data is expected at 10:30 a.m. ET.

Markit Composite and Services data for October is set for release at 11:45 a.m. ET and ISM Non-manufacturing figures are expected at 12 p.m. ET.

Auctions will be held on Wednesday for $25 billion worth of 105-day bills and $30 billion of 154-day bills.

— CNBC’s Fred Imbert contributed to this story.