Here’s the unwelcome surprise awaiting stock investors next year, says this money manager

What tomorrow brings.

AFP via Getty Images

Investors are hesitating a day after pushing major indexes to record highs on biotech Moderna’s MRNA,

While markets may have priced in a lot of that optimism, the rest of the year probably won’t see big market drops, says Thomas H. Kee Jr., president and chief executive of Stock Traders Daily and portfolio manager at Equity Logic.

But that’s coming in 2021, he tells MarketWatch, in our call of the day.

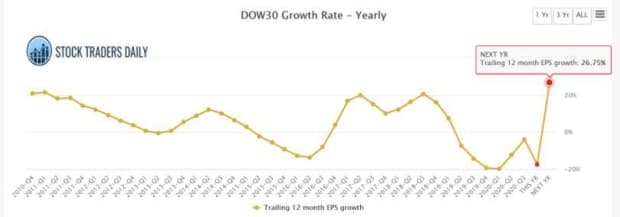

The big reason is that Kee believes analysts’ 2021 earnings per share expectations for the Dow Jones Industrial Average DJIA,

“Assuming the Dow stays exactly where it is right now, and earnings come in at 32% growth for the Dow in 2021. At the end of 2021, the price earnings multiple for the DJIA will be higher than at any other point since the credit crisis, which means it will be extremely expensive,” he says. The market could see a drop of 25% in those circumstances, he says.

“And by the end of next year, you’re going to see material drawdowns in the market, even though everything is going to be getting back to normal,” post-COVID-19, Kee says. “When it comes, it’s going to be a surprise to most investors who expect everything to look extremely good next year. The truth is, this year should be looking worse, and it’s not, because there has been so much stimulus.”

By next year, investors will be dealing with rough economic patches and central banks cutting off stimulus (early to mid-year).

But he says Wall Street bankers will keep the market going this year to ensure those bonuses arrive by the end of it — a weak third quarter scuttled those, he notes.

As for how to play this coming drop in stocks, Kee is sticking to a strategy he recommended to this column in May — rotating between the S&P 500 ETF SPY,

The action in the stock market will matter most, he says. “I’m watching for reversal signals and they come in all kinds of different shapes and sizes,” he says. One possible signal: markets break above a big level of resistance and then reverse back down. It’s one of many, Kee says.

The markets

Dow YM00,

Read: This is how bad commercial real-estate pain could get for banks and other lenders

The buzz

Tesla TSLA,

E-commerce retailer Amazon AMZN,

Home-improvement group Home Depot HD,

Retail sales and import prices, followed by industrial production, business inventories and a home builders index are ahead. Federal Reserve Vice Chair Richard Clarida said late on Monday that the economy would likely need further monetary and fiscal support.

Georgia’s Secretary of State tells the Washington Post that top Republicans, including Sen. Lindsey Graham, have been pressuring him to toss out legal absentee presidential ballots. Meanwhile, the state’s vote recount has so far uncovered 2,600 uncounted ballots that were mostly for President Donald Trump.

Hurricane Iota unleashed on Central America just days after Eta.

The chief executive of Take-Two Interactive TTWO,

Random reads

Muting relatives on Twitter TWTR,

NASA’s space station welcomes new SpaceX crew members:

French radio station accidentally publishes obituaries of living people.