Chinese EV rivals line up to challenge Tesla on their home turf

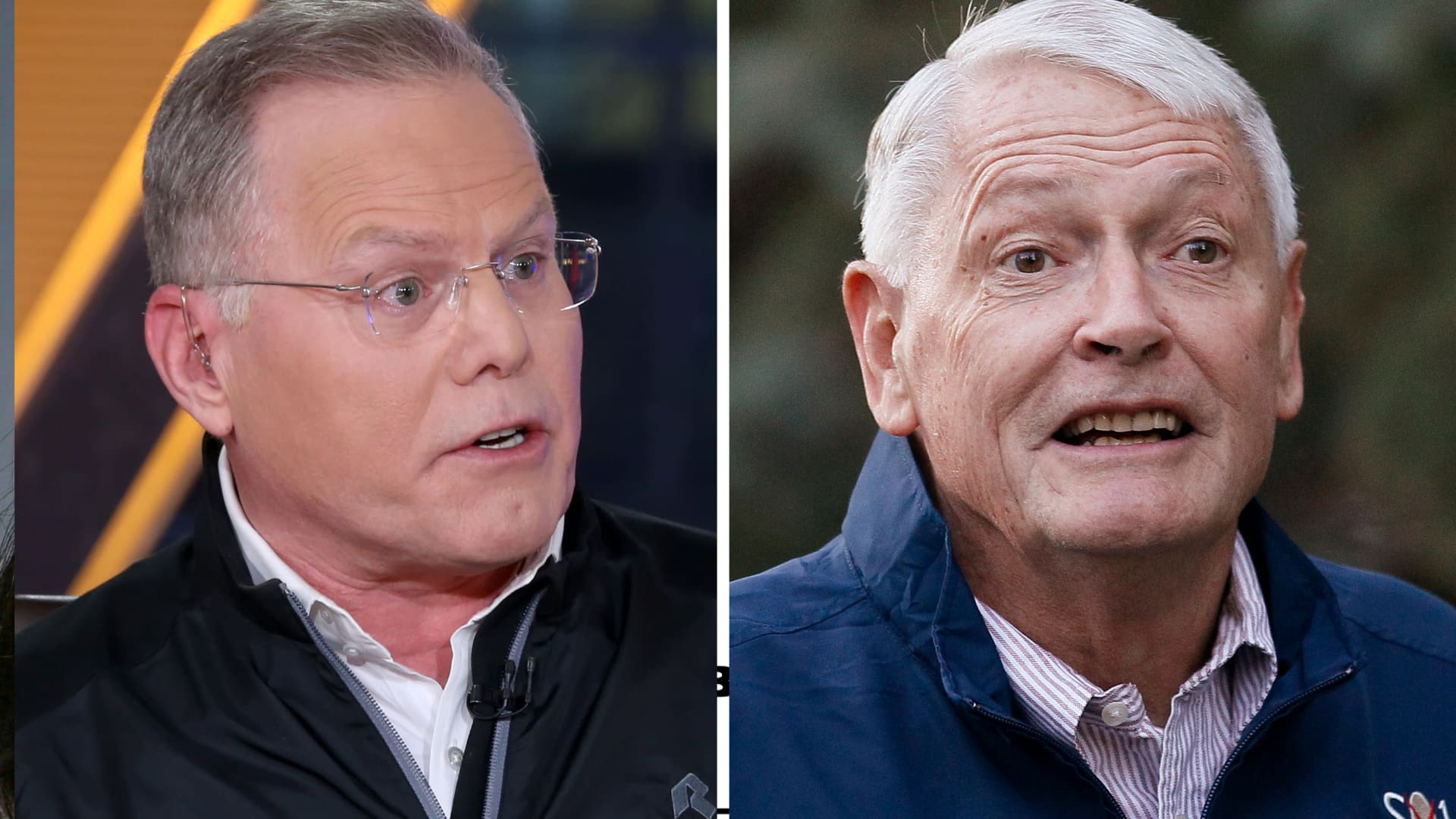

Citron founder Andrew Left, known for some big short calls, recommended Nio shares, now worth $45 each, at $7 two years ago. Now he is short the name and says of the recent gains in multiple EV makers, “The fact is that retail investors take everything to be the next Tesla.”

Evelyn Cheng | CNBC

Electric car investors were transfixed by Tesla‘s rally earlier this week after being named to the Standard & Poor’s 500, but there was other big news in EVs — a rush of very solid earnings reports from smaller rivals gearing up to challenge Elon Musk & Co. in China, the world’s largest market for electric vehicles.

The latest report came from Shanghai-based Nio, which boosted third-quarter sales by 146% to $628 million, with deliveries up to 12,206 vehicles, right about where Tesla was four years ago. Xpeng and Li Auto reported mixed results relative to expectations, but both gave bullish sales guidance and improved gross profit margins, sending shares on a new rally after being battered by a short seller’s report on Nio.

The news adds fuel to the argument over whether Chinese EV makers are following a path set by Tesla in the U.S., beginning a fundamental transformation of the auto market, or merely following Tesla’s sky-high stock market valuation. Last week, before earnings, U.S.-based short seller Citron Research sparked a selloff with a report saying Nio’s business could never be expected to support its $62 billion valuation.

“I like Nio. I think it’s a super cool car,” said Citron founder Andrew Left, who had recommended Nio shares, now worth $45 each, at $7 two years ago. “The fact is that retail investors take everything to be the next Tesla.”

This is what the argument about the Chinese EV makers boils down to: Is any of them another Tesla?

Like Tesla, the bull case for China’s EV sector begins with the sheer size of the market, especially domestically, which is where all of the companies are focused for now.

By late 2022, even 40% of Tesla’s unit sales are likely to come from the China market, where the government is maintaining subsidies for early EV buyers even as U.S. law has ended them for Tesla and General Motors, which have sold more than the 200,000 vehicles with tax credits that federal law allows. Nevertheless, last week GM upped its investment plan by 35% to $27 billion on all-electric and autonomous vehicles through 2025, an increase of $7 billion, from initial plans announced in March.

“We want to lead in this space. We don’t just want to participate, we want to lead,” said Doug Parks, GM executive vice president of global product development, purchasing and supply chain, said during a media briefing. “Tesla’s got a good jump and they’ve done great things. They’re formidable competitors … and there’s a lot of start-ups and everyone else invading this space. We’re not going to subside leadership there.”

Only about 4.5% of Chinese light vehicles are electric-powered, said Dan Ives, managing director of Wedbush Securities in New York, a figure expected to reach 10% by 2027.

“LI, Nio and BYD are some of the most innovative EV companies in the world and they are focused on the China market,” Ives said. “We believe China is eight to nine times the opportunity for EVs as [near-term U.S. sales growth].”

Where Ives and Left agree is that the rise of the Chinese automakers shouldn’t much trouble Tesla investors. Tesla shares have risen sevenfold in the last year, sparking their own valuation debate.

A Tesla Model 3 vehicle set to be delivered to a company employee moves off an assembly line during a ceremony at the company’s Gigafactory in Shanghai, China, on Monday, Dec. 30, 2019. Tesla spent over $1 billion in the most recent quarter on factories, including one in Germany, and Elon Musk has hinted that India could be the next target.

Qilai Shen | Bloomberg | Getty Images

Ives points to the advantages of scale that Tesla gets from its factory in Shanghai, which began making Model 3 sedans in late 2019 and has said it could begin producing Model Y SUVs in China next year. The company noted in its last earnings report in October that capital expenses grew to $1 billion, driven by Model Y investments in new plants — Shanghai, Berlin and Austin. Tesla recently received important government approvals for the Model Y plant as part of its Shanghai gigafactory, and last month teased pictures of progress at the Model Y facility in China. The plant has helped Tesla build a local supply chain and brand awareness that should help it remain a China market leader for more-expensive electric vehicles, Ives said.

Left argues that Tesla’s real edge is intellectual property, though he fears that over time China will find a way to steal much of it. None of the Chinese EV makers, from startups like Nio, Li Auto and Xpeng that make only electric vehicles model to companies like Geely Auto that are adding EVs to an existing lineup of gasoline-powered cars (Geely owns the Volvo brand), have Tesla’s expertise in software and semiconductors, Left said.

“These other companies are putting cars together like Humpty Dumpty, and it’s fine,” the short seller said. “It’s a retail investor phenomenon.”

For now, the retail investor phenomenon and rapid manufacturing is enough to let the companies grow quickly.

Shanghai-based Nio has reached deliveries of12,206 vehicles, about where Tesla was four years ago. Xpeng was among other China-based EV makers that recently gave bullish sales guidance and improved gross profit margins, but short sellers are betting valuations are getting ahead of the potential.

Nio’s report said its unit sales rose 18% from the previous quarter, to 12,206, and revenue climbed 22% to $666.6 million. Bank of America, Deutsche Bank and JPMorgan all raised price targets for Nio shares, with Bank of America saying it now expects Nio to be profitable beginning in 2023, a year earlier than it previously projected.

Li Auto’s report was notable mostly for the sharp increase in its gross profit margin, said Morgan Stanley analyst Tim Hsiao. The gain to a 19.8% profit as a percentage of sales, before accounting for marketing and corporate overhead, from 13.3% in the second quarter, shows how the company is achieving economies of scale as it grows to a sales pace that should hit 11,000 to 12,000 cars in the fourth quarter. Shares, now around $37, have more than tripled since the company went public at $11 a share in July.

“We remain constructive on Li Auto, especially because of its solid gross margin trajectory, and believe that sentiment could be further boosted by the improvement,” Hsiao wrote in a note to investors.

China’s market is real, EV stock valuations maybe less so

Xpeng, which went public in the U.S. in August at $15 a share and has reached $45, saw unit sales rise 166% in the third quarter from the second, to 8,576 units. Gross margins turned positive, but the company lost $169.2 million for the quarter, slightly more than in the second quarter. The company said it began mass deliveries of its full-sized, $35,000-after-subsidies P7 long-range smart sedan in June, and also offers a $22,300 small SUV called the G3.

The company’s pre-IPO pitch was that it is spending heavily on R&D for autonomous driving and other innovations. In an August interview on CNBC, President Brian Gu said “EVs are still less than 5% (of China’s market) and the smart EV market is just taking shape.”

Analysts agree that China’s market is large enough for all of these companies, and more, to grow. Whether they can live up to their valuations is another matter.

Citron’s argument against Nio is that Tesla’s price cuts for Chinese-made Model Ys will undercut Nio, and that the stock is nearly twice as expensive as Tesla’s as a multiple of sales for the next year, at 17 times forecasts.

The others aren’t really cheap, either. Xpeng is also trading at 17 times expected 2021 sales, and Li Auto is at nearly 12 times next year’s sales. Tesla is at about 10.5 even with its runup this year, which leaves the more mature automaker’s stock trading for nearly 130 times next year’s forecasted profits.

“Compared to [Tesla’s] Model Y, the Li One [SUV] is a much bigger car with more space and is designed for the Chinese family,” Li Auto president Yanan Shen said on his company’s earnings call. “We are not worried about the Model Y.”

As with Tesla, valuations for Chinese automakers will take time to shake out. The variables include how fast battery costs come down, and the path of the global economic recovery as new coronavirus vaccines reduce the sense of crisis worldwide.

But Left says that the market in China is huge, even without the China EV start-ups coming to the U.S. in earnest soon, especially because the wide range of incomes in China will let companies attack different price points.

“There’s probably enough for everyone to go around,” he said. “They are all for different markets.”