20 small-cap stocks loved by analysts for 2021

(This is the second in a three-part series listing highly rated stocks that sell-side analysts expect to rise the most over the next 12 months. Part 1 covers large-cap stocks and Part 3 will cover mid-caps.)

Large-cap stocks get nearly all the media headlines, but smaller companies can quickly become large-caps, as this year’s market action has shown.

Below is a list of 20 small-cap stocks, drawn from the S&P Small Cap 600 Index SML,

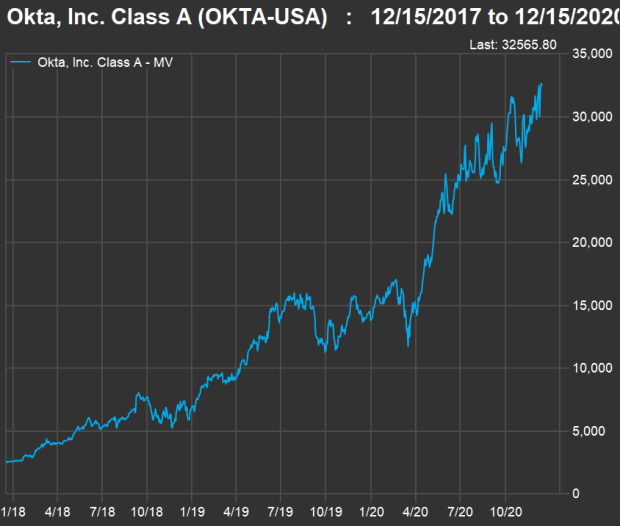

For an example of a small-cap that has grown into a large-cap, take a look at this chart showing the market capitalization of Okta Inc. OKTA,

Okta Inc.’s market value has soared over the past three years. (FactSet)

During this three-year period, Okta’s stock has gained risen 865%.

There is no denying that the large-cap S&P 500 Index SPX,

So in a bull market dominated by companies taking the best advantage of technological innovation, it’s no surprise to see the S&P 500 faring best. This holds true if you look back five, 10 or even 15 years (for which the S&P 500 has returned 292%, compared with 263% for the S&P 600 Small Cap Index, according to FactSet).

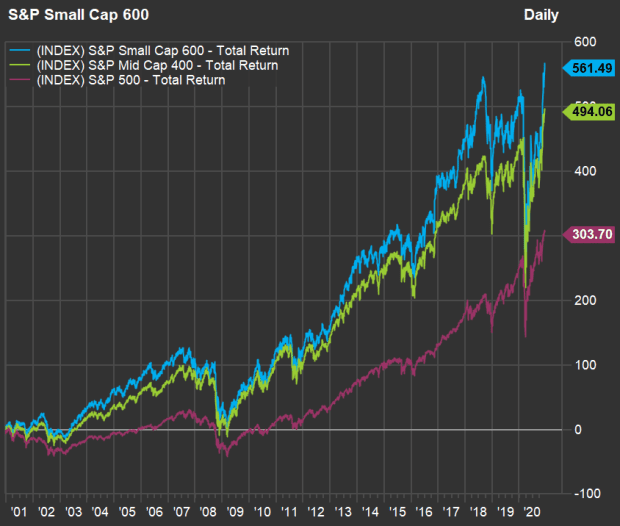

But it hasn’t always been this way. Check out the 20-year chart:

The S&P Small Cap 600 Index and the S&P 400 Mid Cap Index have outperformed the S&P 500 over the past 20 years. (FactSet)

Analysts’ favorite small-caps

Here are the 20 stocks included in the S&P Small Cap 600 Index with at least 75% “buy” ratings with the most upside potential over the next 12 months implied by analysts’ consensus price targets:

Scroll the table to see all the data.

You can see from the total returns for 2020 through Dec. 11 (the right-most column) that small-cap stocks — even the ones favored by analysts — can be volatile. This year’s total returns for the listed names has ranged from a gain of 160% for Vista Outdoor Inc. VSTO,

Vista Outdoor makes ammunition and other hunting accessories, as well as various sports-protection products and outdoor-cooking equipment. The company has benefited from this product lineup in the pandemic environment. Analysts expect its sales for calendar 2020 to increase by 9%, followed by a 7% increase in 2021. (All sales figures in this article use calendar years; many companies have fiscal years that don’t match the calendar.)

The consensus among analysts is for Penn Virginia’s revenue to drop 31% this year, and by another 8% in 2021, before increasing 16% in 2022. The stock is a play on the recovery of fuel demand when (and if) the new vaccines being rolled out can quell COVID-19.

Here are sales growth projections for the group for 2020, 2021 and 2022, based on revenue estimates among analysts polled by FactSet:

Don’t miss: 30 stocks of companies expected to increase sales the most in 2021