Base and Battery Metals Snapshot: Eight companies pursuing critical minerals

Processing test results released in January suggest nickel recoveries of 52%, with 46% of the recovered nickel reporting to a high-grade nickel concentrate, at 37% nickel. According to Mark Selby, Canada Nickel’s chairman and CEO, these latest numbers suggest potential for this high-grade concentrate to be the highest-grade nickel sulphide concentrate in the world (based on data from Wood Mackenzie).

The company said in a press release that this high-grade nickel product could be targeted at battery metal consumers, while the lower-grade concentrate could be used to generate a ferronickel product for the stainless steel market.

Crawford is host to 653 million measured and indicated tonnes grading 0.26% nickel, 0.013% cobalt, 0.028 gram palladium per tonne and 0.012 gram per tonne platinum. There are a further 497 million inferred tonnes grading 0.24% nickel, 0.013% cobalt, 0.026 gram palladium and 0.013 gram platinum. These resources are contained within the Main and East zones and include a higher-grade core of approximately 201 million tonnes grading 0.34% nickel.

Recent drill results also suggest extensions to higher-grade West zone mineralization – the October 2020 discovery returned a 307.5-metre interval of 0.3% nickel in January, extending the higher-grade mineralization by 850 metres northwest.

Nickel mineralization has been traced over a total of 7 km at Craword, with a separate PGM zone next to the Main and East zones. Based on a February update, Canada Nickel has also entered into a binding letter of intent with Noble Mineral Exploration (TSXV: NOB; US-OTC: NLPXF) to consolidate the ownership of the high-priority MacDiarmid nickel target, just west of Glencore‘s (LSE: GLEN) Kidd Creek mine. The geophysical target is 1.8 km long and averages 400 metres in width, making it over 15% larger than the original Crawford Main zone.

The company also signed a non-binding memorandum of understanding (MOU) in January with Glencore, to evaluate the potential use of the major’s Kidd 12,500-tonne-per-day concentrator and metallurgical site to process material mined from Crawford. The Glencore operations are 40 km from the site.

Canada Nickel also signed a MOU in December with the Taykwa Tagamou First Nation to develop electric power for Crawford. The First Nation would develop the electrical transmission assets, which the company would rent.

Canada Nickel has also established NetZero Metals, a division aimed at developing a zero-carbon footprint operation.

A preliminary economic assessment for Crawford is expected in the first quarter of this year.

Canada Nickel has a C$318.5 million market capitalization.

Dore Copper

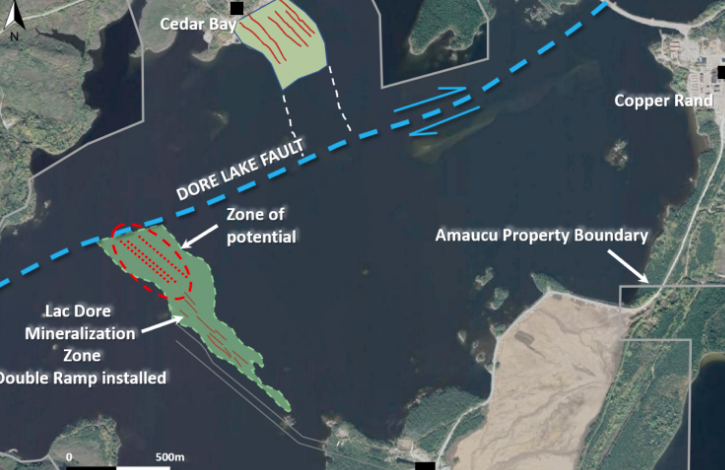

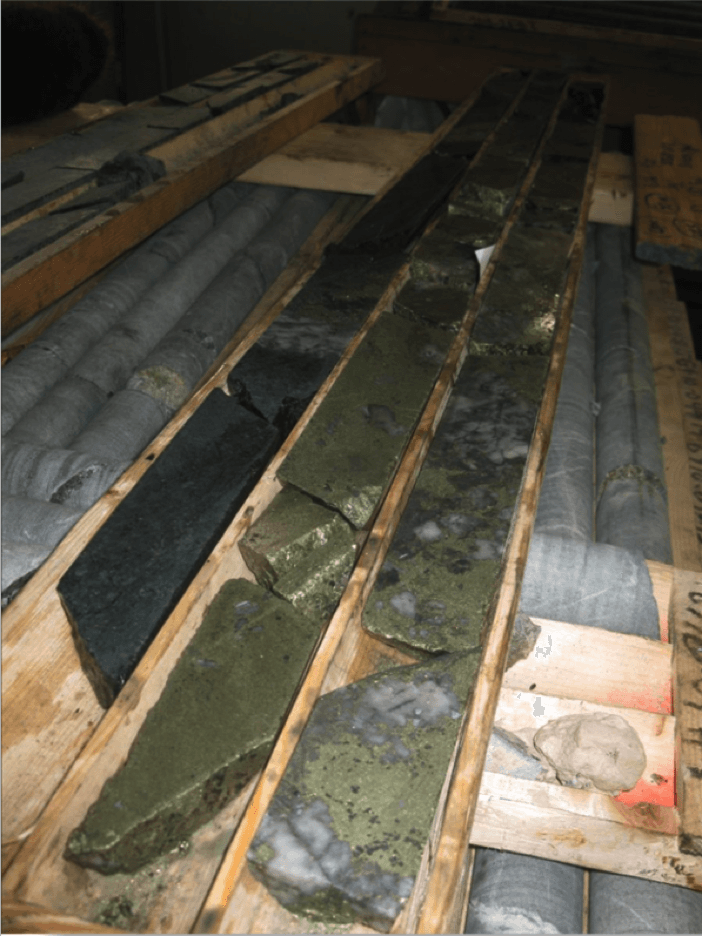

Dore Copper (TSXV: DCMC; US-OTC: DRCMF) is a Quebec-focused copper developer. The company holds approximately 107 sq. km in the Lac Doré-Chibougamau and Joe Mann mining camps. These holdings feature 12 deposits and resource target areas within 60 km of the company’s 2,700 tonne-per-day Copper Rand mill, which closed in 2008. Dore is targeting a hub-and-spoke strategy across these holdings — resource updates are expected in the second quarter of 2021, followed by a preliminary economic assessment in the second half of the year.

Corner Bay includes an indicated resource of 1.4 million tonnes at 3.01% copper and 0.27 gram gold per tonne, with a further 1.7 million inferred tonnes grading 3.84% copper and 0.27 gram gold per tonne. This site features a ramp down to a vertical depth of 115 metres and 2 km of underground development on three levels.

In September, the company reported drill results from Corner Bay, which extended the main deposit by 125 metres to the south and over approximately 300 metres down-dip. Notable intercepts included 6 metres of 3.03% copper, 0.11 gram gold and 6.6 grams silver; and 7 metres of 4.1% copper, 0.38 gram gold and 13.2 grams silver.

In the first half of this year, Dore plans to drill 6,000 metres at this property.

Past-producing Joe Mann generated 1.2 million gold oz. at a head grade of 8.26 grams gold between 1956 and 2007. This site, 60 km from the Copper Rand mill, includes a shaft down to the 1,145-metre level. Exploration highlights, reported in January, included 4 metres of 10.34 grams gold and 0.27% copper; and 1.3 metres of 6.32 grams gold and 0.52% copper.

Cedar Bay produced 3.8 million tonnes grading 1.63% copper and 3.1 grams gold between 1958 and 1990, and includes a shaft down to a depth of 1,036 metres, with development extending down to the 754-metre level. Resources at this project include 130,000 indicated tonnes at 9.44 grams gold and 1.55% copper, with a further 230,000 inferred tonnes grading 8.32 grams gold and 2.13% copper.

Between 1959 and 2008, Copper Rand produced 1.5 million oz. of gold and 500,000 tonnes of copper. Historic resources stand at 1.8 million measured and indicated tonnes grading 1.56% copper and 2.9 grams gold and 420,000 inferred tonnes of 1.89% copper and 2.77 grams gold.

Doré Copper has a C$32.8 million market capitalization.

First Cobalt

First Cobalt (TSXV: FCC; US-OTC: FTSSF) is working to become North America’s first producer of cobalt sulphate for the electric vehicle market through a restart of its First Cobalt refinery in Ontario, the only primary cobalt refinery on the continent. The hydrometallurgical facility started up in 1996 and has been on care and maintenance since 2015.

In late January, the company announced that it had started pre-construction work at the refinery and that detailed engineering and procurement of long lead-time items was underway. At the time, First Cobalt was also negotiating an engineering, procurement, construction and management (EPCM) contract with Ausenco.

In May 2020, the company released the results of a feasibility study on a restart of the facility, with a 25,000 tonne-per-year (55 tonne per day) battery-grade cobalt sulphate production scenario, which, according to the company, would supply 5% of the world’s refined cobalt. The project would produce cobalt sulphate at a minimum grade of 20.5% cobalt at total operating costs of $2.72 per lb. cobalt. With an initial capital requirement of $56 million, the feasibility derived an after-tax net present value estimate of $139 million, at an 8% discount rate and based on $25 per lb. cobalt, with a 53% internal rate of return.

Also in January, First Cobalt secured long-term cobalt hydroxide feed supply arrangements for the refinery with Glencore and a subsidiary of publicly traded China Molybdenum (CMOC), for a total of 4,500 tonnes of contained cobalt a year starting in 2022. The cobalt would be sourced from Glencore’s KCC mine in the Democratic Republic of the Congo and CMOC’s Tenke Fungurume mine, also in the DRC. These agreements represent approximately 90% of the refinery’s projected capacity.

In mid-February, First Cobalt started a study on using black mass material from recycled batteries as a supplemental feed source for the refinery, to potentially recover cobalt, nickel, copper, lithium and manganese, in addition to the cobalt generated from primary feed.

First Cobalt is working on offtake agreements and a financing package for the refinery. Commissioning is expected in the second half of 2022.

In Idaho, the company also holds the Iron Creek project, with indicated resources of 2.2 million tonnes at 0.32% cobalt-equivalent and a further 2.7 million inferred tonnes at 0.28% cobalt-equivalent. The deposit covers 900 metres of strike and remains open, with three adits and 600 metres of underground development also in place at the site.

First Cobalt has a C$187 million market capitalization.

Fuse Cobalt (TSXV: FUSE; US-OTC: FUSEF) is a North America-focused energy metals explorer. The company holds three projects — contiguous Teledyne and Glencore Bucke in Cobalt, Ontario, and Teels Marsh in Nevada.

Teledyne covers a total area of 7.8 sq. km and is adjacent to the southern and western boundaries of the claims that host the past-producing Agaunico cobalt silver mine, which between 1905 and 1961 generated 4.4 million lb. of cobalt and 980,000 oz. of silver.

In 1980, operators of the Teledyne property completed a 701-metre long access decline at the site for underground exploration. In 1981, 22 underground diamond drill holes confirmed the extension of the Agaunico cobalt zone onto these mining claims. The drilling also hit a second zone of cobalt mineralization — intercepts included 16.9 metres of 0.64% cobalt and 8.7 metres of 0.74% cobalt.

Notable diamond drill assays from holes completed in 2017 at Teledyne included 4 metres of 2.32% cobalt; 6 metres of 1.7% cobalt and 6 metres of 1.82 cobalt.

Glencore Bucke, acquired from Glencore in 2018, covers an area of 0.16 sq. km and lies along the western boundary of Teledyne. A 1981 36-hole diamond drill program defined two vein systems at the property — the Main and Northwest zones.

A 21-hole diamond drill campaign completed in the fall of 2017 tested the Main zone over 55 metres of strike and the Northwest zone over 45 metres of strike. Drill highlights included 0.5 metres of 1.62% cobalt and 7 grams silver per tonne; 0.3 metres of 8.42% cobalt and 136 grams silver per tonne and 0.3 metres of 4.45% cobalt and 34.2 grams silver per tonne.

In the fall of 2018, Fuse completed a further 24 holes, aimed at extending the existing zones of mineralization and testing additional targets. Notable intercepts included 0.5 metres of 0.7% cobalt; 3.2 metres of 0.26% cobalt and 1.16% copper; and 1.7 metres of 0.17% cobalt and 4.21% copper.

The Teels Marsh dry lake property, acquired through staking last year, covers 8.1 sq. km and is prospective for lithium brines. The site is 77 km from Clayton Valley.

Fuse Cobalt has a C$16.2 million market capitalization.

Graphite One

Graphite One (TSXV: GPH; US-OTC: GPHOF) is working to become an American producer of high-grade coated spherical graphite (CSG) for the electric vehicle battery market by developing its 95.8-sq.-km Granite Creek property in Alaska, 59 km north of the Nome seaport. The company’s vision is for a vertically integrated project.

A prefeasibility study for Granite Creek is underway, expected by the end of the second quarter. A 2017 preliminary economic assessment of the project suggested a 40-year, 1-million-tonne-per-year surface operation, producing 55,350 tonnes of CSG and graphite specialty materials a year once full production is reached in the sixth year. The proposed processing plant would receive the graphite mineralization, grading 7% carbon graphite, and recover 60,000 tonnes a year of concentrate grading 95% carbon graphite.

The concentrate would then be trucked to the port of Nome and delivered to a manufacturing plant, assumed to be at a brownfield industrial site in Washington, to produce CSG, with a minimum purity of 99.95%, and other value-added graphite products, at 99.8% carbon graphite.

The study assumed a capital cost of $363 million for these operations; a total operating cost of $1,774 per tonne of finished graphite product and an average graphite selling price of $5,054 a tonne (based on $6,200 per tonne for CSG and $1,500 for purified graphite powders). The resulting after-tax net present value estimate, at a 10% discount rate, stands at $616 million, with a 22% internal rate of return and a four-year payback period.

A 2019 resource update estimated measured and indicated resources of 11 million tonnes grading 7.8% carbon graphite, containing 850,534 graphite tonnes and inferred resources of 91.9 million tonnes at 8% carbon graphite, for a further 7.3 million tonnes of graphite.

In May 2020, Graphite One announced that preliminary testwork completed by an independent laboratory on Graphite Creek material suggests potential to produce additional graphite products, such as high-purity coatings, industrial synthetic diamonds and fire suppressant foams. The testing also indicates the presence of critical minerals (from the U.S. Critical Minerals List) within the non-graphite fraction.

Graphite One has a C$54.4 million market capitalization.

Manganese X Energy

Manganese X Energy’s (TSXV: MN; US-OTC: MNXXF) key asset is the 12.3-sq.-km Battery Hill project in southwestern New Brunswick, 5 km from the town of Woodstock. According to CEO Martin Kepman, Manganese X is the only company in North America working on the commercialization of a manganese deposit.

The property is within 12 km of the U.S. border and nearby power transmission lines and railway and road infrastructure that could provide transport to ocean shipping lanes. The project includes five manganese zones: Iron Ore Hill, Moody Hill, Sharpe Farm, Maple Hill and Wakefield. The site features a historic resource of 39 million tonnes grading 9% manganese. Three of the five known manganese occurrences include historic resources — Moody Hill, the company’s initial development target, hosts a historic estimate of approximately 9.1 million tonnes at 9.5% manganese.

In February, Manganese X released assay results from the 28-hole fall 2020 diamond drill program at Battery Hill, reporting the discovery of a new area of surface mineralization in the Maple Hill area, 4.4 km north of Moody Hill. The average assay results from five grab samples collected came in at 20.8% manganese oxide. Drilling at Moody Hill, completed on a 50-metre spacing, confirmed mineralization from surface, down to a maximum depth of 150 metres, over 500 metres of strike. Highlights included 50.4 metres of 11.62% manganese oxide and 54 metres of 11.85% manganese oxide.

With a total of 53 holes, or 9,697 metres, completed by Manganese X at Battery Hill over approximately 2 km of strike, the company is working to deliver a resource estimate late in the first quarter. Once the resource is updated, Manganese X plans to start a preliminary economic assessment of the project.

Test work is underway to develop a flow sheet to generate battery-grade manganese products. In the first phase of work, third-party research company Kemetco Research produced a high-purity manganese sulphate product, with up to 99.95% purity. According to Manganese X, this demonstrates the suitability of the Battery Hill mineralization for battery manufacturing applications.

Second-phase metallurgical test results from mid-January suggest overall manganese recoveries of 85%, with the possibility of eliminating a ‘major step’ in the purification process.

Manganese X also holds 100% of The Disruptive Battery Corp., a company created to advance the use of manganese in stored energy technologies and looking at opportunities in the air purification sector.

Manganese X Energy has a C$93 million market capitalization.

QC Copper & Gold

QC Copper & Gold (TSXV: QCCU; US-OTC: QCCUF) is completing a 20,000-metre drill program at its past-producing 127.8-sq.-km Opemiska project in Quebec’s Chibougamau region. The site hosts four historic underground mines that together generated over 1.1 billion lb. of copper and 750,000 oz. of gold. Between 1953 and 1991, mined grades were at approximately 2.4% copper and 0.3 gram gold per tonne.

QC’s vision for the property is of an open-pit, bulk tonnage operation, mining both the high-grade veins targeted by past operators, as well as lower-grade disseminated copper mineralization outside these veins that was previously overlooked.

In 2019, the company completed a 23-hole, 3,300-metre drill program at Opemiska, focused around the historic Springer mine. Results confirmed QC’s hypothesis of near-surface disseminated mineralization, returning 12 mineralized intersections of approximately 100 metres. Drill highlights included 7.9 metres of 4.65% copper-equivalent from 81.1 metres; 25 metres of 4.15% copper-equivalent starting at 38 metres; and 284.4 metres of 0.3% copper-equivalent from 27.6 metres.

In its current drill program, QC is focusing on defining a near-surface, in-pit resource around the Springer and Perry mines, while also targeting additional underground mineralization at Perry. A resource estimate for these two areas is expected in the first half of 2021. These grounds were added to the company’s portfolio in the fourth quarter of 2019.

A total of 12,810 metres, in 62 holes, is scheduled for Springer. These holes, with an average length of just over 200 metres, are planned on a 50-metre to 75-metre spacing and will target high-grade veins, disseminated zones and crown pillar mineralization.

The past-producing Cooke mine is another potential satellite deposit at Opemiska. Unlike the three historic copper mines, Cooke is a high-grade gold project with copper by-products and previously generated approximately 320,000 oz. from material grading 5.17 grams gold per tonne.

Opemiska covers a 12-km section of the Gwillim fault and also includes volcanogenic massive sulphide mineralization.

The company also has a 36% stake in Athabasca-focused uranium explorer Baselode Energy (TSXV: FIND; US-OTC: BSENF). QC is part of the Ore Group.

QC Copper & Gold has a C$28.1 million market capitalization.

Rokmaster Resources

Rokmaster Resources (TSXV: RKR; US-OTC: RKMSF) is a B.C.-focused explorer and developer, where it holds the Revel Ridge polymetallic deposit, the Big Copper copper-silver occurrence and the Duncan Lake zinc property.

The 142.8-sq.-km Revel Ridge project in southeastern B.C., 35 km north of Revelstoke, is the company’s most advanced project. A December 2020 preliminary economic assessment outlined a 12-year, 2,300-tonne-per-day underground mine, producing a payable average of 89,000 gold oz., 690,000 silver oz., 37.5 million lb. of zinc and 21.2 million lb. of lead annually (124,000 gold-equivalent ounces). Net of by-products, all-in sustaining costs are estimated at $560 per oz. of payable gold.

Using a base-case gold price of $1,561 per oz., the after-tax net present value estimate comes in at C$423 million, based on a 5% discount rate, with a 29.5% internal rate of return and 2.6-year payback.

The proposed mine would extract the Main and Yellowjacket zones, with the mined material processed at a mill with a pressure oxidation plant to produce gold-silver dore and saleable zinc and lead concentrates.

Revel Ridge includes over 3 km of underground development as well as a permitted waste rock storage area and a full camp.

Existing resources at the site include 5.3 million measured and indicated tonnes grading 4.52 grams gold per tonne, 54.9 grams silver per tonne, 2.01% lead and 4.51% zinc (7.57 grams gold-equivalent). Inferred resources add 5 million tonnes at 4.28 grams gold per tonne, 59.4 grams silver per tonne, 1.8% lead and 2.49% zinc (6.36 grams gold-equivalent).

Based on a 2019 option agreement with privately held Huakan International Mining, Rokmaster may earn a 100% stake in Revel Ridge by making cash payments totalling $44.2 million over a five-year period.

Diamond drill results from Revel Ridge, released in mid-February, suggest ‘remarkable’ continuity of mineralization in the parallel Main and Footwall zones and ‘significant’ sliver grades in the Yellowjacket zone. Highlights included 3.3 metres of 7.23 grams gold-equivalent; 4 metres of 11.02 grams gold-equivalent; and 2.9 metres of 580 grams silver-equivalent.

A revised resource is expected in the coming months and an 8,000-metre underground drill program is ongoing at Revel Ridge.

Big Copper in the Creston area of southern B.C. includes a copper-silver occurrence, with mineralization traced over 3 km of strike.

The 39.4-sq.-km Duncan Lake property, also in southern B.C., is drill-ready and features a 15-km length of a prospective anticline crest. Prior surface and underground drilling has traced lead-zinc mineralization over approximately 2,500 metres of strike.

Rokmaster Resources has a C$45.1 million market capitalization.

(This article first appeared in The Northern Miner)