Bumble stock rises 5% after dating app shows 30% sales jump in Q4

Bumble Inc. stock rose nearly 5% in the extended session Wednesday after the dating-app operator’s first quarterly report as a public company showed narrower losses and bigger revenues than analysts expected.

Bumble BMBL,

Revenue rose 31% to $165.6 million, from $126.3 million a year ago, the company said. Bumble said it ended the quarter with 2.7 million paying users, a 32% increase from the fourth quarter of 2019.

Analysts polled by FactSet had expected Bumble to report a GAAP loss of 9 cents a share on sales of $163.3 million.

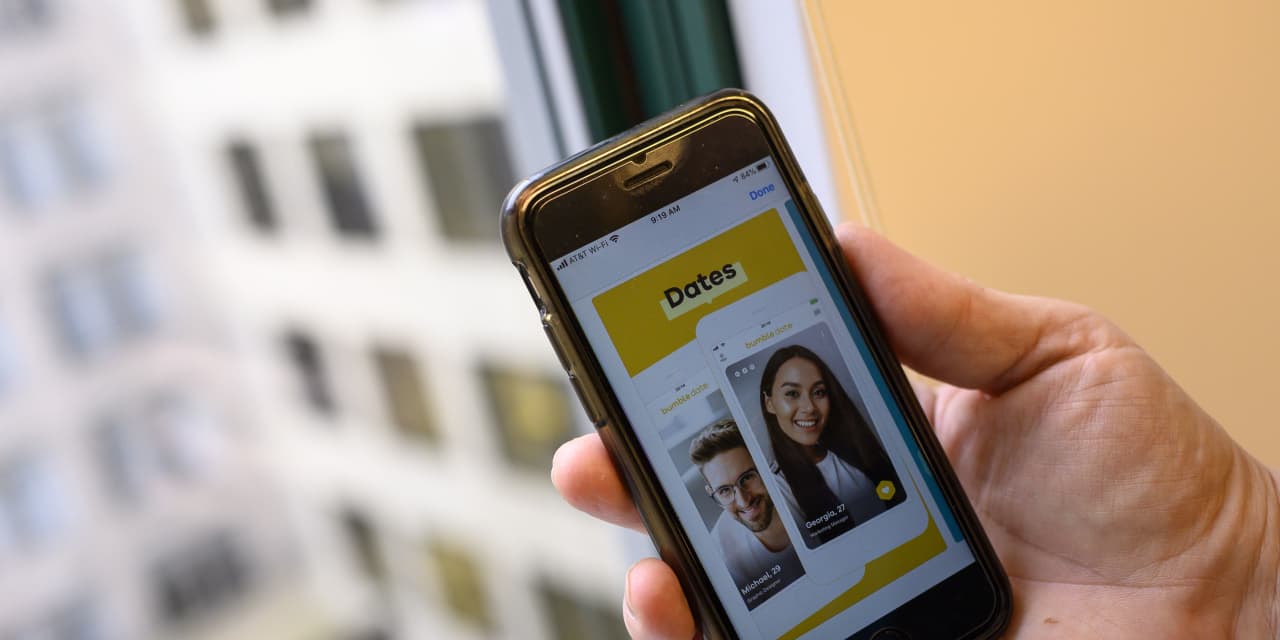

The company runs its namesake Bumble app as well as Badoo, a dating app that’s popular in Europe and Latin America. The Bumble app consists of Bumble Date, for finding romantic partners, Bumble BFF, for finding platonic friends, and Bumble Bizz, for finding networking connections.

The company guided for first-quarter 2021 revenue between $163 million and $165 million, and an adjusted EBITDA between $41 million and $42 million.

For the full-year 2021, the company said it expects revenue between $716 million and $726 million and adjusted EBITDA between $173 million and $178 million.

The company went public last month, with shares rising 70% on their first day of trading.

Bumble remains “focused on driving scale, investing in our users and expanding internationally,” Chief Executive Whitney Wolfe said in a statement. “Our IPO was a pivotal milestone, but we are just getting started and are excited for the next chapter of our journey.”

Bumble’s revenue growth has slowed amid the pandemic. The company generated $488.9 million in revenue during 2019, up about 36% from a year earlier, whereas Bumble recorded revenue of $582.2 million in 2020, up 19%.

Bumble primarily generates revenue from paid subscriptions and purchases of premium dating-app features, though the company also makes some money from advertising.

Emily Bary in New York contributed to this report.