Biden may propose $1 trillion in new taxes, says a former aide — and here’s how Congress will react

Now that the coronavirus relief package is actually law, it is onto infrastructure for the Biden administration and its razor-thin Democratic majority in Congress. But infrastructure legislation will come with strings attached — very hefty new taxes.

The White House will propose $1 trillion worth of new taxes, according to Sarah Bianchi, head of U.S. public policy and political strategy at Evercore ISI and the former director of economic and domestic policy for then Vice President Joe Biden.

Officials including Treasury Secretary Janet Yellen have started suggesting what will be in the White House plan. Bianchi says hiking the corporate tax rate to 28% from 21%, establishing a global minimum tax and raising what’s called the global intangible low-taxed income rate to 21% will be in his plan. The plan will probably include nearly doubling capital-gains taxes on those with income over $1 million, and likely will include taxing unrealized gains at death, ending carried interest and raising the top individual income-tax rate.

Other possibilities include restoring the 2009 estate tax policies, limiting individual deductions, phasing out some business income deductions and establishing a financial transactions tax.

Bianchi says Congress isn’t likely to swallow the whole proposal — she suggests it will only agree to $500 billion of new taxes. For instance, Congress may agree to increase the corporate tax rate, but only to 25%. She says Congress will agree to end carried interest, and is likely to approve increasing the top individual rate of taxes, but won’t be as eager to increase capital-gains taxes. The global minimum tax that Yellen has floated also is considered unlikely to pass.

Get ready for the dot plot

There are four things to watch in the Federal Reserve decision, due at 2 p.m., according to Alan Ruskin, chief international strategist at Deutsche Bank. The market’s initial knee-jerk reaction is likely to center on the so-called dot plot — “the most captivating part of their formal presentation and likely to create the most volatility,” says Ruskin. In December, a large majority didn’t expect an increase in rates until 2024. “Surely, the fiscal initiatives have brought forward tightening, if they have brought forward an accelerated recovery by at least a year. There is an argument for a flatter distribution and much fatter tails attached to the Fed dot distribution,” he says.

Also of importance will be the summary of economic projections, and what the recently passed stimulus will due to the central bank’s estimates of gross domestic product, unemployment and inflation in the years ahead; Federal Reserve Chair Jerome Powell’s comments on whether the central bank has successfully built a bridge across the COVID economic divide; and the more technical issue of whether banks will get another delay in meeting supplementary leverage ratio rules.

The COVID-19 vaccine from drug company AstraZeneca AZN,

Plug Power PLUG,

Uber Technologies UBER,

Home builder Lennar LEN,

Bill Gross, the legendary bond investor, told Bloomberg Television he made $10 million selling options on videogames retailer GameStop GME,

There were at least eight people killed in three Atlanta-area massage parlor shootings that could be tied to rising anti-Asian sentiment.

Bond yields on the move

As the open approached, bond yields started to rise, hitting tech stock futures in particular. The S&P 500 contract ES00,

Quarter of the way there

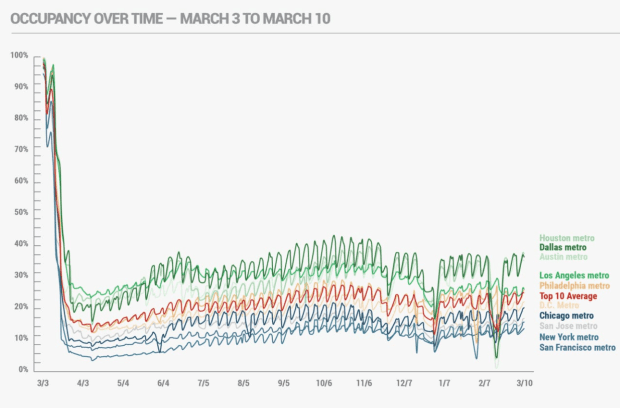

Kastle Systems, a provider of office security services, has been using its keycard and fob data to track office occupancy. Half of the cities measured saw increases in building occupancy last week, bringing the 10-city national average up to 25%, up 0.2% from the week before. Houston has the top occupancy at just over 37%.

Random reads

The latest celebrity vaccination performance — musicals star Elaine Paige singing a new version of “Memory” from “Cats.”

From Chicago to Dublin to Latvia, here are St. Patrick’s Day celebrations across the world.

Broker Sotheby’s is moving into the world of digital art, following rival Christie’s record-setting auction.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.