National Grid Makes $11 Billion Deal in Move to Green Future

(Bloomberg) — National Grid Plc agreed to buy PPL Corp.’s U.K. electricity distribution business for 7.8 billion pounds ($10.9 billion), a move that will transform the company as it prepares for a low-carbon future.

The biggest U.K. utilities transaction in a decade highlights how crucial grids have become as nations figure out how to navigate the shift to electricity from fossil fuels.

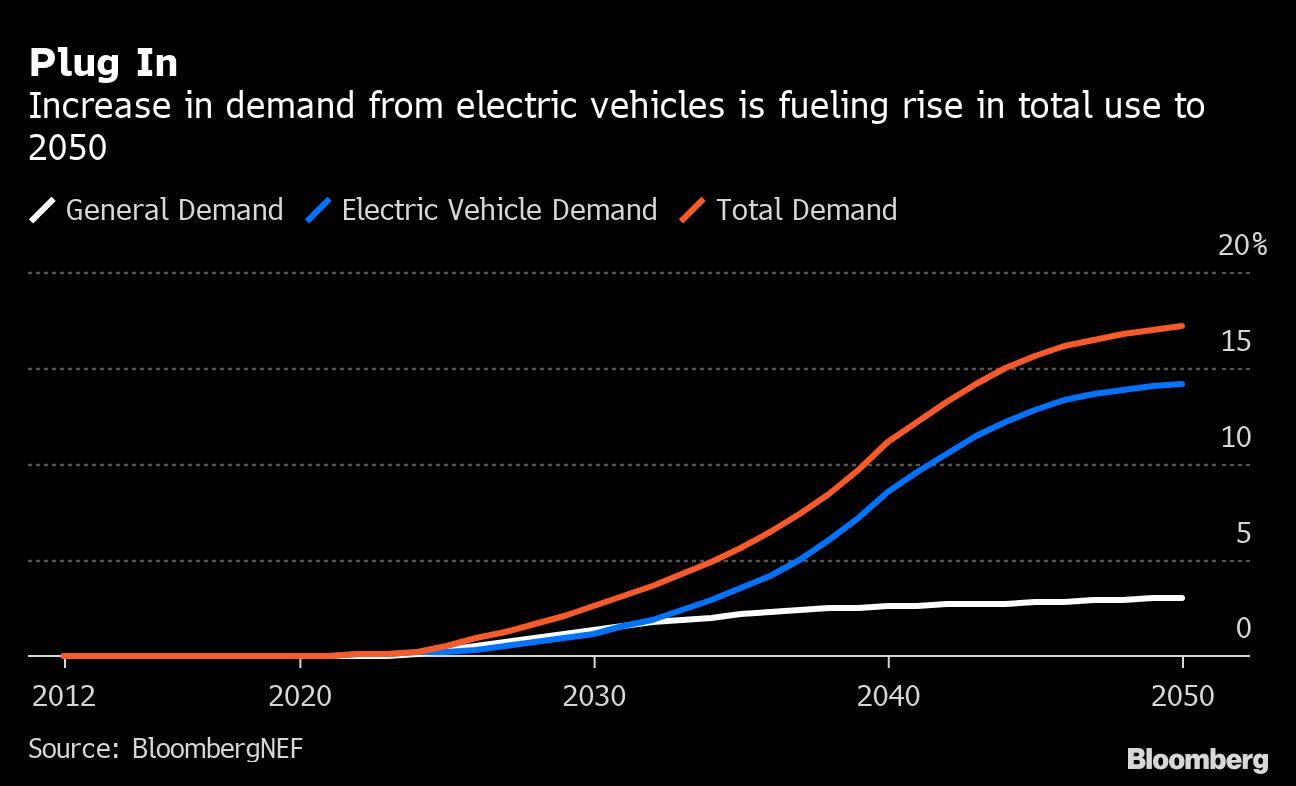

Distribution grids, the local networks that feed directly into homes and businesses, are at the heart of the energy transition. Smart homes with electric heating systems, as many as 30 million electric cars, and small scale renewable generation will all be connected to local grids in the coming decades.

“This makes an awful lot of sense for the U.K, and National Grid in terms of the energy transition,” chief executive officer John Pettigrew said in an interview. “We believe that the growth that we’re likely to see in the distribution sector is going to be stronger and more certain and longer than other elements of the energy sector.”

In a separate deal, the network manager agreed to sell the Narragansett Electric Company in the U.S. to PPL for an equity value of $3.8 billion. National Grid also announced it intends to sell its majority stake in its gas grid business later this year.

The WPD sale drew interest from a wide-range of companies. The government’s climate pledges are what’s attracting investors to distribution grids, according to Randolph Brazier, director of innovation and electricity systems at the Energy Networks Association.

“Ultimately, it’s driven by net zero,” he said. “Because people are connecting all these new technologies to the distribution grid.”

Local network businesses are about digitalization, decarbonization, and decentralization. They’re all underpinned by net zero, he said.

Completion of the WPD deal, which will be funded with bridge financing through debt, is expected within the next four months and completion of the NECO Sale is expected before the end of the first quarter of 2022. National Grid said it plans to start the sale process of its gas unit in the second half of this year.

Once the deals complete, the National Grid portfolio will be 70% electricity, 30% gas, Pettigrew said. The fossil fuel is quickly becoming the next target of climate policies aimed at effectively eliminating emissions by 2050 in the U.K.

Western Power provides electricity to more than 7.9 million U.K. customers in the Midlands, South West and Wales.

National Grid has a commitment to reach net zero for scope one and two emissions. It plans to cut scope three emissions, on the energy carried through its networks to customers, by 20% by 2030 from a 2016 baseline.

Reducing the carbon in the fuel carried in its gas network is possible through hydrogen. The utility is currently looking at how it can switch from piping natural gas through its networks to clean burning hydrogen to heat homes.

“We view the transaction as a positive step for National Grid,” John Musk, analyst at RBC Europe Ltd said in a note. Adding that the market will need time “to digest” the deal.

Shares fell 1.9% to 815 pence a share by 9:25 a.m. in London.

(Updates with charts and context throughout)

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.