Bonds Plunge, Stocks Undue Gains on Inflation Risk: Markets Wrap

(Bloomberg) — Inflation concerns are rattling investors worldwide once again, fueling a selloff in U.S. bonds and sending stocks down from record highs.

Ten-year Treasury yields climbed above 1.70% for the first time since January 2020, while the 30-year breached 2.5% for the first time since August 2019. The Nasdaq 100 Index, a benchmark for high-valuation stocks that are sensitive to rising yields, sank.

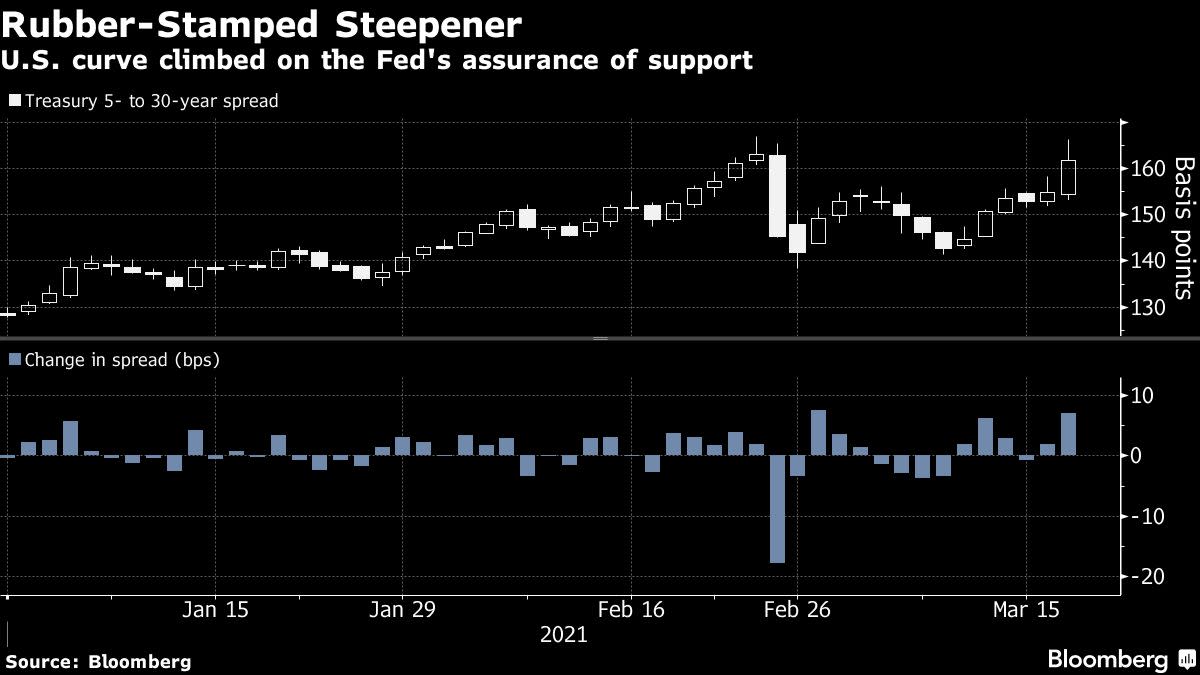

The benchmark S&P 500 reversed gains from Wednesday, when the closely-watched index hit all-time highs. The Dow Jones Industrial Average was little changed. The Federal Reserve’s apparent willingness to keep pumping support into the economy and let it run hotter has spurred bets on faster growth and inflation, sending market expectations of price pressures to multi-year highs.

“Judging by the increase in yields on Thursday morning, financial markets fear the Fed might be too relaxed about the risks of an overheating economy and runaway inflation,” according to Silvia Dall’Angelo, senior economist in Federated Hermes’s international business. “Volatility in bond markets is likely to continue, fueled by the vagueness of the Fed’s reaction function.”

The dollar held gains after initial jobless claims unexpectedly rose last week to the highest since mid-February.

Read: Treasury Yields Top 1.75% After Powell Spurs Bets on Inflation

In Asia, stocks were boosted by lingering enthusiasm from the Fed’s outlook for stronger growth. Automakers and banks, which tend to outperform during cyclical upswings, were higher in Europe. Japan’s Topix jumped past the 2,000 mark for the first time since 1991, becoming the region’s top-performing major equity index this year.

Elsewhere, oil slipped after U.S. crude stockpiles topped half a billion barrels and the International Energy Agency said global supplies are plentiful. Bitcoin traded around $58,000.

Japan’s government bond yields rose on a Nikkei report that the Bank of Japan is considering widening the trading range around the 10-year target, which could spur concerns about policy tightening.

These are some key events this week:

Bank of Japan monetary policy decision and Governor Haruhiko Kuroda briefing Friday.

These are some of the moves in markets:

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.