Here are 5 post-pandemic moves investors should make now, says Wells Fargo

Wall Street is giving back some of Monday’s gains as appetite for risk fades ahead of the first joint appearance by Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen on Capitol Hill, where they’ll discuss pandemic policies.

In premarked remarks, Powell said the U.S. economy has recovered ground faster than expected and “looks to be strengthening.” And most probably agree with him, as more Americans get vaccinated, and hopefully get ahead of those variants.

Tuesday also marks one year to the day the S&P 500 SPX,

It seems a good enough time to think about your post-pandemic portfolio, and our call of the day, from Wells Fargo’s head of global asset strategy Tracie McMillion, has five strategies to get you started.

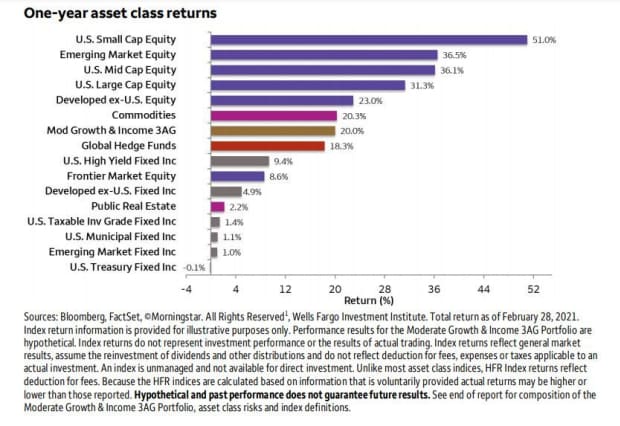

She’s big on rebalancing and diversifying quarterly. In a note to clients, she outpoints this chart which shows how one of their portfolios that did those two things fared relative to individual assets classes, and how market pullbacks can offer diversification opportunities.

As for those five things to do now:

- Diversify between equity asset-classes and sectors. “We expect the global economy to grow faster than the U.S. economy, so global diversification may be increasingly important to capture world-wide equity gains,” said McMillion. For example, emerging markets could bounce back faster and offer more attractive opportunities over developed. As for U.S. stocks, she suggests a barbell approach with bigger allocations to cyclically oriented large and small-cap stocks. She expects higher corporate taxes, but says growth and fiscal spending could offset that. Stick to information technology, financials, consumer discretionary, materials, industrials and communication services.

- Be choosy about fixed income. The 40-year bull market is probably winding down, with interest rates set to rise then hover near historic lows, making it tougher for big capital gains in that asset class. “In today’s low-yield environment, income investors should consider allocations to high-yielding fixed-income classes, including corporate bonds and emerging market bonds, but investors should do so judiciously in line with their risk tolerance,” she said.

- You need more commodities. As the global economy keeps improving, so will demand for commodities, and that’s as supplies remain constrained for a while. For example, 2020’s plunge in oil prices crushed weaker suppliers and those surviving ones may not respond to rising demand fast enough. “Gold and other precious metals may act as a volatility hedge to portfolios diversifying away from low fixed-income yields, and agricultural commodities’ prices may continue to climb on rising demand,” said McMillion.

- Use hedging strategies to mitigate downside risk and take advantage of rising mergers and acquisitions activity. The strategist says they see a good year ahead for hedge funds and private capital strategies capitalizing on post-pandemic trends, with some even offering a hedge for downside risk. And if we get more deals as Wells Fargo expects, that will benefit merger arbitrage and activist managers. Widening differences in returns over individual assets should also be a boost for those hedge strategies and some active managers.

- Private capital works for some. “Innovative smaller companies and startups that provide and utilize cutting-edge technology should offer opportunities for investors. The reshoring of supply chains may also offer create opportunities for new ventures,” said McMillion.

Onward to a rough start

The Dow DJIA,

And what’s going on at AstraZeneca?

Shares of AstraZeneca AZN,

Hobbled by a slow vaccine rollout in Europe, Germany will stretch its lockdown another month, shutting down public life over Easter. And in the U.K., holidays abroad could result in a nearly $7,000 fine. Meanwhile, Israel continues to offer hope of what could be:

The administration of President Joe Biden is laying the groundwork for a $3 trillion package of investments on infrastructure and domestic needs.

On the stock front, videogame retailer GameStop GME,

Videogame chat platform Discord may be the target of a $10 billion buyout by Microsoft MSFT,

Days after a deadly shooting in Atlanta, a gunman killed 10 people at a Colorado supermarket.

Random reads

Redditors on why Americans may not be welcome abroad yet.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.