S&P 500 closes flat near record high in another muted session ahead of key inflation data

U.S. stocks hovered near their record levels on Monday as dull trading resumed before the release of widely-watched inflation data and the start of first-quarter corporate earnings.

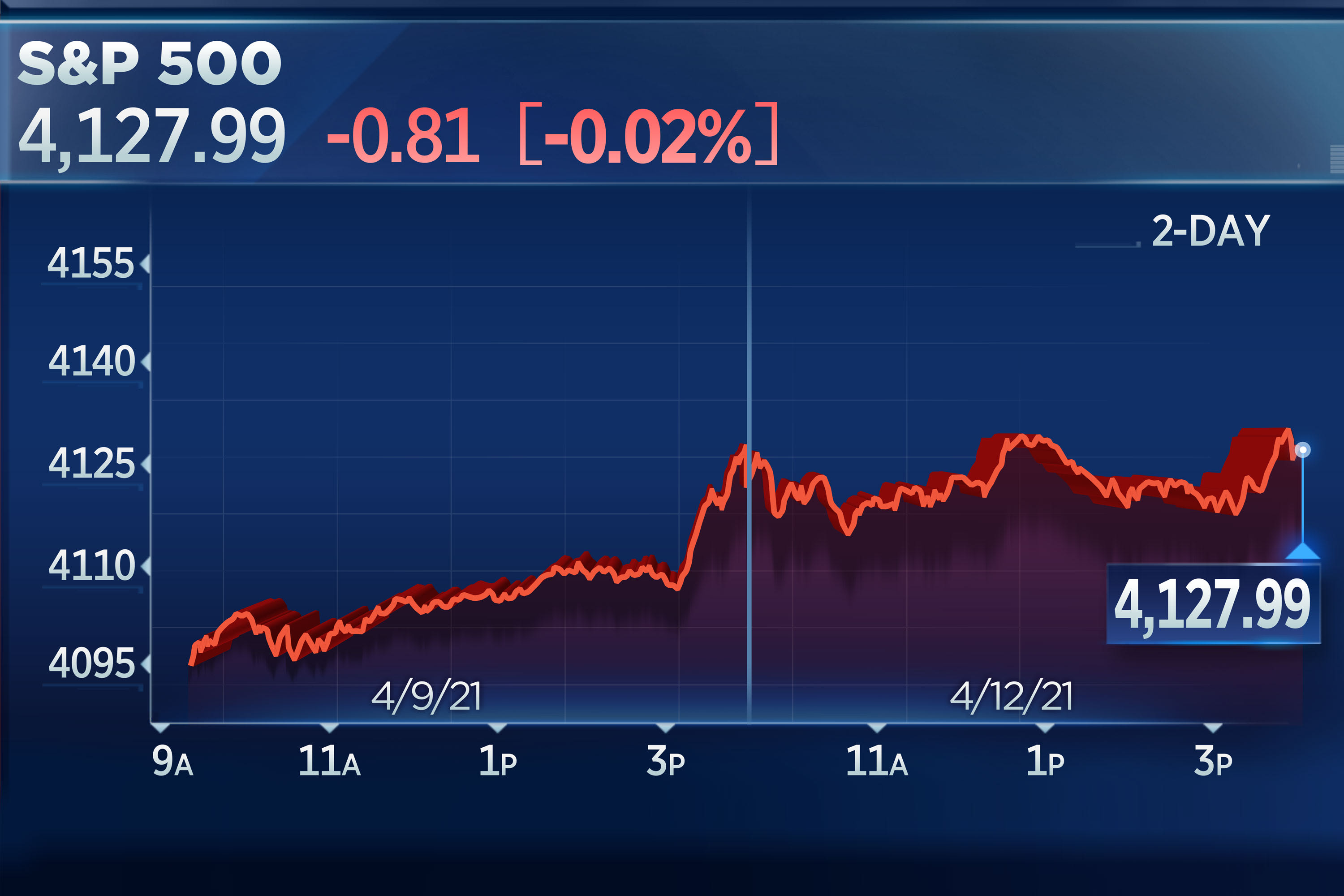

The S&P 500 dipped less than 1 point to 4,127.99 after closing at a record high in the previous session. The Dow Jones Industrial Average slipped 55.20 points, or 0.2%, to 33,745.40, also falling from a record high. Intel was the biggest decliner in the blue-chip Dow, dropping more than 4%. The Nasdaq Composite fell 0.4% to 13,850.00.

Wall Street has been relatively quiet with the S&P 500 moving within 1% for five sessions in a row. Market volatility has declined to pre-pandemic levels amid rising reopening optimism. The Cboe Volatility Index, AKA the VIX or the market’s fear gauge, has traded below 18 for the past four days, a level unseen since February 2020.

Shares of Nuance Communications jumped nearly 16% after Microsoft announced it will buy the speech recognition company in a $16 billion deal. The Nuance acquisition represents Microsoft’s largest acquisition since it bought LinkedIn for more than $26 billion in 2016.

Nvidia jumped 5.6% after the chip giant said it first quarter revenue for fiscal 2022 is tracking above its previously provided outlook and that it expects demand to continue to exceed supply for much of this year.

The weakness in reopening plays weighed on the overall market with shares of Carnival and Norwegian Cruise Line off more than 4% each. United Airlines fell 3.9% after the carrier said its first-quarter revenue is expected to fall 66% compared with the same period in 2019. The new guidance fell near the top of the range between 65% and 70% that the company had previously forecast.

“Amid new highs it’s not surprising for the market to be moving somewhat in a holding pattern of late,” said Chris Larkin, managing director of trading and investing product at E-Trade. “All eyes will likely be on the CPI read tomorrow for a benchmark on where we stand on the inflation front. And of course we’re ushering in earnings season which could be a catalyst for market moves over the next few weeks.”

The first-quarter earnings reporting season begins this week, with expectations set for broadly positive news and an uptrend for U.S. equities thanks to a recovering economy. Many of the nation’s largest banks, including Goldman Sachs and JPMorgan Chase will this week report results for the three months ended March 31.

This week is also packed with Federal Reserve speeches and key economic data including a hotly anticipated inflation reading Tuesday, when the U.S. consumer price index is released. Economists polled by Dow Jones anticipate a 0.5% gain in CPI month over month and a 2.5% increase from last year’s level.

Tesla gained 3.7% to above $700 Monday after Canaccord Genuity upgraded the stock to buy and raised its price target to $1,071, citing its battery innovations.

Fed Chairman Jerome Powell on Sunday reiterated that the Fed wants to see inflation rise above its 2% for an extended period before officials move to raise interest rates.

“We want to see inflation move up to 2% — and we mean that on a sustainable basis, we don’t mean just tap the base once,” Powell said in an interview that aired Sunday evening on CBS News’ “60 Minutes.” “But then we’d also like to see it on track to move moderately above 2% for some time.”

He added that amid an accelerated Covid-19 vaccine rollout and strong fiscal support, the U.S. economy appears to be at a turning point.

Powell will also speak Wednesday at an Economic Club of Washington event.

Investors will also keep an eye on President Joe Biden’s effort to advance a major infrastructure proposal known as the American Jobs Plan. Biden, who with other Democrats promised significant an infrastructure overhaul in the 2020 elections, will meet with a bipartisan group of lawmakers on Monday to try to persuade Capitol Hill to back the $2 trillion package.

Congress will return to Washington this week and be in session for the first time since Biden debuted his proposal, which earmarks hundreds of billions of dollars for roads, bridges, airports, broadband, electric vehicles, housing and job training.

The president’s plan would also increase the corporate tax rate to 28% and crack down on other overseas tax avoidance strategies.

Enjoyed this article?

For exclusive stock picks, investment ideas and CNBC global livestream

Sign up for CNBC Pro

Start your free trial now