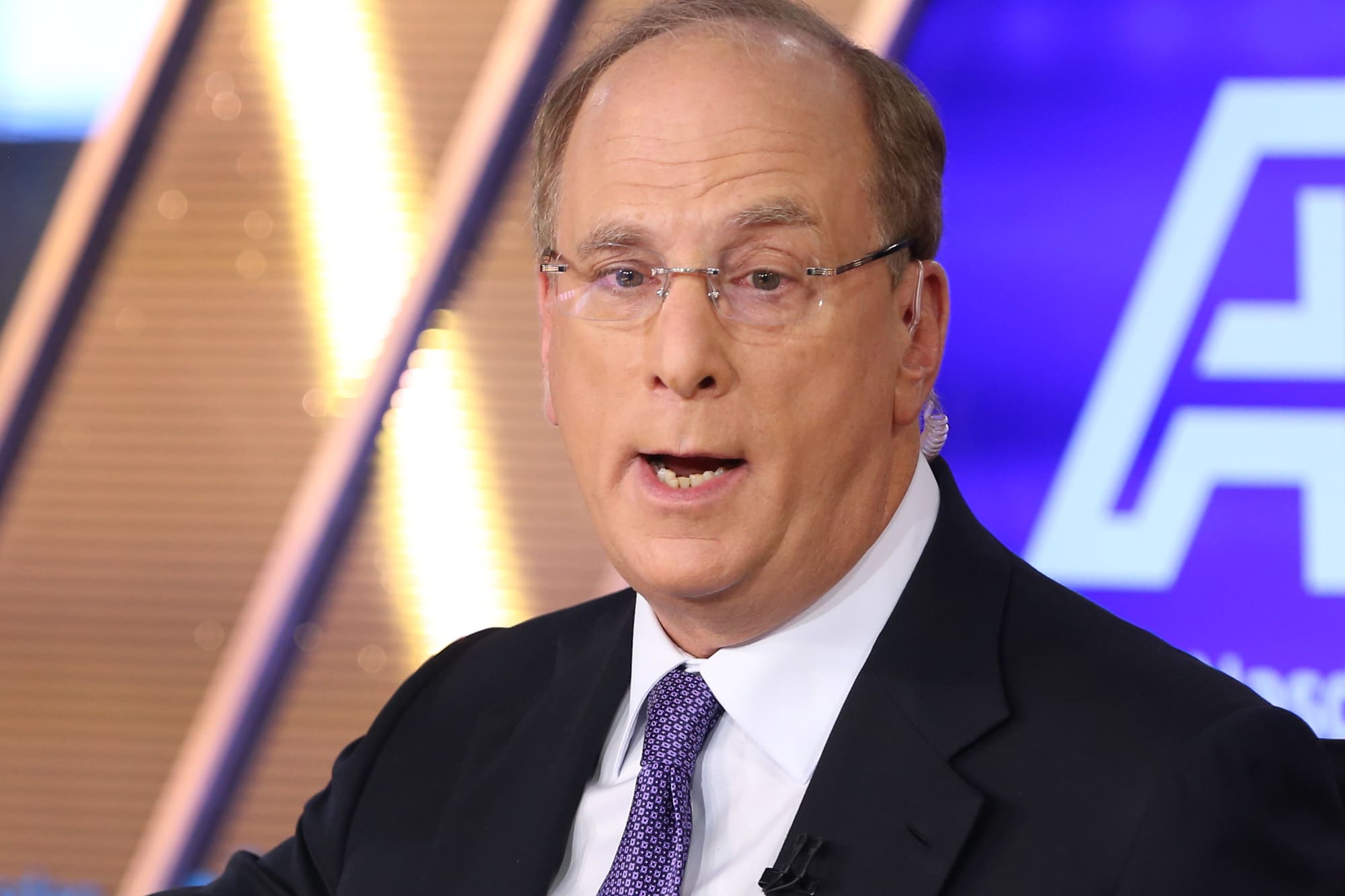

BlackRock CEO Larry Fink told CNBC on Thursday that the world’s largest money manager has more discussions with its institutional clients on issues around climate change and inflation than it does on cryptocurrencies.

“Our broad-based client relationships, we’ve had very little interconnectivity on the conversation on crypto other than a fascination,” Fink said in an interview on “Squawk Box.”

The BlackRock co-founder and chairman believes crypto can “become a great asset class,” acknowledging that his firm made some moves into bitcoin.

“We’re studying it. We make money on it, but I’m not here to tell you that we’re seeing broad-based interest by institutions worldwide,” Fink said.

“Maybe they’re talking to somebody else, so I don’t want to suggest that we have perfect information,” he added, shortly after BlackRock reported better-than-expected earnings and a record $9 trillion in assets under management.

For BlackRock’s clients specifically, Fink said other topics rank higher on the list of concern.

“The amount of conversation we’re having on climate risk and how they should navigate portfolios is a major component of the conversation,” Fink said. “The conversations about our [budget] deficits and … on inflation risk is far more dominant with our clients worldwide than the whole conversation about crypto.”

Fink’s comments Thursday came one day after the largest cryptocurrency exchange in the U.S., Coinbase, went public on the Nasdaq. Coinbase’s direct listing was heralded as a major milestone in the growing acceptance of cryptocurrencies as an asset class. Coinbase finished Wednesday’s session with a market cap of nearly $86 billion.