China’s Internet Stocks Face More Pain, Top Global Investors Say

(Bloomberg) — After a historic antitrust crackdown on China’s biggest tech companies last week, investors are betting there is more pain ahead.

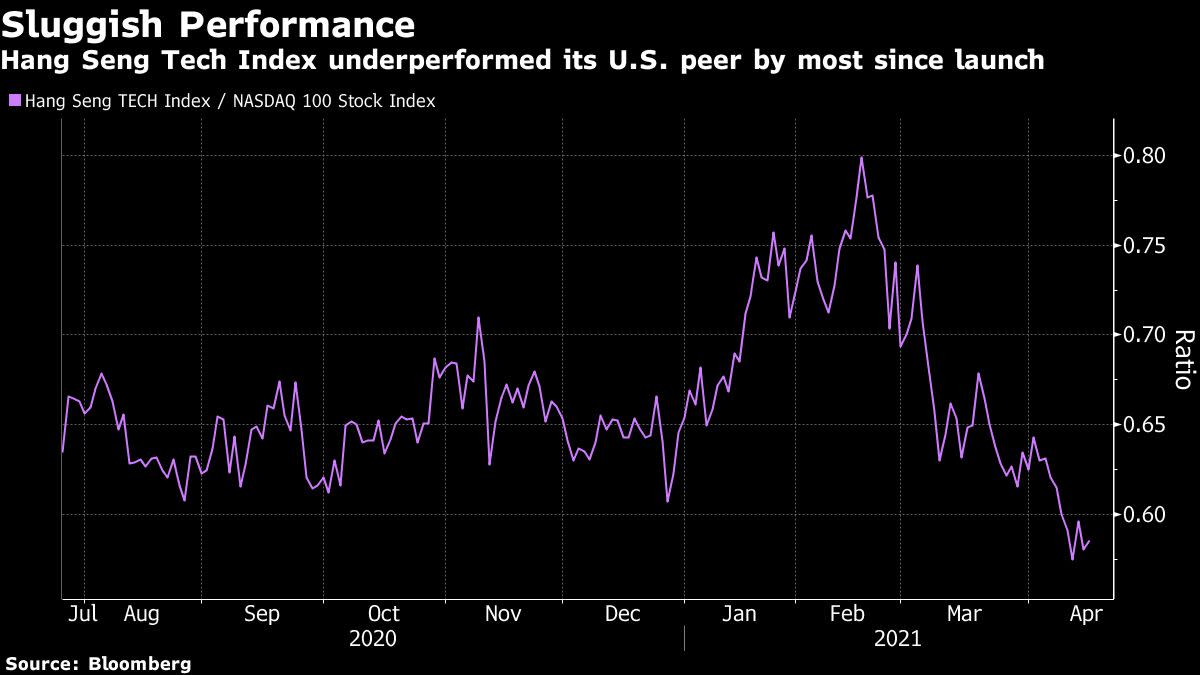

GAM Investments, BNP Paribas Asset Management and JP Morgan Asset Management Inc. see more regulatory tightening in China’s clampdown on monopolistic practices, putting pressure on the country’s leading internet stocks over the next few months. The Hang Seng Tech Index, where many Chinese tech giants are listed, has already lost about a quarter of its value from a rout that began mid-February.

The shockwaves from Beijing’s bid to quell abuses of information and market dominance among industry leaders have left global investors pondering the prospects of China’s internet firms. The antitrust crackdown has exacerbated a global tech selloff sparked by rising bond yields, as traders forecast tighter liquidity conditions at home and abroad and lower company valuations.

“Regulations for China internet companies, especially the big ones, will continue to tighten in 2021,” said Marcella Chow, global market strategist at JP Morgan Asset. “This uncertainty may act as a cap for some companies temporarily.”

China slapped a record $2.8 billion fine on Alibaba Group Holding Ltd. after a four-month long investigation into the e-commerce giant’s market practices, then ordered an overhaul of Ant Group Co. Over the past week, more than 30 tech giants issued pledges to obey antitrust laws after Beijing gave them a month to conduct reviews and comply with government guidelines.

READ: Jack Ma’s Double-Whammy Marks the End of China Tech’s Golden Age

Alibaba shares have slumped 23% in Hong Kong from a peak in October. Food delivery platform Meituan and tech giant Tencent Holdings Ltd., which have been on analyst radars for regulatory probes, are down 36% and 18%, respectively, from their peaks earlier this year. By contrast, the Nasdaq 100 index is up more than 8% this year despite entering a technical correction in March.

Looking ahead, China’s tech companies are likely to move far more cautiously on acquisitions, over-compensate on getting signoffs from Beijing, and levy lower fees on the domestic internet traffic they dominate. This coincides with some facing delisting threats and sales curbs in the U.S., and others reverberating from a selloff sparked by Archegos Capital Management.

Valuations too are serving as a deterrent for investors. Even after its decline, the Hang Seng Tech Index is trading at about 38 times its 12-month earnings estimates versus the 29 times multiple of its American counterpart.

“We have already applied a valuations discount to the whole Chinese internet sector to factor in higher regulation risks,” said Jian Shi Cortesi, a Zurich-based fund manager at GAM. The $132 billion asset manager has reduced its exposure to the sector in the past few months amid high valuations, she added.

Keep the Faith

That said, Beijing has moved far faster with its antitrust reforms than the U.S. and Europe have in similar efforts. The landmark case against Microsoft Corp.’s alleged software monopoly took more than half a decade of back-and-forth before settling in 2004. Current hearings involving U.S. tech titans from Google to Facebook Inc. span several fronts, multiple cases and plaintiffs, and may not see the inside of a courtroom for years to come.

In contrast, Beijing regulators torpedoed Ant’s IPO the month after Ma’s infamous speech, published new rules shortly after intended to curb monopolistic practices across its internet landscape, then launched its probe into Alibaba on Christmas Eve.

“Clarity reduces uncertainty, so this is a positive,” said Joshua Crabb, a portfolio manager at Robeco in Hong Kong.

That has helped give investors more optimism for the long term. Money managers see the potential for tech companies to boost earnings as digital technologies catch on for everything from e-commerce and entertainment to social media, a trend that has been accelerated by the pandemic.

Meanwhile, mainland traders have kept the faith. They still hold about 6.5% stake in Tencent, the highest in at least three years, according to calculations by Bloomberg based on exchange data.

“Post this round of regulation scrutiny, we believe the Chinese internet industry will resume healthy growth,” GAM’s Cortesi said.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.