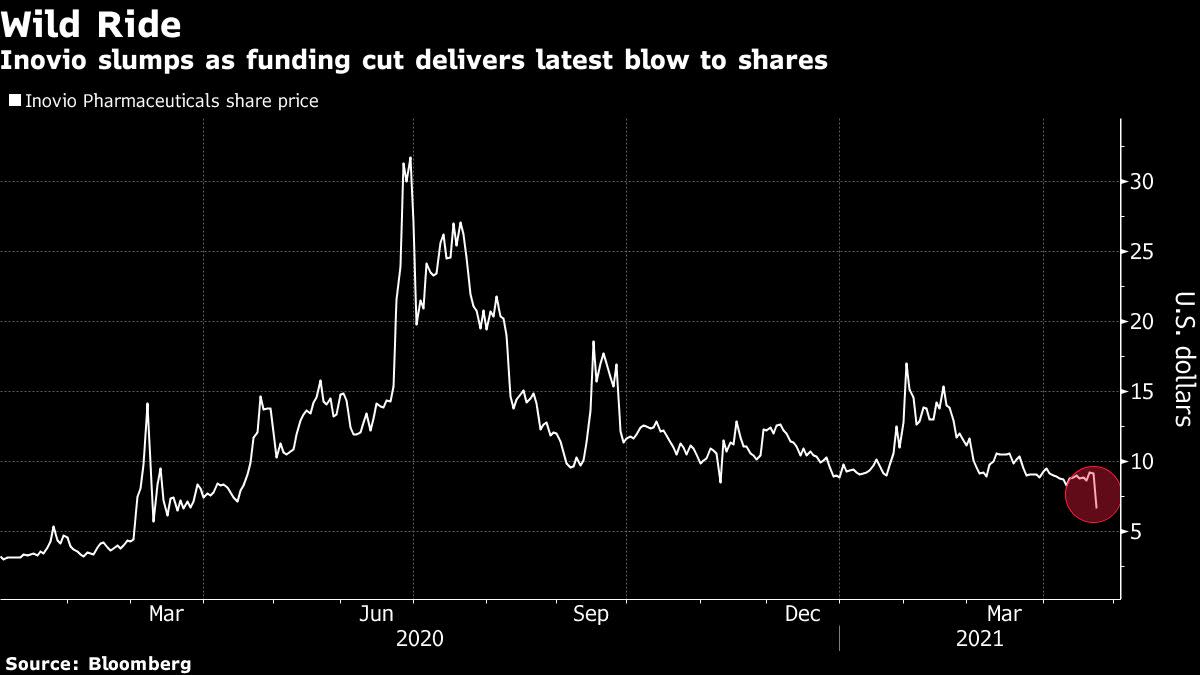

Inovio Drops After U.S. Cuts Off Funding; Short Sellers Gain

(Bloomberg) — Inovio Pharmaceuticals Inc. sank as much as 29% Friday after the U.S. government pulled funding for its Covid-19 vaccine research, a vindication for short sellers who have been amassing positions in the biotech stock.

Bears betting against Inovio are set to reap nearly $160 million from Friday’s plunge alone, quintupling their $40 million in profits year-to-date, according to Ihor Dusaniwsky, S3 Partners managing director of predictive analytics.

Issues with a key supplier, development delays including a partial hold on testing from the Food and Drug Administration and the abundance of Covid-19 vaccine supplies in the U.S. have hurt the advancement of Plymouth Meeting, Pennsylvania-based Inovio’s shot. Add to that Friday’s news that the Department of Defense will curtail funding for its late-stage vaccine trial because of the broad availability of other shots.

“The decision results from the changing environment of Covid-19 with the rapid deployment of vaccines,” the government agency said, according to Inovio’s statement released earlier. “This decision is not a reflection of the awardee or product, rather a fast-moving environment associated with the former Operation Warp Speed on decisions related to future products.”

The case of Inovio is among the few recent examples where short sellers betting against a company’s success have paid off. More broadly, hedge funds have elected to side-step placing bearish bets to avoid getting hammered by the rise of Reddit-fueled rallies and euphoric retail investors.

Despite backlash from Reddit users earlier this year, Citron Capital’s bets against Inovio were the fund’s largest contributor from shorting to a 155% return in 2020, according to a January letter to investors. Citron was far from being the company’s only skeptic, with roughly a third of shares available for trading sold short as of Friday, data compiled by S3 Partners shows. The total short positions stood at $634 million, the data show.

The company will continue to develop its shot through Phase 3 testing, though mostly outside the U.S. “Inovio remains well-positioned to support both pandemic and endemic vaccine needs with INO-4800 and INO-4802,” according to an earlier statement alluding to the company’s Covid-19 shot as well as a vaccine meant to address Covid variants. Inovio declined to comment beyond its initial press release.

There are now three vaccines authorized in the U.S. and even with distribution plans for one of those shots currently paused nationally, many health experts say the world’s most lucrative drug market has enough to go around.

Sell-side analysts, who are not known for excessive pessimism, were divided on the company’s outlook. Six analysts rate the stock at a hold-equivalent compared to just four who recommended shares to clients while none were sell rated, data compiled by Bloomberg show. Still, the average price target of $15 suggests the shares could more than double from Friday’s level.

With the FDA partial pause on the trial unresolved and following Friday’s setback, Inovio’s “window for success, already narrow, closes a bit more,” Piper Sandler analyst Christopher Raymond wrote in a research note. He has a Wall Street low price target of $7.

“INO-4800 has not been part of our valuation,” he said, referring to the vaccine candidate. “However, talking with investors, it appears the market has concerned itself with little else. Not a great set-up in our view, and given today’s events, we continue to remain on the sidelines.”

(Updates to add analyst ratings, comment from ninth paragraph.)

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.