GE earnings: Stock has rallied while earnings estimates have dropped. Will investors or analysts be right this time?

General Electric Co. is scheduled to report first-quarter results before Tuesday’s opening bell, and there may be some concern that investors are set up to be disappointed, given that the industrial conglomerate’s stock has been rising even as analyst expectations have been falling.

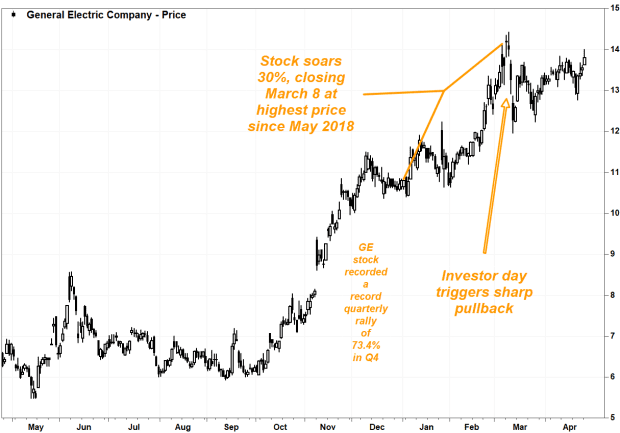

A similar dynamic had occurred ahead of GE’s much-anticipated investors day on March 10, as the stock GE,

Since the industrial conglomerate reported fourth-quarter results on Jan. 26, the FactSet consensus for earnings per share (EPS) has dropped 67% and for revenue has fallen 5.1%, with estimates for three of GE’s four business units declining. Meanwhile, the outlook for industrial free cash flow (FCF) is now more than four-times more negative than it was three months ago.

And yet GE’s stock, which rose 1.9% in midday trading Monday, has climbed 22.2% since the end of January. In comparison, the SPDR Industrial Select Sector exchange-traded fund XLI,

As an example of the difference in the outlook for earnings and the stock, UBS analyst Markus Mittermaier recently raised his stock price target to $17 from $15, citing an acceleration of the transformation into a “simpler” company, but trimmed his first-quarter EPS estimate to 2 cents from 3 cents, and cut his 2021 outlook to 26 cents from 29 cents.

The numbers

Earnings: The average estimate of the 17 analysts surveyed by FactSet is for adjusted first-quarter EPS of a penny per share, down from 5 cents a year ago. On Jan. 29, the FactSet EPS consensus was 3 cents.

Estimize, a crowdsourcing platform that gathers estimates from buy-side analysts, hedge-fund managers, company executives, academics and others, has a much higher consensus EPS estimate of 4 cents.

Revenue: The FactSet consensus for revenue is $17.59 billion, down from $20.52 billion a year ago. The consensus has fallen by nearly $1 billion, from an $18.54 billion estimate as of Jan. 29. The Estimize revenue consensus is at $17.91 billion.

For GE’s business segments, the FactSet revenue consensus for Aviation has fallen to $5.28 billion from $5.39 billion on Jan. 29, has declined for Power to $4.00 billion from $4.16 billion and has slipped for Healthcare to $4.09 billion from $4.10 billion. The estimate has increased for Renewable Energy to $3.26 billion from $3.22 billion.

Industrial free cash flow: The average FCF estimate, of the two analysts who provided estimates to FactSet, is now negative $1.21 billion, with a range of negative $870.0 million to negative $1.55 billion. On Jan. 29, the range was negative $747.0 million to positive $216.0 million.

Stock movements

• GE shares have rallied the after the past two earnings reports, by an average of 3.6%, after falling by an average of 3.8% after the previous two earnings reports. Over the past 10 earnings reports, the stock has gained six times, for an average gain of 7.5%, and fallen by an average 4.3% after the other four reports.

• Options traders have prepared for a smaller-than-usual stock move after GE’s earnings report. An options strategy known as a straddle, which is designed so the buyer of the straddle makes money if the stock moves, in either direction, more than the straddle pricing implies, has been priced for a 67-cent move on Tuesday, according to data provided by Option Research & Technology Services (ORATS). That compares with the average price move over the past 12 quarters of 80 cents, ORATS said. Based on current prices, a straddle buyer would make money if the stock moves 4.9% in either direction. Read more about straddles.

• Since the end of January, the percentage of Wall Street analysts surveyed by FactSet with the equivalent of buy ratings has declined to 60% from 68%, while the percentage of analysts with hold ratings increased to 40% from 32%. No analysts have the equivalent of sell ratings on GE’s stock.

• Baker Hughes Co.’s stock BKR,