AMC stock reverses lower ahead of earnings, as options traders prep for bigger-than-usual reaction

Shares of AMC Entertainment Holdings Inc. reversed course Thursday, putting them on track to extend a long losing streak just before the movie theater operator releases quarterly results.

The stock AMC,

Earlier this week, the company rescheduled its annual shareholder meeting at the last minute, to give its shareholders more time “to have their voices heard.” The new date for the meeting is July 29.

AMC is slated to reveal its first-quarter report after Thursday’s closing bell. The stock has gained on the day after the past five quarterly results, by an average of 7.1%.

The company is expected to report a first-quarter per-share loss that narrows to $1.34 from $19.99 a year ago, according to FactSet, as its theaters have been reopening with limited capacity as COVID-19 related restrictions have eased. The FactSet consensus for revenue is for an 84% decline to $148.3 million, in line with AMC’s guidance provided in late April.

Analysts have slashed their estimates since AMC reported fourth-quarter results in early March, as the FactSet consensus for per-share losses has widened from $1.29 at the end of February and the FactSet sales consensus has declined from $339.8 million.

Don’t miss: AMC lost nearly $1 billion in holiday season, but stock is gaining as executives see better days ahead.

Options traders appear to be prepared for some fireworks after the results, as an options strategy known as a “straddle” is priced for a one-day, post-earnings move of about 9.8% in either direction, according to FactSet data.

A straddle is a pure volatility play that involves the simultaneous pricing of both bullish (calls) and bearish (puts) options with strike prices at current, or “at-the-money” prices, for expiration at the end of the week.

Meanwhile, the average one-day post earnings move for the stock has been 5.1% in either direction after the past 20 quarterly reports, while the median move was just 3.9%, according to a MarketWatch calculation of FactSet data. After the past 10 reports, the average move was 8.1% and the median move was 6.4%.

The stock has gained 11 times after the past 20 reports, by an average of 5.9%, while the declines have averaged 4.1%. After the past 10 reports, the average gain was 8.2% and the average loss was 8.4%.

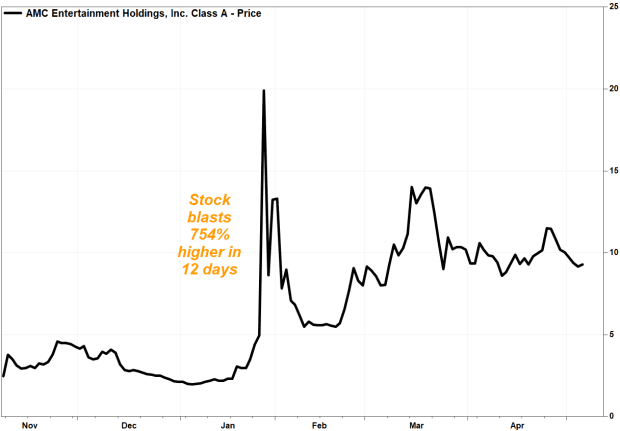

The so-called “meme” stock has seesawed within narrowing ranges since it got caught up in the trading frenzy surrounding heavily shorted shares earlier this year, and is now trading around the middle of its late-January range. The stock had soared 754%, from a Jan. 15 close of $2.33 to a Jan. 27 close of $19.90 before paring some gains.

The latest available exchange data shows that short interest, or bearish bets on AMC’s stock, increased to a record 93.9 million shares, or 22.5% of the public float, compared with short interest of 38.1 million shares are the end of 2020.

AMC’s stock has soared 326.2% year to date, while shares of fellow movie theater operator Cinemark Holdings Inc. CNK,

Of the nine analysts surveyed by FactSet, one analyst is bullish, four have the equivalent of hold ratings and four have the equivalent of sell ratings. The average stock price target is $4.44, or 51% below current levels, but more than double the average of $2.15 as the end of 2020.