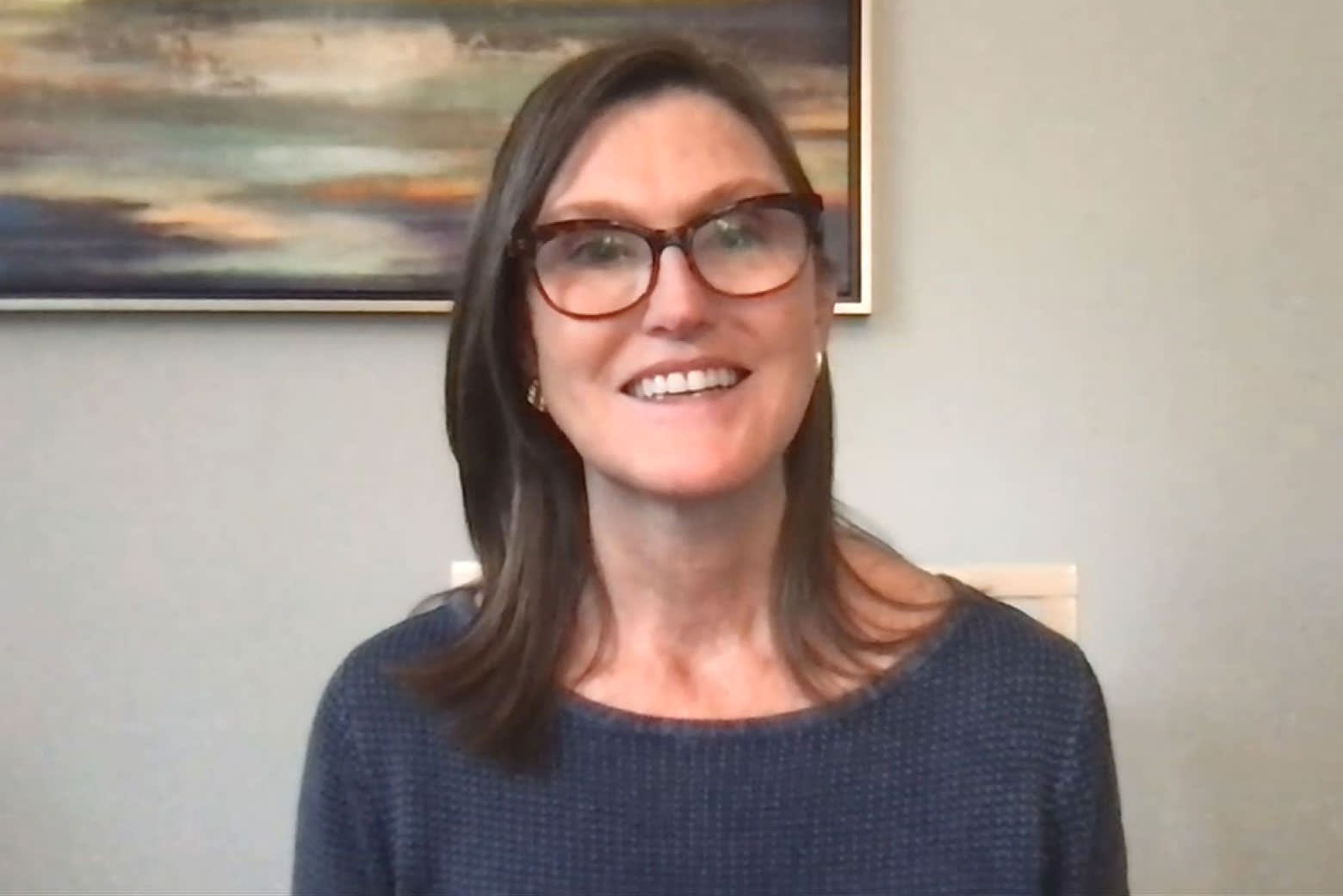

Cathie Wood

Source: CNBC

Cathie Wood’s flagship fund Ark Innovation hit its lowest point of the year on Monday amid further selling in innovation stocks.

Ark Innovation‘s drop of as much as 5% on Monday dragged the “disruptive innovation” ETF below its February low, a level that many investors are watching as a barometer for the larger tech sector.

Ark Innovation is now nearly 35% off its most recent high: $159.70 on Feb. 16.

Wood’s core ETF is now down nearly 13% this month and more than 15% year-to-date.

Some of Ark Innovation’s top holdings took big hits on Monday as the Nasdaq Composite dropped as much as 1.5%. Tesla fell 4% and Teladoc Health dropped 4.6%. Square and Roku fell nearly 6% and 3%, respectively. DraftKings declined more than 3% and Zillow lost over 2%.

Wood told CNBC on Friday that she loves the set-up for her ETFs following the most recent sell-off in technology stocks. She said she envisions her strategies posting a compound annual rate of return between 25% and 30%.

“I love this set-up,” Wood said Friday on CNBC’s “Closing Bell.” “The worst thing that could have happened to us is to have the market narrowly focus on just our ilk of stock — the innovation space.”

However, more than $1.1 billion of fund flows have left Ark Innovation this month. Ark Invest — including its five core ETFs — has lost about nearly $2 billion in investor dollars in May, according to FactSet.

200-day moving average long gone

Ark Innovation broke below its 200-day moving average, a key technical level watched by traders that is essentially the average of the past 200 closing prices.

“The issue with ARKK and other speculative growth ETFs is that short-term rallies have been aggressively faded for three months now,” Frank Cappelleri, Instinet executive director, told CNBC. “The ETF will have to do more than just bounce for a few days to convince traders otherwise.”

“In other words, simply getting back above the 200-day moving average won’t mean much without upside follow through. That continues to be the biggest concern,” Cappelleri added.