Horror movie: Run away from AMC stock as if your life depended on it

Fans of classic horror movies love typical cliches such as victims attempting to escape in a car that won’t start, or a group of clueless teenagers taking refuge in an old house.

As viewers, we can’t help but groaning aloud “No — don’t go in there!” As we know, the killer lurks behind the next door.

It is both obvious and exciting as we know the characters’ terrible decisions on screen will result in disaster and entertainment. Likewise, AMC Entertainment Holdings AMC,

Read: A new short squeeze in GameStop and AMC? This social-media sentiment tracker says so

House of horrors

Pre-Covid, AMC operated 1,004 movie theaters, had 103.8 million shares outstanding and owed $4.8 billion. As of the first quarter of 2021, AMC had 950 theaters, 493 million shares outstanding (after a secondary offering in May 2021) and owes $6 billion.

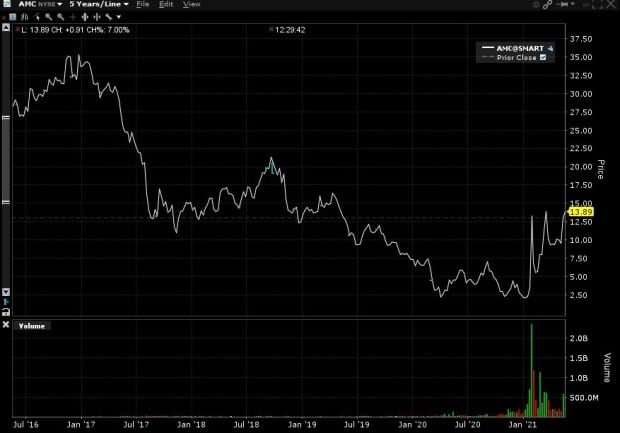

The increase in shares outstanding means every $1 in stock price in 2021 moves the market cap five times as much as a $1 increase in 2019. Shockingly, as shown in the chart below, at its five-year high of $35 in 2016, the market cap was only $3.5 billion compared with $6.9 billion at $14 in 2021. Today AMC has the highest market cap and valuation in its public history.

Nightmare on Elm Street

As AMC stock continues to attract valuation-apathetic investors, management and large institutional investors are taking advantage. AMC management has issued hundreds of millions of shares and debt, which helps AMC stock stay alive but at the cost of heavy dilution to shareholders.

The winners here are management, where if AMC had to declare chapter 11 bankruptcy protection, the managers might lose their stock options and be fired in the restructuring.

Instead, with new shares and debt, management gets to survive along with the equity holders.

How diluted are shareholders? If you owned 10% of the company in 2019 and did not contribute to any of the secondary offerings, your interest would have been diluted to 2%.

That’s not all. With all the new debt issuance, first-quarter 2021 interest costs annualize to about $600 million. In AMC’s best year of 2018, the company produced $848 million of EBITDA (earnings before interest, taxes, depreciation and amortization). If the company were to climb back to that record year, about 70% of that EBITDA would go to servicing the debt. Equity shareholders would have very little left for themselves.

Bag holders

According to a Reuters article, institutional investors including Silver Lake and the Ontario Teachers Pension Plan have eagerly sold their holdings of AMC to retail investors.

“Silver Lake converted $600 million of debt into equity and promptly sold the stock,” the story says.

Silver Lake had initiated the convertible deal with AMC in 2018, and once Covid lockdowns started in 2020, it looked like the investors would take a large loss on their debt. Sometimes it is better to be lucky than good, as the rush of retail investors gave Silver Lake the opportunity to get out of their dubious loan with a profit!

Clearly, institutions that have vast resources to conduct due diligence on AMC are fleeing the stock, leaving retail investors to hold the bag.

Even if AMC were to return to its record years of producing $800 million in EBITDA, the large dilution to equity holders along with the additional debt service required leave very little, if any, profits for the retail stockholder.

While AMC might make for a fun meme, there is nothing fun about losing money, and AMC stock seems to be a highly negative setup skewed toward investor losses even if a massive recovery in earnings takes place.

Sometimes the best course of action with a stock is exactly that as in a horror movie — avoid the haunted house and run away.

Brian Frank is chief investment officer of Florida-based Frank Capital Partners LLC and portfolio manager of the Frank Value Fund. He and his clients have no position in AMC.