10-year Treasury yield rises as Fed hints at reconsidering asset purchases in upcoming meetings

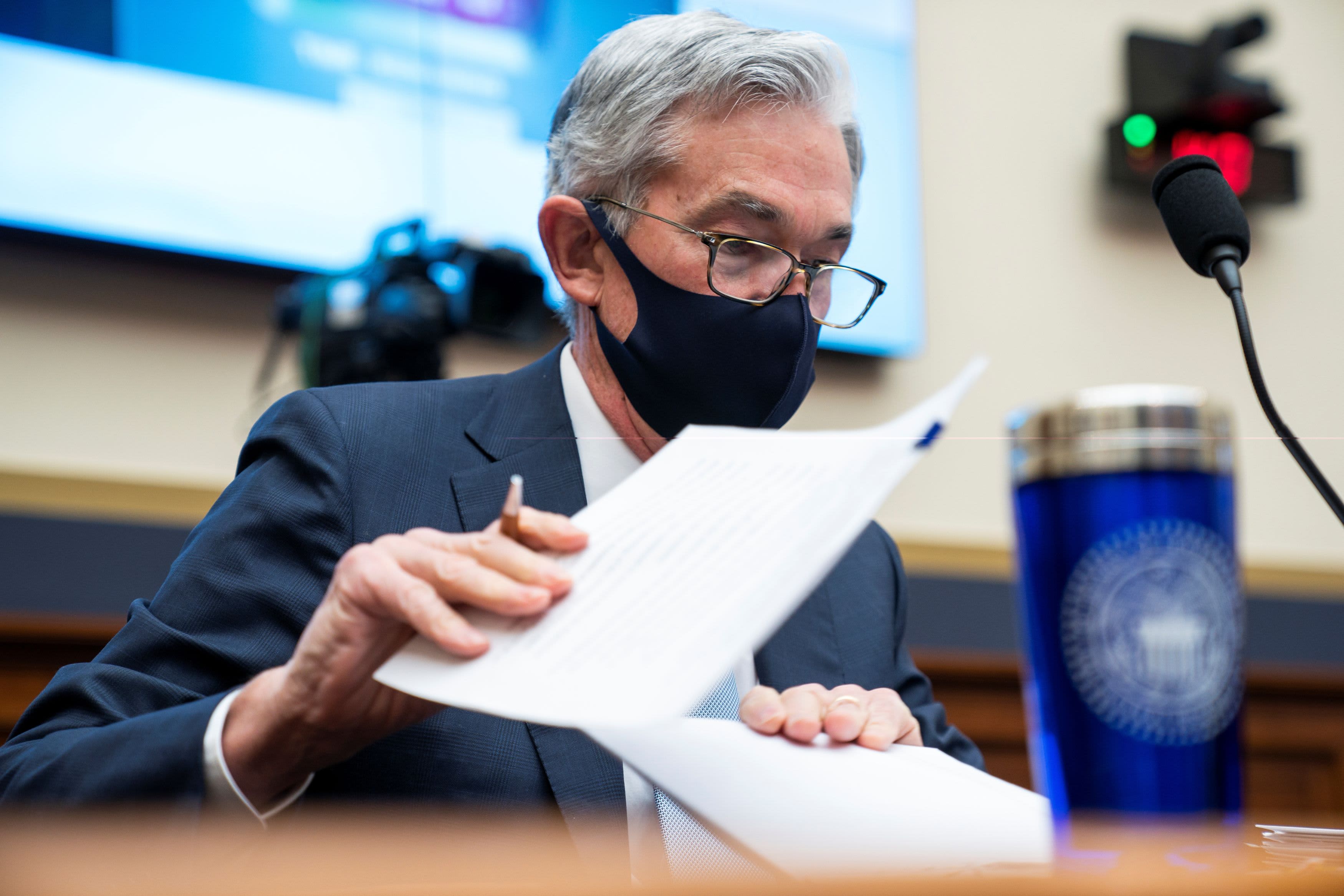

Federal Reserve Chair Jerome Powell prepares for a House Financial Services Committee hearing on “Oversight of the Treasury Department’s and Federal Reserve’s Pandemic Response” in the Rayburn House Office Building in Washington, D.C. on Dec. 2, 2020.

Jim Lo Scalzo | Reuters

Treasury yields rose on Wednesday, following the release of minutes from the Federal Reserve’s last policy meeting in which officials hinted at reconsidering their easy policy. The central bank had hinted at reconsidering its easy policies if the economy continues to rapidly improve.

The yield on the benchmark 10-year Treasury note rose 4 basis points to 1.676% at around 2:15 p.m. ET. The yield on the 30-year Treasury bond rose 3 basis points to 2.39%. Bond yields move inversely to prices.

Fed officials at their April meeting said a strong pickup in economic activity could spur conversations about tightening monetary policy, according to minutes from the session released Wednesday.

“A number of participants suggested that if the economy continued to make rapid progress toward the Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases,” the meeting summary stated.

The Fed released minutes from its April 27-28 meeting, with investors looking for clues about the central bank’s views on inflation and when it might start to tighten monetary policy. The threat of inflation has been an overhang recently in the stock market, as investors worry inflation pickup that is more than transitory could cause the central bank to raise interest rates.

At the session, the policymaking Federal Open Market Committee voted to hold benchmark short-term borrowing rates near zero and to continue buying at least $120 billion in bonds each months.

An auction will be held Wednesday for $27 billion of 20-year bonds.