Chipotle stock rallies after longtime skeptic says it’s time to buy

Shares of Chipotle Mexican Grill Inc. bounced Thursday, after a long-skeptical analyst turned bullish, citing an “attractive” valuation and signs that sales trends will accelerate.

The fast-casual Mexican food restaurant chain’s stock CMG,

UBS analyst Dennis Geiger raised his rating to buy, after being at neutral for the past 16 months and at sell for at least two years before that. He raised his stock-price target to $1,700, which is now 27% above current prices, from $1,575.

“We see near-term catalysts to reaccelerate sales trends, from increased dining room volumes as consumer mobility grows and elevated digital sales are retained, upcoming pricing increases and new product and loyalty contribution,” Geiger wrote in a note to clients. “Additionally, multiple growth opportunities remain underappreciated, including [long-term] contribution from Chipotlanes, potential for growing repurchase activity, and international unit expansion.”

Don’t miss: ‘Chipotlanes’? Chipotle CFO says the idea of drive-through service was controversial at first

Geiger also said the stock’s risk-versus-reward profile “skews significantly to the upside” after the recent pullback.

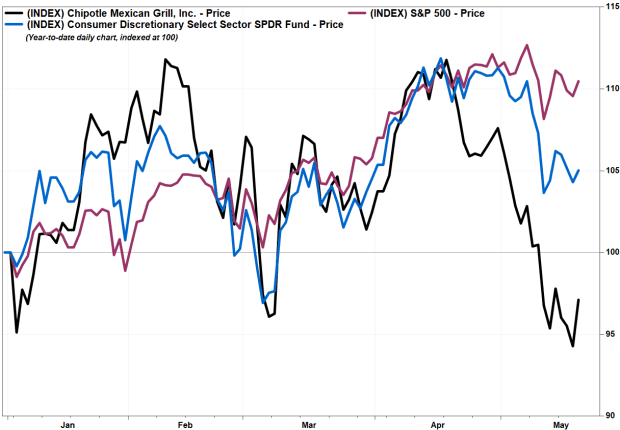

The stock had tumbled 12.4% in May through Wednesday, while the SPDR Consumer Discretionary Select Sector exchange-traded fund XLY had lost 6.3% and the S&P 500 index SPX had declined 1.6%.

In late April, the company reported first-quarter revenue that rose 23.4% to $1.74 billion, as same-store sales grew 17.2% and digital sales soared 133.9% to a record, and to represent half of overall sales. The company also boosted its stock repurchase program by $100 million.

Geiger said he expects increased pricing, expected in the summer and fall, to face just modest customer resistance. Read more about recent price hikes.

“Sales drivers continue to resonate and appear on trend with customer wants — UBS Evidence Lab survey highlights a multiyear improvement in key brand perceptions and demand for digital, loyalty, delivery and menu variety,” Geiger wrote.

Of the 32 analysts surveyed by FactSet who cover Chipotle, 19 (59%) rate it the equivalent of buy and the rest rate it the equivalent of hold. Geiger’s new stock price target is roughly in line with the average of $1,709.07.

Chipotle’s stock has rallied 30.3% over the past 12 months, while the consumer discretionary ETF has run up 40% and the S&P 500 has hiked up 40.1%.