Semiconductor stocks led the tech sector rally to begin the week.

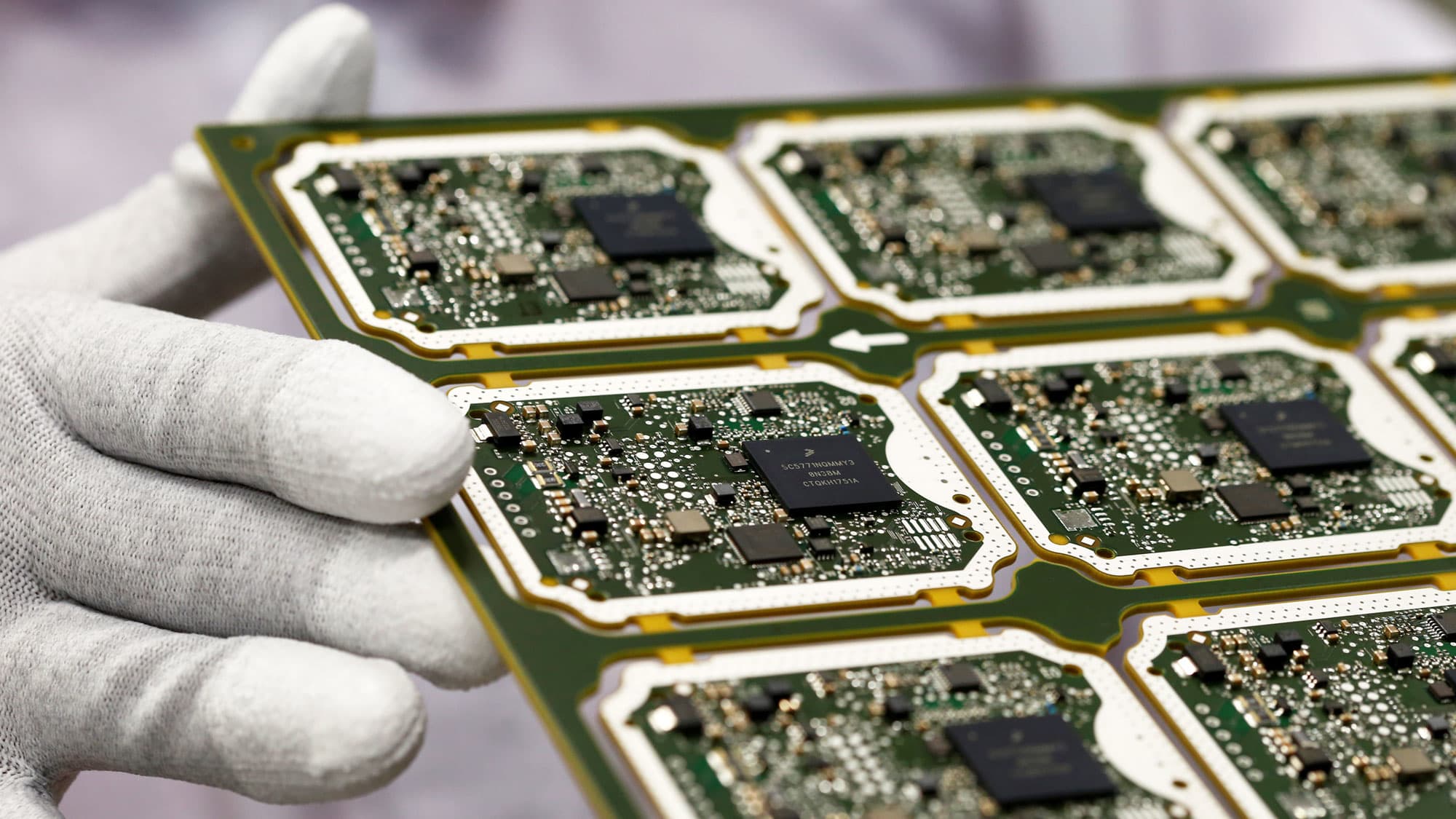

The SMH semiconductor ETF, which tracks the major chipmakers, rose more than 2% on Monday, outpacing the XLK technology ETF and broader S&P 500. The group has been on watch as supply chain disruptions have squeezed industries ranging from automobiles to household appliances.

Ari Wald, head of technical analysis at Oppenheimer, on Monday reiterated his optimism for the semis.

“We’re bullish on the semiconductor industry,” he told CNBC’s “Trading Nation.” “The reason why is that the industry is correcting from a position of strength – specifically, the semiconductor SOX index is coming off a new high relative to the tech sector in April.”

“Looking ahead, we’d be much more concerned if a new price high was undermined by a lower relative high versus the sector. That would indicate that leadership is shifting away from this high beta, cyclical part of the sector. That is not the case,” he said.

As for fundamentals, rising Covid cases in key chipmaker manufacturing hub Taiwan may cast a pall over an already fragile supply chain. The region is the third-largest chipmaker by sales, behind the U.S. and mainland China. Taiwan Semiconductor Manufacturing, a major producer, confirmed over the weekend that one of its staff members had contracted Covid-19, though said operations had not been impacted.

But the threat of another supply chain squeeze is not concerning Boris Schlossberg, managing director of FX strategy at BK Asset Management.

“The story in Taiwan is a little bit overblown. I think they have incredible control on the ground, tremendously disciplined society so whatever Covid problems they have, they’ll be able to get them under control and I think it’s going to have minimal impact on production going forward,” he said in the same interview.

Still, any weakness the chipmakers see as a result of supply chain issues should be viewed as an opportunity, he said.

“Any kind of buy the dip is basically the story of SOX, the shortage of supply right now is going to take a very long time to work out and demand is going to remain constant for quite a while so I think any kind of a dip in the SOX index, is going to be a buy,” he said.